-

The Department of Housing and Urban Development would permanently allow servicers to use online and remote communications to establish borrower contact, as they did during the pandemic.

July 31 -

With the appointment, interim leader Bill Emerson will take over the role of president and chief operating officer, while Bob Walters announced his retirement.

July 31 -

Wall Street securities dealers expect a glut of Treasury sales to start coming soon as the government steps up its borrowing.

July 31 -

The owner of Tri-Emerald Financial Group claimed unregistered securities it was offering would increase in value by more than tenfold before an eventual Nasdaq listing.

July 28 -

Citing issues that arose during this spring's bank failures, the central bank and other agencies urge depositories to ensure they are ready to borrow at a moment's notice.

July 28 -

The association thinks this could simplify and manage the costs of two new pending credit requirements by allowing companies to add the one that's been through a price hike second.

July 27 -

While the monthly amount decreased by only a few dollars in June, it was the first decline since late last year, according to the Mortgage Bankers Association.

July 27 -

A successful merger would culminate an over two-year period of major losses and pestered with criticism over the firm's mass layoffs.

July 26 -

The decline occurred even as interest rates held steady, but average loan amounts shot up due to a heightened slowdown of federally sponsored activity, the Mortgage Bankers Association said.

July 26 -

Analysts look at whether the FOMC will bring the last rate hike in the cycle, whether recession is coming, and whether the Fed is making a policy mistake.

July 24 -

Housing finance organizations argue that these companies are relatively small, and allowing other agencies to be the first line of defense has worked.

July 21 -

Also, Cenlar welcomes client management leader, NFM promotes influencer-marketing executive and Guzzo & Co. hires transgender chief operations officer.

July 21 -

The Columbus, Georgia, bank is selling a $1.3 billion portfolio as part of a plan to pay off higher-cost funding. Though there are rising concerns about the office sector, Synovus said the loans it's offloading have pristine credit quality.

July 20 -

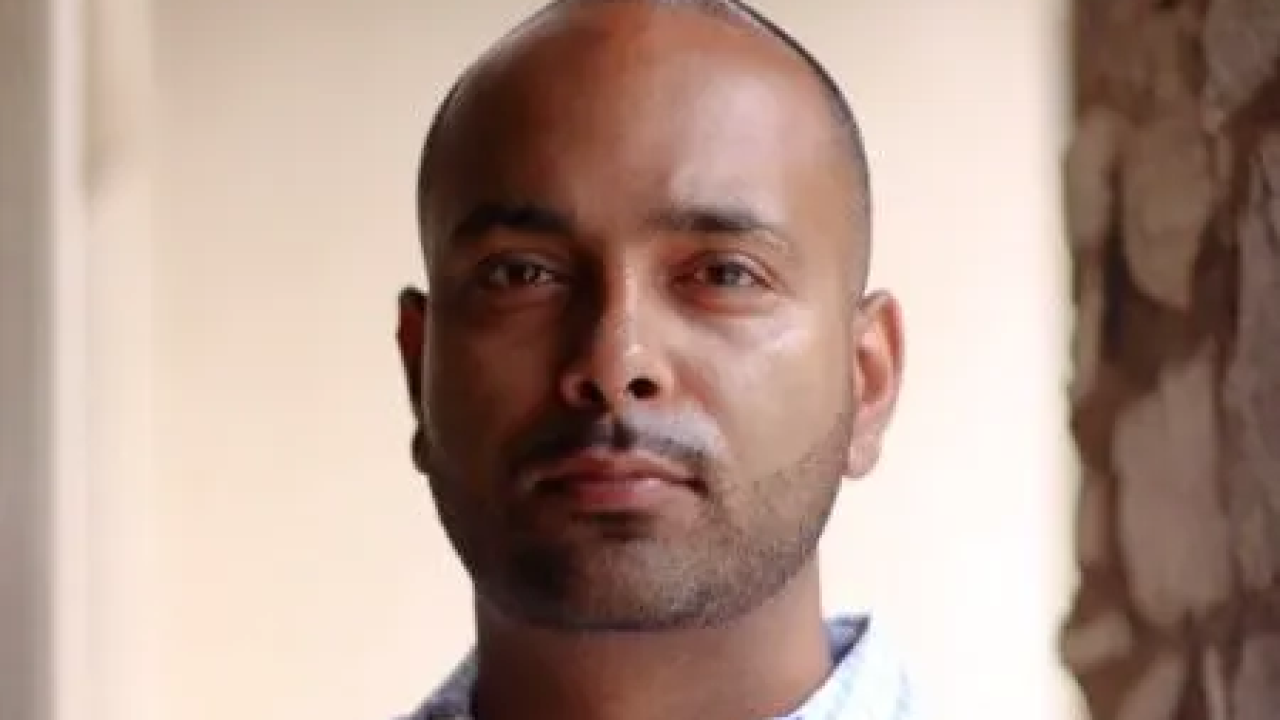

Rohit Chopra, the director of the Consumer Financial Protection Bureau, weighed in on credit card late fees, an upcoming open banking rulemaking and the chaos that could result if the Supreme Court defunds the agency.

July 20 -

The Consumer Financial Protection Bureau celebrates its 12th anniversary on Friday, prompting Director Rohit Chopra to discuss the agency's work including a proposal to set credit card late fees at $8 and the upcoming Supreme Court case that could defund the bureau.

July 20 -

Declining rates contributed to a surge in refinances, but a sluggish market is capping purchase activity, according to the Mortgage Bankers Association.

July 19 -

The nearly 8% growth on a seasonally adjusted annualized basis is well above the historical average, according to the government-sponsored enterprise.

July 17 -

The share of homeowners late by 30-59 days got slightly higher but remained below 1%, according to the Federal Housing Finance Agency.

July 17 -

Consumer Financial Protection Bureau Director Rohit Chopra will engage in informal talks with Didier Reynders, the European Commission's commissioner for justice and consumer protection, on artificial intelligence, buy now/pay later and digital payments.

July 17 -

Even though the price of softwood lumber has climbed up by more than 7% in the last three months, it sits 21% below its level from a year ago.

July 14