-

Across-the-board decreases across all loan types drove the Mortgage Bankers Association's full credit availability index to its lowest in three months.

January 8 -

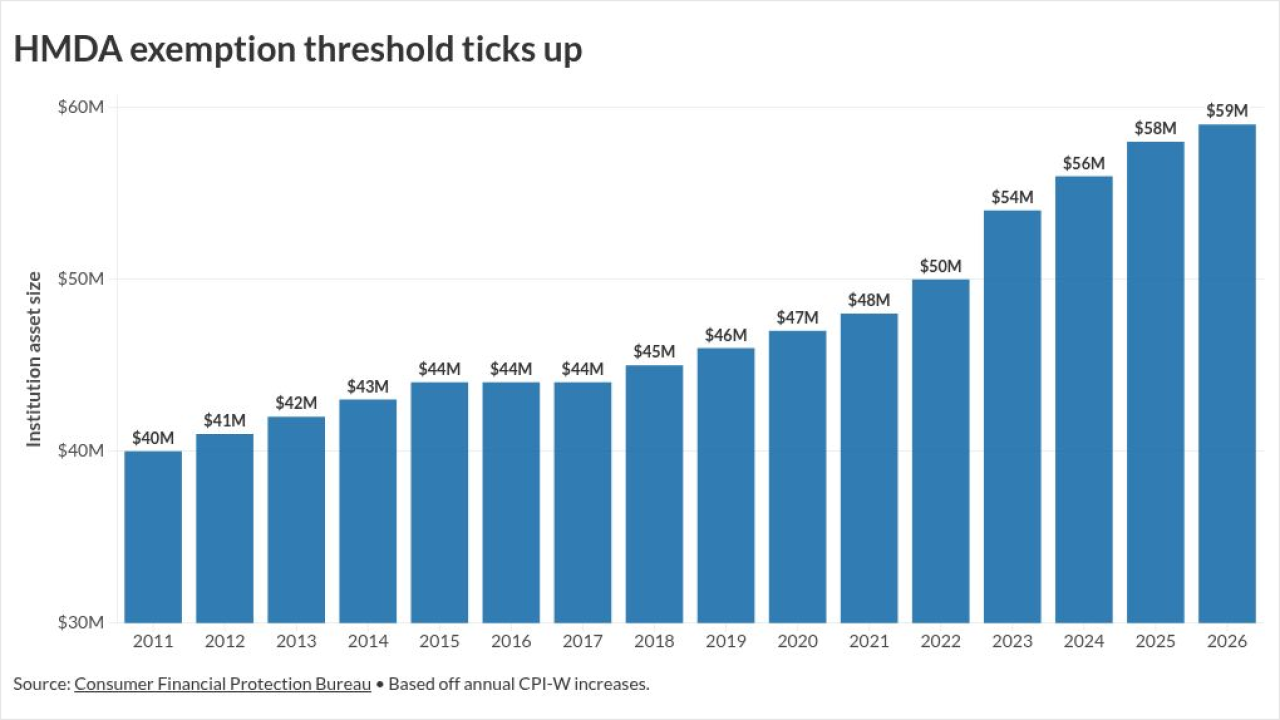

Originators with less than $59 million in assets don't have to share their loan data with CFPB, as the semi-shuttered regulator continues mortgage oversight.

January 8 -

The company was founded in 1986 by current CEO Mat Ishbia's father Jeff and became the No. 1 originator by dollar volume in the third quarter of 2022.

January 7 -

Largely strong credit qualities were offset because by loans on single-family homes in the pool dropping by 0.5%, and that the percentage of loans that received due diligence decreased by 0.4%.

January 7 -

The deal still faces a lawsuit from activist investor HoldCo Asset Management, which contends that Comerica didn't properly shop itself before agreeing to sell to Fifth Third.

January 6 -

With limited seasoning and primarily a clean payment history, OBX 2026-NQM1 had a seasoned probability of default of 33.3% among the AAA stresses and 11.4% among the B.

January 6 -

Yields gravitated back toward session lows — down three to four basis points on the day — after the December ISM manufacturing gauge unexpectedly dropped.

January 5 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

The rally sparked by the weekend US arrest of Venezuela's President Nicolas Maduro also faltered as oil prices rebounded from their initial declines

January 5 -

Brinton joins the mortgage industry trade group after previously holding accounting leadership positions at a range of business organizations and nonprofits.

January 2 -

The merger of equals, which received a chilly reception from investors when it was announced in July, closed faster than analysts had expected.

January 2 -

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

December 31 -

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

December 30 -

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

December 29 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

A significant portion of the loans in the pool by balance, 44.5%, are designated at non-QM, according to DBRS, adding that about 50% of the loans in the pool were made to investors for business purposes.

December 29 -

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

December 24 -

The regulator lowered benchmarks for acquisitions of certain single-family loans including low-income refinances, and left multifamily targets intact.

December 23 -

The president's latest commentary comes as he is looking to new leadership at the Fed to help reduce borrowing costs, as he increasingly feels political pressure to address voter concerns over affordability.

December 23