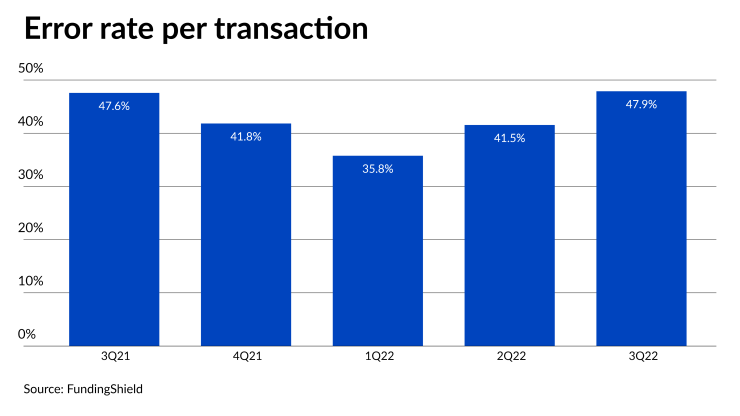

Wire and title fraud risk increased to a new high in the third quarter with just under half of all real estate transactions having at least one indicator of a potential problem, a report from FundingShield said.

The overall error rate for the quarter was 47.9%, compared with 41.6% in the second quarter and 47.6% for the third quarter of 2021. Wire fraud risk

"With the contraction in market transaction volumes, the impact is that much more severe for lenders where a single wire or title fraud event could be catastrophic," said Ike Suri, FundingShield's CEO in an accompanying commentary.

In 2021, the Federal Bureau of Investigation's Internet Crime Complaint Center received

Business email compromise has been a growing concern for

In addition, the data showed a 35% increase in closing agent insurance policy coverage gaps and nearly 50% increase in transaction data and title file order registration issues at time of close.

By far, the largest single error was seen in the closing protection letter, in 47.6% of transactions, up from 43% in the second quarter.

The next largest category involved errors and omissions insurance coverage at 6.7%, followed by wire problems at 5.7% and validation of the closing protection letter at 5%; the latter was up from 3.4% in the second quarter.

State license issues were found in 1.6% of third quarter transactions, a 31% increase from the second quarter's 1.2%.