As we enter the second year of the Great COVID mortgage boom of the early 2020s, there are already telltale signs that the positive effect of low interest rates care of the Federal Open Market Committee is ebbing.

This is not to say that 2021 will not be another extremely good year for the mortgage industry, but the wind that promoted record loan originations is clearly shifting.

First and foremost, the fact that yields on the 10-year Treasury note have risen by more than half a point since January signals that the all-important interest rate environment is changing. Somehow absurd fiscal policy in Washington was not a problem for global capital markets during four years of President Trump, but that situation

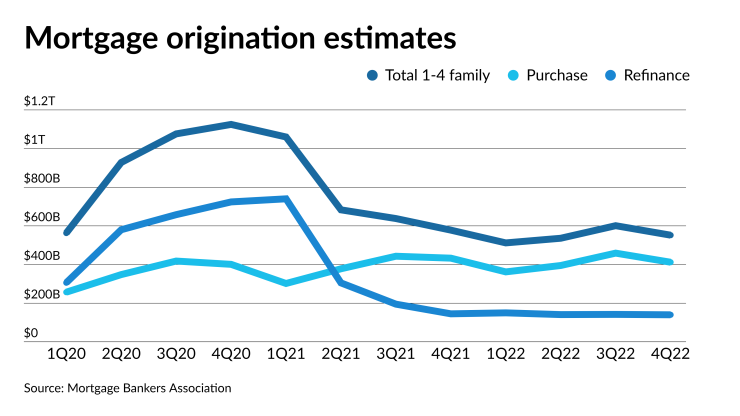

With the increase in interest rates, estimates for future loan origination volumes have begun to fall and with it the estimated earnings for that lucky group of residential mortgage issuers that managed to go public since last year. The chart below shows actual production for 2020 and estimates for 2021 from the Mortgage Bankers Association.

Even though 2021 is again going to be a strong year overall, the MBA estimates that mortgage refinance transactions are going to be cut in half this quarter due to the move in benchmark rates.

While the bond market has certainly backed up, the FOMC continues to aggressively buy new issue mortgage-backed securities. Indeed, loan pools continue to trade as brisk premiums in the secondary market despite the selloff in MBS and Treasury paper. Another data point: short-term financing costs continue to fall in the short-term money markets.

The decline in mortgage volumes from the record levels of 2020 augers changes for many parts of the housing finance ecosystem. As backlogs shrink and lenders and brokers must compete harder for quality loans, the rate of

Brad Finkelstein reported in NMN that “while rates are expected to remain low by historical standards, even a modest increase is expected to cut refi demand as 2021 continues. Typically, refinancings are considered to be less prone to application defects than purchase loans because of the different motivations for seeking a loan.”

Another aspect of shrinking volumes that directly impacts mortgage lenders is the need to constantly reassess overhead and expenses to keep production volumes in line with headcount. In the past year, the residential mortgage industry has grown headcount by at least a third to handle record production and also

“With the refinance boom wavering and government-related forbearance set to eventually end, some companies are reverting to a recession-era strategy that’s not been widely used in years: cross-training licensed loan officers to handle modifications,”

“Equipping licensed loan officers to handle requests for modified payments, as well as new loans, could make for an easier transition to more gradual mortgage hiring if a rate-rise drives volumes lower while economic damage from the pandemic lingers.”

One area where lenders are likely to need cross-training is the latest unfunded mandate from Congress to help lower-income Americans gain access to federal grants meant to support home owners. As with the CARES Act, Congress expects lenders and servicers to provide financial counseling to home owners without compensation to help them gain access to grants and other subsidies.

Yet another sign that we are entering the mature phase of the mortgage finance cycle is the emergence of some rather immature and silly behavior by some of the less competitive mortgage issuers. Last week, United Wholesale Mortgage its mortgage brokers

While Quicken Loans, the largest component of Dan Gilbert's Rocket, is the nation's No. 1 mortgage lender by overall business, it trails UWM in the key category of underwriting loans for independent mortgage brokers. In simple terms, UWM matches up a broker with a warm lead with a lender who will fund the mortgage for a fee. But as the average 30-year fixed rate climbed to its

This is not the first time that UWM has picked a fight with Rocket, which is one of the top lenders overall in the mortgage industry. Yet falling refinance volumes are bad news for both firms and especially for UWM, which lacks a significant purchase mortgage business to fall back upon when refinance transactions slow.

While Wall Street’s initial take was that the spat with UWM would hurt Rocket the most, those equity analysts maybe should think again. News reports indicate that UWM CEO and shareholder Mat Ishbia singled out Rocket and Fairway the two competitors for “hurting the wholesale channel.”

Of note, UWM threatened to impose punitive financial penalties on brokers that do business with the other firms, a strategy that could expose the firm to legal action. The actions of UWM drew a swift response from industry leaders.

"Consumers are best served when they have choices created by a robust, competitive market," said MBA President Bob Broeksmit in a thinly veiled rebuke to Ishiba."Our mortgage market is extraordinarily competitive, with thousands of lenders, multiple delivery channels, and varying business models. MBA does not condone activities designed to thwart competition in the mortgage market and limit loan options available to borrowers."

Falling loan volumes are likely to take the air out of the valuations for publicly traded mortgage firms in coming months, even for market leader Rocket which, for now, seems completely disconnected from such fundamental concerns. But should the MBA’s bearish prognostications regarding refinance volumes be realized, then the end of 2021 is going to look a lot more like a normal mortgage market than the past twelve months.