-

Contracts to buy existing homes plunged in March by the most since 2010 as the coronavirus forced people to stay home and the economy spiraled down.

April 29 -

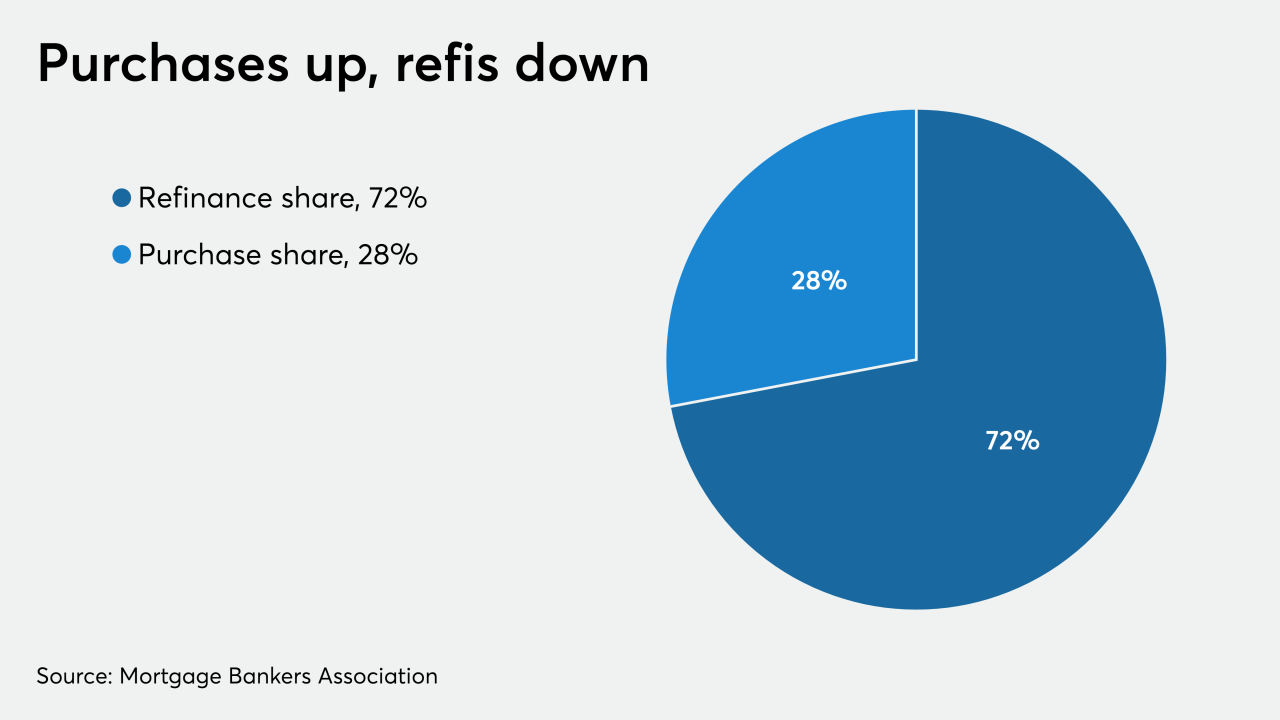

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

The Consumer Financial Protection Bureau's chief operating officer will take a similar position at the Federal Housing Finance Agency, fulfilling one of the multiple recruiting goals the FHFA announced in January.

April 28 -

The government-sponsored enterprises are focusing on how loans can be repaid after the federal forbearance period ends, and projections for loan modification volumes suggest the larger industry should, too.

April 28 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

Refinancing drove a 75% year-over-year increase in mortgage banking revenue during the first quarter at Flagstar Bancorp as it shored up its operations to avoid other negative repercussions from the coronavirus.

April 28 -

Mass layoffs and furloughs due to COVID-19 disproportionately affected Asian, black and Latino workers, and, in turn, will impact their housing security the most, according to Zillow.

April 28 -

Dallas-area home prices were up just 2.5% in the latest national comparison, but the small year-over-year increase came in February before the COVID-19 pandemic significantly impacted the market.

April 28 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The agency stated it’s concerned that securitization payment cash flow for the notes could be disrupted by deals’ stop-advance features that limit the period in which servicers must cover principal and interest payments on delinquent loans to MBS noteholders.

April 27 -

The number of loans in forbearance increased by a full percentage point over the past week, according to the Mortgage Bankers Association.

April 27 -

Pre-pandemic, home-buying power was high, but few are likely to buy a home today given a host of uncertainties regarding coronavirus, First American said.

April 27 -

As lenders scale up on their remote capabilities in response to the pandemic, the software companies that service them see exponential growth.

April 27 -

The FHFA's director said the announcement is meant to “combat ongoing misinformation” about efforts to let homeowners skip mortgage payments due to the coronavirus pandemic.

April 27 -

The bureau said it began developing the standards before the coronavirus pandemic. But more transfers may occur as some servicers struggle to meet their obligations during the economic downturn.

April 24 -

Recognizing the leading originators of Federal Housing Administration mortgages in the 2020 Top Producers survey.

April 24 -

FHFA Director Mark Calabria stated that he was directing the GSEs to "add liquidity" to the markets, but the actions of the FHFA say precisely the opposite.

April 24 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Treasury secretary said recent government moves will help the firms get through the risk of millions of borrowers missing their loan payments.

April 24 -

The coronavirus outbreak has shuttered business and kept people hunkered down in their homes. Perhaps unsurprisingly, it's also resulted in a market that experts describe as essentially frozen in place.

April 23 -

The Federal Housing Administration has provided struggling homeowners with payment flexibility and explored other measures. At the same time, the agency is mindful of protecting itself against downside risks.

April 23

![“We want to make sure that our cash [inflows] exceed our cash outflows, so again, we’re looking at a lot of different things, and premiums being one of them, but there are other things that we’re considering as well," FHA Commissioner Brian Montgomery said.](https://arizent.brightspotcdn.com/dims4/default/15b0d4f/2147483647/strip/true/crop/1260x709+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fc0%2Fd2%2F5bd96a5a4a9eb632ac3bfd4b8da9%2Fmontgomery-brian-fha.png)