Even if the U.S. economy slows during the rest of 2019, the outlook for the housing and mortgage market remains strong, said economists at Fannie Mae and Freddie Mac.

Gross domestic product grew 3.2% in the first quarter, but Fannie Mae projects the second quarter to have just 1.7% growth, while Freddie Mac is slightly more bearish at 1.5%.

"On the heels of a strong first quarter, we upgraded our full-year 2019 forecast of real GDP growth by one-tenth to 2.3%," said Fannie Mae Chief Economist Doug Duncan in a press release. "Prior quarter upticks in net exports and inventories may have fueled the growth, but a deeper dive into the underlying data of each suggests weakness.

"Escalating trade tensions between the United States and China continue to represent a real downside risk to headline growth, while improving productivity and stronger-than-expected growth out of the euro area offer roughly offsetting upside risk. As the Fed continues to preach patience and inflation remains well below target levels, we revised our forecast in May to reflect our expectation of zero rate hikes in 2019 and 2020," he said.

Freddie Mac also sees GDP growth ending 2019 at 2.3%, up from

This was based on lower-than-expected volume of government-guaranteed mortgages in the first quarter, $75 billion versus April's projected $79 billion. "Our outlook for the housing market remains largely unchanged," Freddie Mac Chief Economist Sam Khater said in a press release. "We still expect stronger home sales and housing starts in the coming months due to favorable market conditions and accelerating wage growth."

Freddie Mac still expects refinancings to make up 30% of 2019's origination activity even though

"Additionally, our quarterly report on refinance activity shows that few U.S. homeowners are choosing to tap into their largest source of wealth despite having a record $16 trillion in home equity available to them," Khater said. "Most homeowners remain reluctant to increase their mortgage balance, whereas we continue to see balance increases on auto loans, credit cards and student loans."

Fannie Mae increased its home sales estimate to 6 million from 5.98 million in April.

"Residential fixed investment may have dragged on growth for the fifth consecutive quarter, but we remain optimistic that the spring home buying season will be a productive one," Duncan said. "We revised upward our 2019 purchase and refinance mortgage origination forecasts amid continued strong demand and a boost to entry-level inventory, the pullback in mortgage rates and slowing home price appreciation."

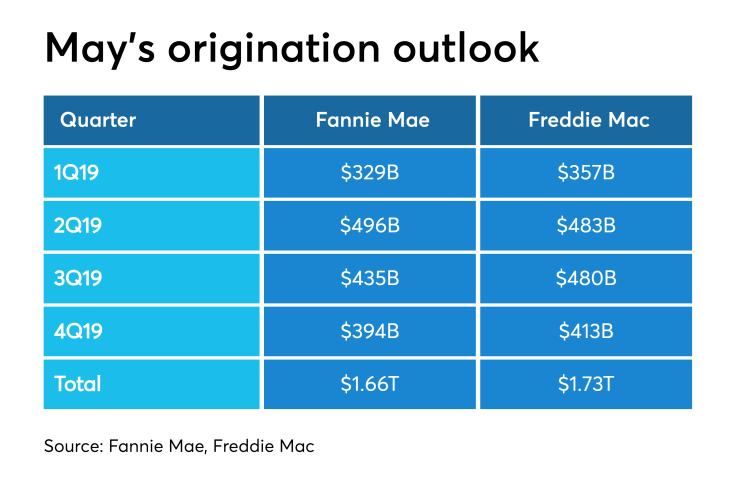

Fannie Mae now predicts $1.66 trillion in total volume this year, with $1.183 trillion coming from purchase and $471 billion from refis. In April,

While Freddie Mac left its 2020 projection unchanged at $1.7 trillion, Fannie Mae's forecast was cut to $1.64 trillion from $1.66 trillion.