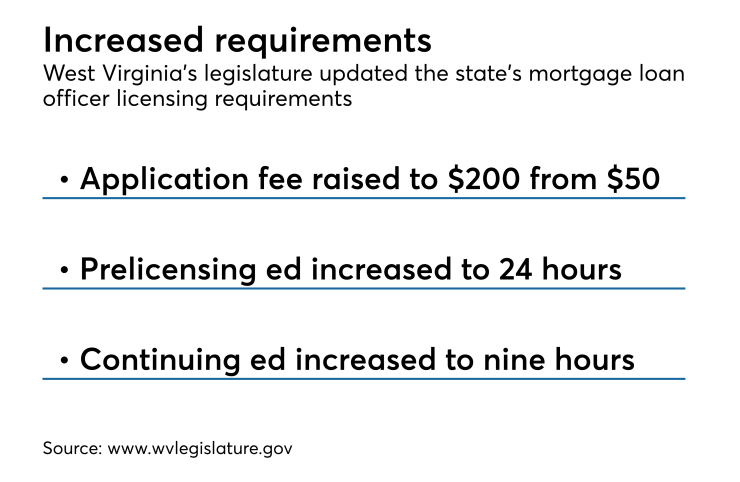

Mortgage licensees in West Virginia will pay higher application fees and need to take additional hours of mandatory prelicensing and continuing education under an amendment to the state's licensing law.

The state's Senate approved the bill unanimously on March 2 while it passed its House on Feb. 20 by a vote of 90 to 5. It is in effect 90 days following passage the final version of the bill said.

It raises the license application fee to $200 from $50 and increases the number of hours for prelicensing education to 24 from 22 by adding an additional two hours of training related to the state's mortgage and consumer laws or issues.

The continuing education requirement was increased to nine total hours as an additional hour of training on West Virginia law or regulations was added.

The bill was introduced by delegate Cindy Frich, the chairwoman of the House Banking Committee at the request of the state's Division of Financial Institutions.

Unchanged is a section that allows the Commissioner of Financial Institutions to grant a provisional license to a mortgage loan originator that had already met all the other licensing requirements but had not yet passed a test on the state's mortgage laws and regulations, provided that the person takes and passes the test within 60 days of the test becoming available.

The full U.S. Senate this week is debating S. 2155,

"We expect a procedural vote early in the week and full passage later," a research note from Keefe, Bruyette & Woods analyst Brian Gardner said. "Despite some attacks from the Warren wing of the Democratic Party, we think support for the bill from a group of 13 Democrats remains strong, which is why we are confident the bill will pass."