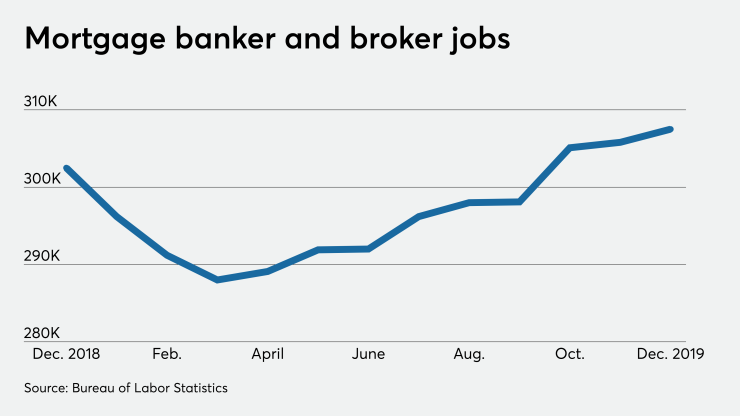

The latest employment report shows mortgage payrolls were smaller than originally estimated in 2019, but it also finds hiring improved near year-end rather than undergoing its usual seasonal slowdown.

Nonbank mortgage jobs totaled 307,500 in December, up from 305,800 the previous month and from 302,500 a year earlier, according to the Bureau of Labor Statistics. Mortgage employment numbers reported for the past year were revised as part of the bureau's year-end adjustment of its monthly sample-based estimates.

General trends seen in the earlier estimates remained the same, but a drop

"There's been a tremendous opportunity in the marketplace over the last six to eight months that's really been interest-rate driven. What we've seen is that, even heading into the winter, production was still up," said Todd Sheinin, chief operating officer at Homespire Mortgage Corp., a mortgage banker based in Gaithersburg, Md. "In our industry, it's usually very seasonal. This winter we've seen a lot less of that. We got maybe half of a month of that reduced production."

Rate-driven surges in production this winter have led to a need to sustainably hire

Both banker and broker employment estimates were higher in December, and credit providers were responsible for the majority of jobs in the market.

But the increase in broker activity was more pronounced and largely fueled the overall month-to-month gain in nonbank mortgage employment.

"I think that, over the past couple of months, mortgage broker employment has been increasing and a lot of that is support people," said Rocke Andrews, president of the National Association of Mortgage Brokers and the owner of Lending Arizona in Tucson. "Housing, in general, is improving. The Western region and the South seem to be the strongest economies right now. People are moving to those states."

In addition to a strong housing market, tax reform that took effect last year and made it temporarily

Broader job numbers that the BLS reports with less of a lag than its nonbank mortgage estimates also were strong in the latest employment report.

In January, employers across all industries added 225,000 people to their payrolls, as compared to an upwardly revised 147,000 the previous month. Unemployment rose slightly to 3.6% from 3.5% the previous month and residential construction employment increased by 20,200.

"Construction was likely helped by better-than-usual January weather," Dean Baker, a senior economist at the Center for Economic and Policy Research, said in a report.