Purchasing power grew for the 14th consecutive month in February but rising property values and mortgage rates are likely to keep listings off the market, according to First American.

The Real House Price Index — a metric that adjusts residential property prices for income and interest rate fluctuations — jumped 1.6% from January and while falling 1.3% annually. RHPI growth equates to decreased affordability for buyers. Median household income increased to $73,554 from $72,738 and $69,133 the year prior. House-buying power rose to $517,513 from $516,773 the month before and $447,605 in 2020.

With the

“Using Flow of Funds data from the Federal Reserve as of the end of 2020, we estimate that U.S. households own about $32 trillion in owner-occupied real estate, $11 trillion in debt, and the remaining $21 trillion in equity,” First American deputy chief economist Odeta Kushi told NMN.

All three dollar amounts are the highest ever, as homeowner equity continues to follow a steep upward trajectory underway since 2012. This growth gives borrowers more household value and an inclination to upgrade their living situation through an economic theory called “the wealth effect,” according to First American chief economist Mark Fleming.

However,

“Instead of a tailwind, rising mortgage rates increase the monthly cost of borrowing the same amount that a homeowner owes on their existing mortgage,” Fleming said in the report. “Additionally, the record low level of houses for sale makes it difficult to find the next house to buy, so sellers — who are also prospective buyers — don’t sell for fear of

At the state level, Arizona’s annual rise of 8.41% outpaced the nation in February, trailed closely by Wyoming’s 8.4% and 6.16% in Vermont. Iowa fell furthest, with a 4.43% decline, with decreases of 3.48% coming in Massachusetts and 3.47 in Illinois.

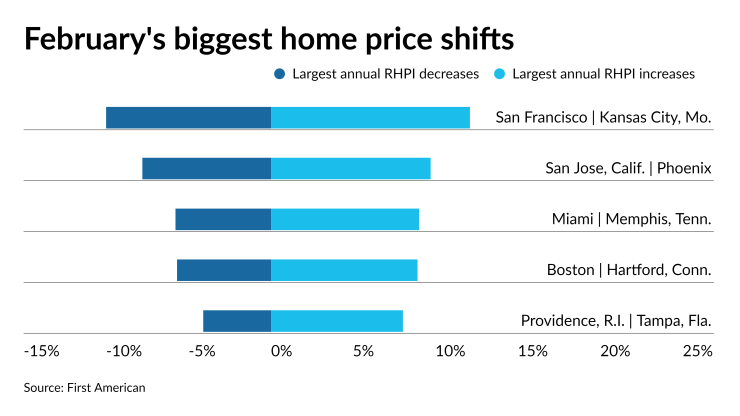

By housing market, RHPI rose annually by 12.1% in Kansas City, Mo., followed by 9.71% in Phoenix and 9.03% in Memphis, Tenn. San Francisco experienced the largest decrease at 9.97%, with San Jose, Calif., coming next at 7.75% and Miami at 5.83%.