Both servicers and mortgage borrowers under duress from natural disasters or other unexpected events are

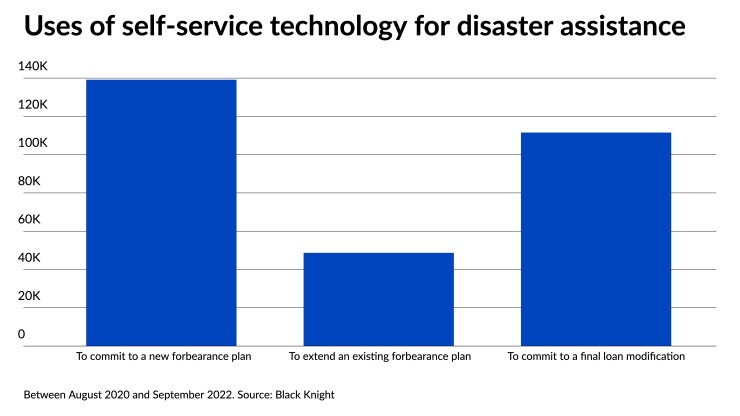

The data and technology provider found approximately 342,000 borrowers accessed a self-service option from August 2020 to September 2022 during the COVID-19 pandemic. Of that number, 139,154 eventually entered forbearance through interactions with the tool.

Forbearance extensions were also requested by 48,702, while almost one-third, or 111,543, committed themselves to a final loan-modification program using the self-service technology, or SST. A disaster-assistance self-help feature was offered by 21 out of 70 servicers using Black Knight's technology.

"While events like

"By proactively engaging homeowners who may be struggling to pay their mortgage and empowering them with tools that help them understand their options, servicers can expect positive outcomes that may include higher portfolio retention, increased customer satisfaction and loyalty, greater servicing efficiency and fewer third-party collections."

The availability of self-service technology could turn out to be a game changer for many borrowers, easing some of the embarrassment and burden they face, said Dana Dillard, principal at Housing Finance Strategies. It also serves as an educational tool for them to understand loss-mitigation options.

"When you fall behind in your payments, it's hard to talk to a stranger about it many times. They're just trying to figure out what their situation is," she said in an interview.

"A lot of people have never been delinquent before, so they don't know about options there either," Dillard added.

The nationwide impact of COVID-19 provided Black Knight with a unique opportunity to study the demand and uptake of its SST on a wider scale compared to other unplanned events. While

In its analysis, Black Knight found servicers became aware of potential borrower distress more quickly when SST was used, while also allowing them to configure workflows to adapt to changes in loss-mitigation programs. With a window into the process, mortgage holders also experienced less stress and were more willing to get involved, bettering their chances to avoid foreclosure.

"When borrowers face periods of financial hardship, they need seamless access to qualified assistance options," Nackashi said. "The COVID-19 pandemic brought this fact to light like never before, and as we expect to see an increasing number of natural disasters, it's in the best interest of both servicers and the homeowners they serve to stand prepared with self-service technology."

But building out an SST system to adequately serve each borrower remains complicated. "All the different loan products have different scenarios and different loss-mitigation options," Dillard said.

While the industry has tried to streamline it as much as possible, "you really can't. It's very individualized. So to automate that — it's very challenging."

A total of 8.4 million households opted to enter a COVID-19 forbearance plan, which was open to almost all borrowers attesting hardship under provisions of the CARES Act, according to data tracked by Black Knight. An average of 70,000 loss-mitigation cases emerged each month in the course of the pandemic. Currently, 5.1 million remain in forbearance, with 84% of them in performing status.

Despite success of the CARES Act in keeping people in their homes, interest in self-service technology will likely remain. While

The Federal Housing Finance Agency already agreed to expand a payment-deferral option earlier this year to include all distressed borrowers with mortgages backed by Fannie Mae or Freddie Mac. Previously, the Federal Housing Administration also said it would also offer some of its pandemic loss-mitigation options to all borrowers facing imminent default.