While millennials today comprise the largest cohort of homebuyers, the aging baby boomer generation has created 7.86 million more homeowners and 2.82 million renters age 60 and older — growth rates higher than any other demographic.

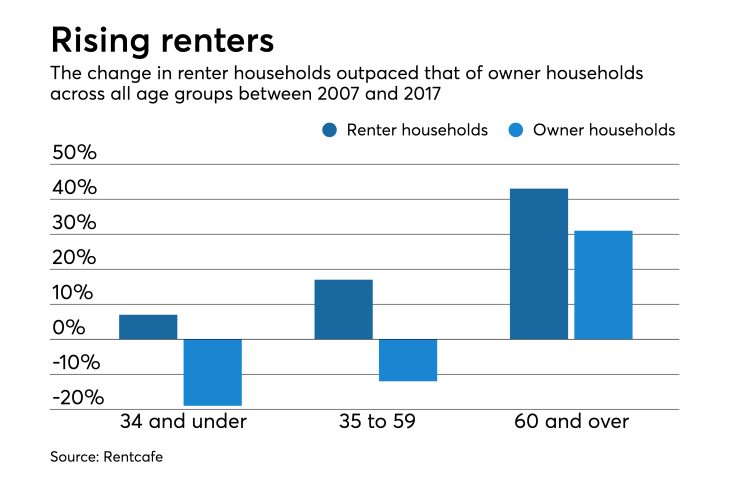

The number of renters age 60 or older grew 43% from 2007 to 2017, while the number of homeowners in that age bracket grew 31%, according to an analysis of Census Bureau data by rental listing website Rentcafe.

The combination of aging boomers, lower homeownership rates following the Great Recession and other factors contributed to the number of homeowners age 35 to 59 to decline by nearly 5 million households over the 10-year span. Meanwhile, the number of renters in this demographic grew by nearly 3 million households, Rentcafe found.

These trends point to a number of opportunities and challenges for the real estate and mortgage industries. The number of senior renters is expected to increase by nearly 19 million households by 2035, Rentcafe projects, while the share of renters for all other age groups is expected to fall over the same period.

Greater rental demand from seniors may require additional development of age-appropriate housing inventory, which will

But with more than 33 million senior homeowners (as of 2017), residential mortgage lenders may find greater demand for

Among younger consumers, the rise in renting demonstrates the still-untapped potential for homeownership among millennials, who are just now

But headwinds abound. As the number of senior homeowners rises,