-

Former principal economist at the Federal Housing Finance Agency Paul Manchester breaks down how the targets have been calculated and discusses the implications for the set determined for 2022 to 2024.

January 31 Federal Housing Finance Agency

Federal Housing Finance Agency -

The co-founder of Arch Capital Solutions reviews the changes made to reporting disclosures on mortgages for condominiums and units located in HOAs that were part of a response to the tragic condo collapse in Surfside, Florida.

January 28 Arch Capital Solutions

Arch Capital Solutions -

The borrower sent bogus documents to a settlement company claiming a $111K lien was satisfied to complete a sale.

January 28 -

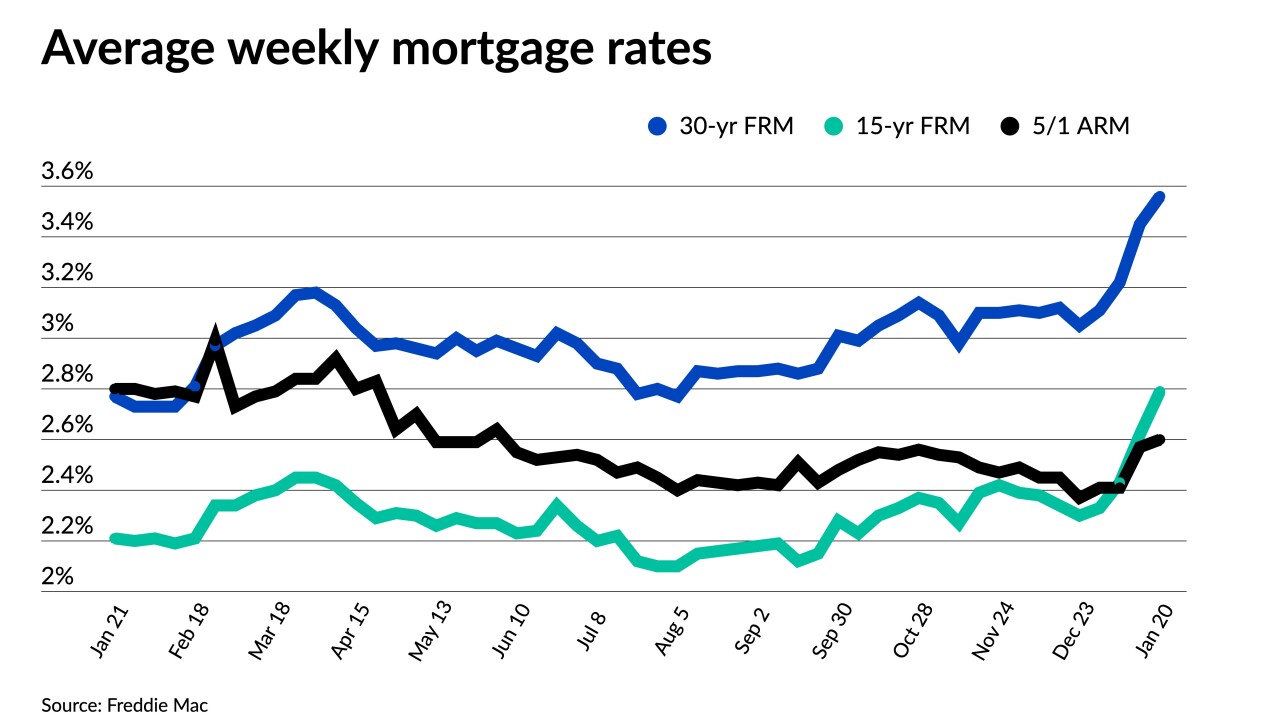

But economists predict upward pressure in the coming months after comments from Federal Reserve Chair Jerome Powell.

January 27 -

Federal Reserve Chair Jerome Powell said the central bank was ready to raise interest rates in March and didn’t rule out moving at every meeting to tackle the highest inflation in a generation.

January 26 -

The rule addresses concerns related to what has previously been a lack of coverage for funds used to cover delinquent borrowers’ principal and interest payments, and clarifies guidance for specific situations.

January 26 -

And a recent slowdown in government-backed loan issuance is pushing average purchase amounts to another record high.

January 26 -

Eleven other defendants participated in the elaborate scam, which led to approval of unqualified buyers and numerous defaults of FHA-backed mortgages.

January 24 -

The deal gives Blackstone a portfolio of 42 garden-style apartment communities totaling more than 12,600 units in 13 states, including Texas, Arizona, Florida, Colorado and Georgia.

January 24 -

Treasury dealers and investors are busy trying to predict exactly when the Federal Reserve might pull the trigger on cutting the size of its balance sheet and how big that drawdown could be when it does.

January 21 -

The mortgage industry has long sought a reduction, which could make homes more affordable to entry-level buyers with limited incomes, but such a measure also would limit the agency’s claims-paying resources.

January 20 -

All major averages have risen to start 2022, with the 15-year surpassing the ARM.

January 20 -

The Federal Reserve Board would become far more diverse if Sarah Bloom Raskin, Philip Jefferson and Lisa Cook are confirmed by the Senate. Jefferson and Cook are respected economists seen as likely to get the nod, but Republicans will challenge Raskin's assertions that bank regulators can play a vital role in combating climate change.

January 14 -

Average prices were up 15% compared to the same month in 2020.

January 14 -

Despite that year-over-year decline, the company beat analysts' expectations with fourth-quarter net income of $5.8 billion. Stronger commercial lending and lower expenses cushioned the blow in consumer credit.

January 14 -

The company's fourth-quarter trading revenue declined notably more than analysts had expected, while its business and consumer lending each dropped 1% year over year.

January 14 -

In a Senate confirmation hearing, the acting Federal Housing Finance Agency director echoed her predecessor’s view that restructuring of Fannie Mae and Freddie Mac should fall to Congress, and pointed to measures aimed at mitigating risk for the agencies.

January 13 -

The company reached an agreement with 39 states to pay $1.85 billion to resolve claims that it had used predatory lending practices.

January 13 -

Chief Operating and Growth Officer Pat Dodd becomes interim president and CEO following Frank Martell’s move to non-executive chairman of the company’s board.

January 13 -

The SEC claims Morningstar put investors at a risk when rating $30 billion in CMBS deals from 2015-2016. Morningstar defends its integrity and independence.

January 13