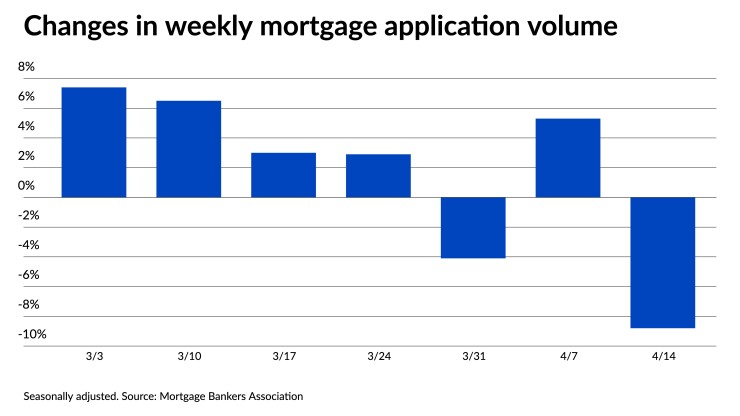

Higher rates and ongoing affordability issues held borrowers back and slowed the pace of new incoming mortgage applications for the

The MBA's Market Composite Index, a weekly measure of loan activity based on surveys of the trade group's members, dropped a seasonally adjusted 8.8% for the period ending April 14, as both refinances and purchases fell. Volumes for the week were lower by 44.1% compared to the same period in 2022.

"With more first-time home buyers in the market, we continue to see increased sensitivity to rate changes," said MBA vice president and deputy chief economist Joel Kan in a press release.

Interest rates increased across the board in all categories tracked by the association, including for the most commonly used 30-year conforming mortgage with balances below $726,200. After declining five straight weeks, the average climbed up 13 basis points from the previous week to 6.43% from 6.3%. Points for 80% loan-to-value ratio loans also increased to 0.63 from 0.55.

The average

"The spread between the jumbo and conforming 30-year fixed rates widened slightly last week to 15 basis points, but this was a much tighter spread compared to the past year. As banks reduce their willingness to hold jumbo loans, we expect this narrowing trend to continue," Kan said.

Upwardly trending rates contributed to the seasonally adjusted Purchase Index sliding 10% week over week. On an annual basis, purchase activity is still 36.4% below year-ago volumes.

"Affordability challenges persist, and there is limited for-sale inventory in many markets across the country, so buyers remain selective on when they act," Kan said.

A jump in the average purchase size reported on new applications also points to signs of a pullback

On the other hand, the mean refinance size fell, finishing 2% lower at $262,400 compared to $267,700 one week prior, according to the MBA. Across applications of all types, the average amount increased to $389,200 from $387,700, inching up 0.4%.

Several recent reports from housing researchers have similarly underscored affordability hurdles many aspiring homeowners are facing at the start of

Seasonally adjusted Government Index numbers provided another sign first-time buyers decided to hit pause last week as well. The number of purchase loans guaranteed by the

Despite that drop, FHA-sponsored applications overall managed to garner a higher share relative to total volume from seven days earlier in the survey, increasing to 12.7% from 12.3%. But a decrease in the portion of loans backed by the Department of Veterans Affairs, which tumbled to 11.7% from 12.8%, more than offset the FHA growth. Meanwhile, U.S. Department of Agriculture-backed applications accounted for the same 0.5% share as the previous week.

The Refinance Index headed downward 5.8% for the survey period and finished 56% below its level of a year ago, as current interest rate levels continue to provide little incentive for most borrowers. The share of refinances relative to total volume increased, though, to 27.6% from 27% the prior week.

As fixed interest rates move upward, interest in adjustable-rate mortgages typically picks up as well, with borrowers turning to them in search of payment relief. In line with the trend, the share of ARM applications came in higher week over week, making up 6.3% of overall volume compared to 6% seven days earlier.

All other mortgage rates among MBA lenders in addition to the 30-year conforming and jumbo headed up in tandem last week.

Meanwhile, the 30-year average contract rate for FHA-backed fixed home loans increased 4 basis points to 6.33% from 6.29% a week earlier. Points increased to 0.94 from 0.91.

The 15-year fixed-rate mortgage average also surged by more than 10 basis points, averaging 5.89% compared to 5.78% one week prior. Points for 80% LTV ratio loans rose to 0.65 from 0.57.

The hybrid 5/1 adjustable-rate mortgage increased to an average of 5.56% from 5.51% on a weekly basis, with points decreasing to 0.72 from 0.9. Terms of the loans carry a fixed rate for five years, before becoming variable.