-

Following the resignation of CEO Patrick Donlon as the result of a settlement, Yield Solutions Group has taken operational control of Trusted American Mortgage.

December 31 -

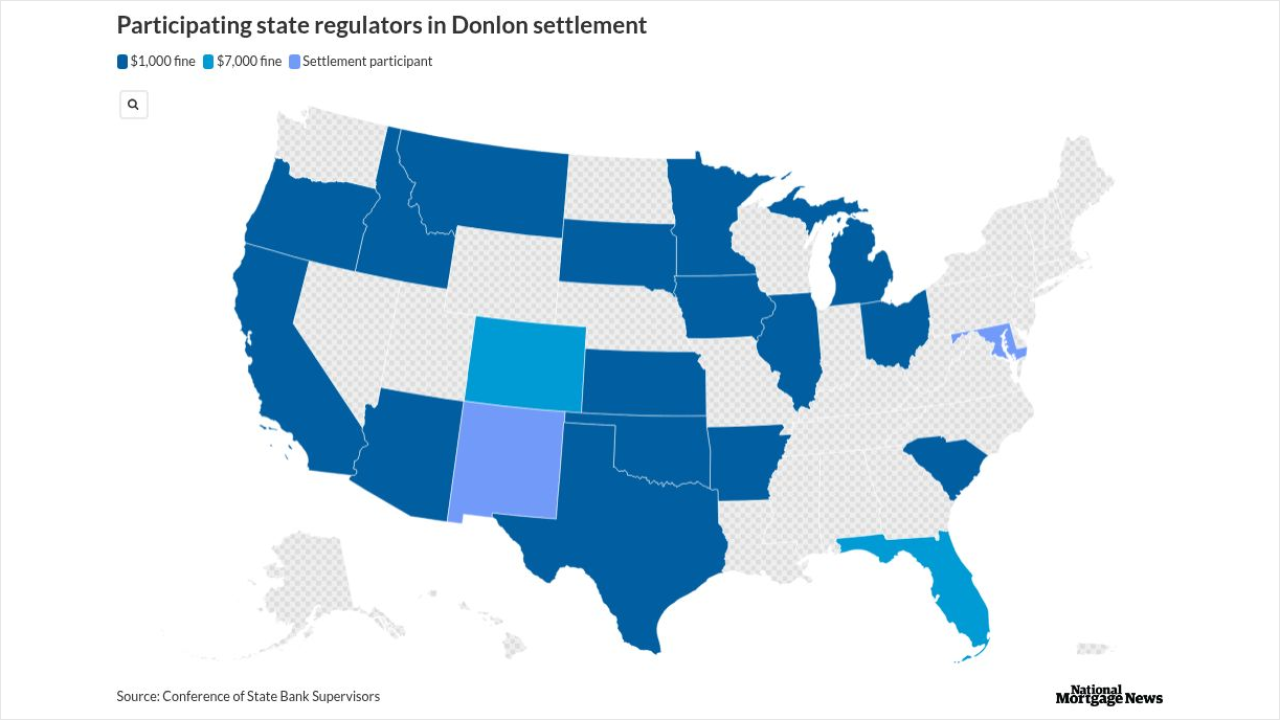

Patrick Terrance Donlon, CEO of Trusted American Mortgage, settled allegations from 21 states another person took industry education courses for him.

December 26 -

Momentum against Maryland guidance that extends licensing requirements to securitization trusts is growing and some legislators want to scale it back.

February 24 -

In its initial message to the new head of the Consumer Financial Protection Bureau, the Community Home Lenders Association reiterated its call to require depository loan officers to be licensed.

October 4 -

All states that had licensing restrictions related to remote work temporarily lifted them due to the pandemic, but whether those changes could become permanent remains to be seen.

August 17 -

The Conference of State Bank Supervisors on Friday launched a centralized link to state websites highlighting information relevant to business continuity plans for licensed mortgage loan officers.

March 13 -

A Conference of State Bank Supervisors subsidiary settled a lawsuit with defendants who allegedly misused and reproduced copyrighted questions from a national exam mortgage loan officers take to obtain licenses.

January 8 -

The Consumer Financial Protection Bureau issued new rules governing mortgage lenders' screening and training of loan originators with temporary authority.

November 15 -

Mortgage brokers need to consider bringing their business into new locations to overcome limitations like competition and a finite number of possible customers.

March 15 JW Surety Bonds

JW Surety Bonds -

New Jersey Governor Phil Murphy signed a bill to revise the state's Residential Mortgage Lending Act to facilitate transitional licensing for loan officers and to streamline the law's provisions for borrower fees.

August 31 -

Servicers and MSR investors face increased regulation and oversight as nearly all states now require some form of licensing for firms responsible for mortgage collections.

July 23 -

Mortgage licensees in West Virginia will pay higher application fees and need to take additional hours of mandatory prelicensing and continuing education under an amendment to the state's licensing law.

March 5 -

Tired of working as a yacht captain, Pancho Jiminez decided to get into real estate even though he knows it's a highly competitive field in Florida.

February 27 -

The Consumer Financial Protection Bureau was created in part to ensure that nonbanks are subject to federal oversight, but the fact is that 99% of banks are exempt from CFPB supervision.

October 11 Community Home Lenders of America

Community Home Lenders of America -

Although property tax loans raise concerns for the mortgage industry, there is a way for property tax lenders and mortgage companies to co-exist.

October 6 Clear Tax

Clear Tax -

A Consumer Financial Protection Bureau proposal would limit how much Home Mortgage Disclosure Act data is released to the public in an effort to protect consumer privacy.

September 20 -

Before joining NMN, our new reporter Elina Tarkazikis was a real estate agent. From endless fees to the benefits of working on a team, she explains why many things agents should know entering the business also apply to mortgage loan officers.

August 24 -

Opes Advisors shows would-be borrowers how purchasing a house fits into their total financial picture, now and years into the future. Many of its loan officers are licensed investment advisors.

December 20 -

While compliance costs continue to increase for lenders, the rising age of company owners is what's prompting many independent mortgage bankers to sell their companies.

October 18 -

Restoring consumer confidence in financial services won't be easy after the latest banking brouhaha, but the Consumer Financial Protection Bureau can help by proactively holding all mortgage loan officers to the same federal licensing standard.

September 26 Community Home Lenders of America

Community Home Lenders of America