Veterans United Home Loans is the target of a potential class-action lawsuit over alleged illegal predatory practices.

The three plaintiffs, all military veterans, accused the lender of deceptively suggesting it was part of the Department of Veterans Affairs or the federal government and steering clients to more costly loans, the filing said.

The lawsuit was filed Wednesday in the U.S. District Court for the Western District of Missouri against Veterans United and its affiliates Mortgage Research Center and Realty Search Solutions, the parent company of Veterans United Realty. The plaintiffs are represented by Hagens Berman

"Our lawsuit against Veterans United is two-fold," said Steve Berman, managing partner and cofounder of Hagens Berman, in a press release Thursday. "First, we believe Veterans United has engaged in blatantly illegal practices that have harmed homebuyers through predatory loan practices, and second, Veterans United has

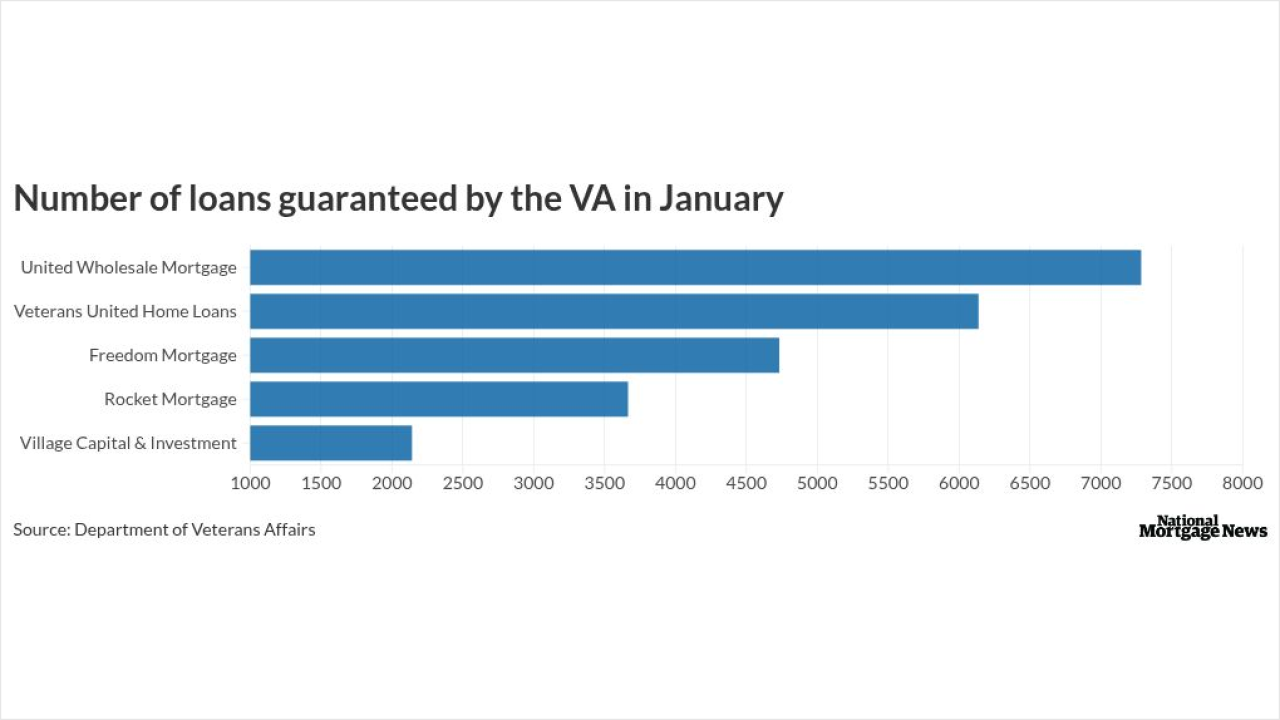

Veterans United's marketing used American flag motifs and a claim to be "The Nation's #1 VA Lender" to intentionally mislead homebuyers into thinking it was part of the government agency. Multiple real estate and loan officers routinely lost business to Veterans United because veteran and military customers believed it was affiliated with the VA, the lawsuit said.

"These mortgage companies should be ashamed of their underhanded business tactics and are wholly unaffiliated with the military," Berman said. "No owner, coowner or founder has served in the military."

The plaintiffs also claimed Veterans United violated the Real Estate Settlement Procedures Act by steering customers away from loans with better interest rates. The lawsuit alleges a perpetual loop of illegal referrals, in which Veterans United connected buyers to real estate agents who, in exchange, were required to steer clients back to Veterans United for their mortgages. If agents stopped doing so, they wouldn't receive more leads.

The agents also paid Veterans United roughly 35% of their commission, according to attorneys.

Veterans United offers less financial aid packages compared to its competitors and its loans have higher interest rates as well, the release said.

"For 24 years, we have been committed to serving veterans and military families with love, care and respect," a Veterans United spokesperson said. "We're aware of the lawsuit that was filed. We deny the accusations and look forward to disputing this through the legal process."

This is one of many lawsuits Hagens Berman is involved in regarding deception and steering, including