April was likely the lowest point in coronavirus-impacted home buying activity, especially when it comes to purchasing newly constructed houses, the Mortgage Bankers Association said.

Mortgage loan applications submitted to buy a new home fell by 25% in April compared with March and by 12% versus

"New-home purchase applications severely weakened in April, which coincided with the peak of the social distancing efforts and restrictions on nonessential activities to help slow the spread of COVID-19," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "MBA estimates that new-home sales dropped to an annualized pace of 533,000 (seasonally adjusted) units, the slowest since December 2016. This decline was in line with data from our

"There's evidence now that unrealized, pent-up demand is being released as states start to reopen. We expect that heading into the summer, more prospective homebuyers will gradually return to the market," Kan said.

The MBA's new-home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

April's estimate was a 23.5% drop from March's annualized pace of 697,000 units. On an unadjusted basis, the MBA estimates that there were 51,000 new-home sales in April, down 28.2% from March's 71,000 new-home sales.

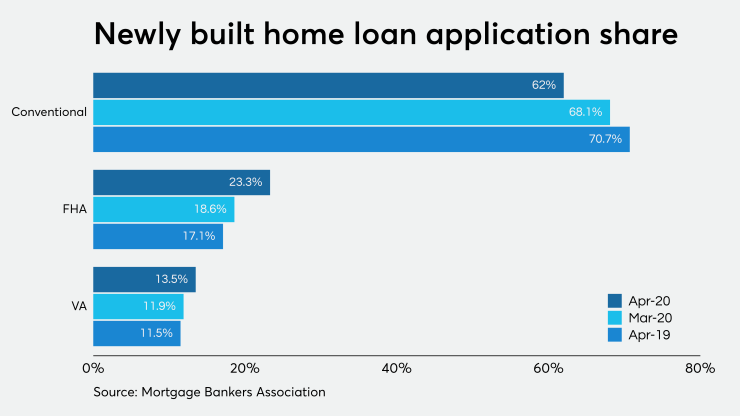

There was a big shift toward government-insured loans and away from conventional mortgages in April from March. That could be a sign of shifting underwriting requirements.

Among new-home buyers, 62% submitted applications for conventional mortgages in April, while 23.3% sought Federal Housing Administration-insured loans. Veterans Affairs-guaranteed mortgages had a 13.5% share while U.S. Department of Agriculture/Rural Housing Service loans composed 1.2% of the total applications submitted to purchase a newly built home.

But in March, conventional loans had a 68.1% share, with FHA at 18.6% and VA at 11.9%. The shift is even more stark compared with April 2019, when 70.7% of new-home buyers looked to get a conventional mortgage, with FHA at a 17.1% share and VA at 11.5%.

The average loan size of new homes decreased to $334,641 in April from $344,556 in March and $338,745 for April 2019.

But will there be newly built homes entering the market for people to buy?

Single-family housing authorizations decreased 7.37% in April from March, according to the BuildFax Housing Health Report.

However, on a year-over-year basis, activity grew 1.2%. That pace of growth is much slower than March, when authorizations increased 6.62% year over year.

Separately, the National Association of Home Builders/Wells Fargo Housing Market Index reported a

But there were sharp declines in existing-home construction activity, BuildFax said, with maintenance volume sliding 29.09% year over year.

Additionally, remodel volume and spend — a subset of maintenance that includes renovations, additions and alterations — decreased 33.83% compared with April 2019.

"Existing housing activity plunged in April alongside existing home sales, the latter of which is one major factor that drives maintenance and remodels," Jonathan Kanarek, BuildFax managing director, said in the report. "Existing home sales undoubtedly spur increased maintenance and remodeling activity as homeowners prepare to sell their home or, given the aging house stock, purchase and repair a fixer-upper."

However, maintenance and remodeling activity is expected to rebound as the number of home sales starts increasing later this year, he added.