-

Banking regulators restored the scandal-plagued bank's score three years after assigning it the lowest possible rating under the Community Reinvestment Act.

May 4 -

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

May 4 -

Less competition in the marketplace meant customers were less apt to fudge the truth on a loan application.

May 4 -

The Federal Reserve's emergency rescue of the U.S. mortgage market should have set off celebration among lenders trying to keep up with demand from borrowers. Instead, executives at Quicken Loans got a hefty margin call.

May 4 -

As the coronavirus takes a major toll on housing inventory and credit availability, pent-up buyer demand could lead to market recovery, according to Redfin.

May 1 -

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

May 1 -

Fannie Mae's profitability suffered but it managed to stabilize the mortgage market in the first quarter even with the coronavirus disrupting, among other things, certain credit-risk transfer vehicles it has used.

May 1 -

Net income grew by nearly 1,990% year-over-year as its core mortgage services businesses gained scale.

May 1 -

The Home Loan bank will make zero-interest loans, match charitable donations that members make to nonprofits and small businesses, and provide additional funding for economic development grants.

May 1 -

About 7.3% of U.S. mortgages entered forbearance plans in April, providing temporary relief to more than 3.8 million borrowers who have lost income during the coronavirus pandemic.

May 1 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

Dallas-Fort Worth home prices have slightly declined in each of the last three quarters.

April 30 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

Mortgage rates fell to their lowest level since Freddie Mac started reporting this data in 1971, as the coronavirus shutdown continued to play havoc with the economy.

April 30 -

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

Federal Reserve officials restated their pledge to hold the benchmark interest rate near zero and will keep buying bonds, judging that the coronavirus pandemic "poses considerable risks to the economic outlook over the medium term."

April 29 -

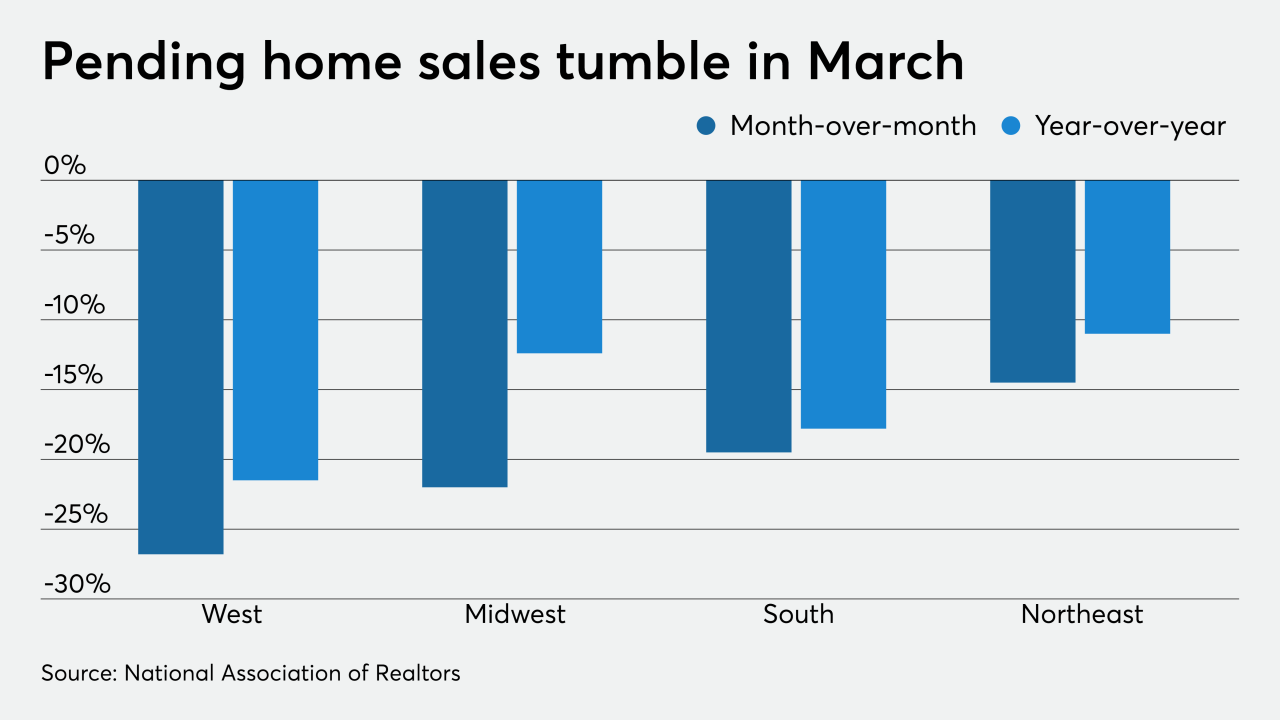

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

It's now definitive: Before coronavirus hit, the Seattle area's home market was hotter than almost anywhere else in the country.

April 29