-

Three US senators opened an inquiry into insurance ratings firm Demotech and whether its assessments may be exposing Fannie Mae and Freddie Mac to growing risks tied to climate-driven insurer failures.

December 23 -

A California judge dismissed 13 claims against United Wholesale Mortgage that alleged the lender disclosed personal information to third parties.

December 23 -

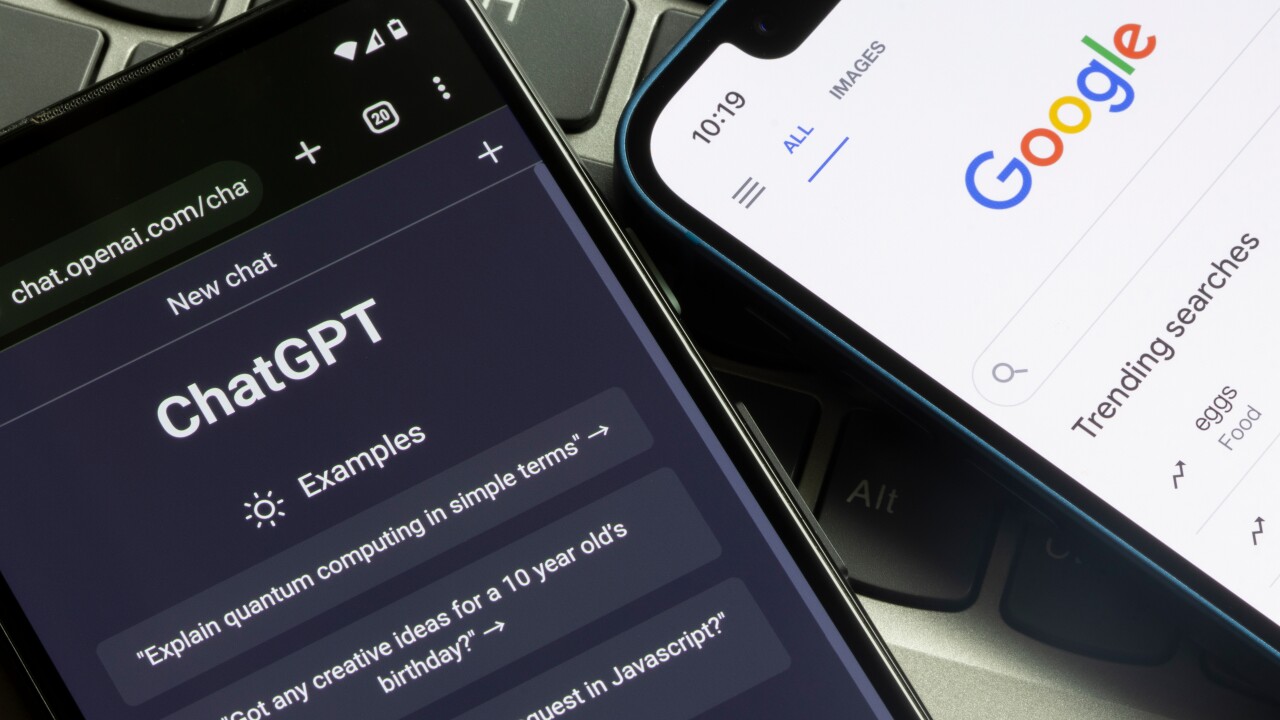

AI tools like ChatGPT are reshaping mortgage marketing, forcing lenders to rethink SEO, brand authority and how they show up as consumers turn to generative search for answers.

December 23 -

Proxy advisory firm Institutional Shareholder Services recommended approval of Fifth Third's $10.9 billion proposed acquisition of Comerica.

December 22 -

Principal will be distributed pro rata among the senior A1 through A3 certificates, and subordinate bonds will not receive any principal until all senior classes are reduced to zero.

December 19 -

The move formalizes acting leadership roles both have had in different segments of the government-backed mortgage market serving many first-time homebuyers.

December 19 -

Monthly excess spread will confer credit enhancement to the notes, KBRA said, and while it will be released it will not be available as credit enhancement in future payment periods.

December 18 -

The Dallas bank turned down another offer because it thought it could get a higher price from Fifth Third, and also could ink an agreement faster, according to Comerica's latest regulatory filing.

December 18 -

Congress has passed a bill giving taxpayers who have been affected by natural disasters some extra time to file a claim for a tax credit or refund.

December 18 -

The Federal Reserve said in a statement that its "understanding of innovation products and services have evolved" since the initial guidance was published in 2023.

December 18 -

The deal significantly grows United Wholesale Mortgage's servicing portfolio, and it will increase the float on its common stock, making it more investable.

December 17 -

The lawsuit is the latest scrutiny over personnel moves this year at the companies under the purview of U.S. Federal Housing Finance Agency Director Bill Pulte.

December 17 -

The trade group's letter to FHFA Director Bill Pulte pointed out that lenders were facing credit report price hikes for four straight years.

December 16 -

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

December 16 -

Federal Reserve Gov. Stephen Miran said higher goods prices could be the trade-off for bolstering national security and addressing geo-economic risks.

December 15 -

Fannie Mae and Freddie Mac have added billions of dollars of mortgage-backed securities and home loans to their balance sheets in recent months, fueling speculation that they're trying to push down lending rates and boost their profitability ahead of a potential public offering.

December 15 -

Rohit Chopra is named senior advisor to the Democratic Attorneys General Association's working group on consumer protection and affordability; Flagstar Bank adds additional wealth-planning capabilities to its private banking division; Chime promotes three members of its executive leadership team; and more in this week's banking news roundup.

December 12 -

The Department of Housing and Urban Development announced the FHA-insured loan caps for low- and high-cost areas, which are set based on conforming loan limits.

December 12 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

The new monthly reporting rule lists improved accuracy and timeliness of MBS payments among its goals, with implementation planned for February 2026.

December 12