-

Leaders of its parent company touted the success of subscription models and also made a case for its proposed merger with Black Knight in an earnings call

November 3 -

Higher rates are also affecting the share of loans that actually go all the way to closing, Black Knight found.

July 11 -

While rate and term refinancings had the largest drop in volume, credit scores for cash-outs are 33 points lower than one year prior, indicating that these borrowers need financial liquidity, a Black Knight report found.

June 13 -

Mortgage Cadence, the No. 3 loan origination system provider, believes it will pick up market share among nonbanks if the deal between the two heavyweight entities goes through.

May 24 -

Intercontinental Exchange Inc. is tapping the investment-grade market with a bond sale in as many as six parts to help finance its acquisition of the fintech.

May 12 -

Private equity firms have been weighing bids for the tech provider, according to people familiar with the matter.

April 5 -

Optimal Blue researchers found correlations of 75% or more when looking at numbers of different loan-size cohorts, but the percentages came in lower when state data was analyzed.

February 28 -

The platform, built off a recent acquisition, looks to create efficiency in the growing wholesale lending market.

September 15 -

The company's expanded portfolio through its acquisition spree drove revenue, representatives said.

August 5 -

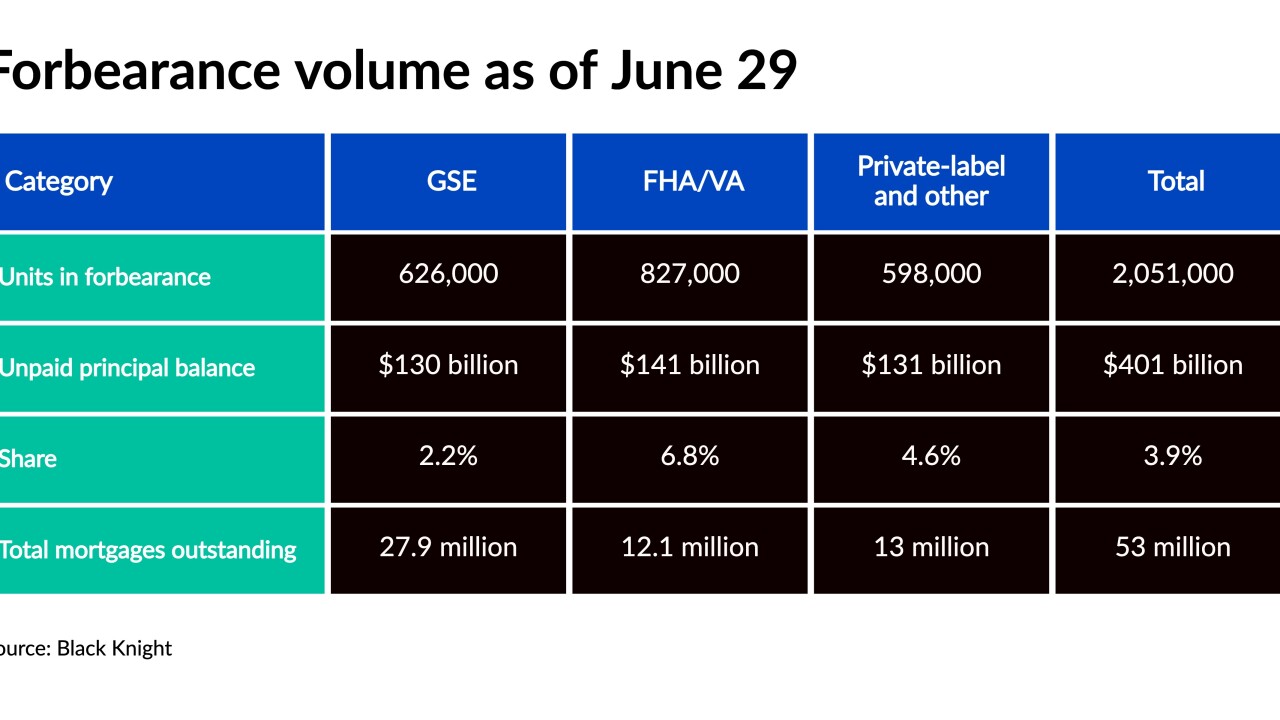

However, 8% fewer borrowers are still in a plan compared with a month ago, Black Knight said.

July 30 -

The relatively low share of borrowers who were distressed in June adds to signs that the offramp from government relief measures may not lead to an overwhelming wave of foreclosures.

July 22 -

The sharp decline suggests borrowers are recovering enough from pandemic-related hardships to leave forbearance plans even before a key expiration date arrives this fall.

July 9 -

The number of GSE-backed and government sponsored loans in forbearance declined, while portfolio and private-label loans increased.

July 2 -

The long-time title and mortgage technology industry executive wants to reduce the number of public company boards he serves on.

June 14 -

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

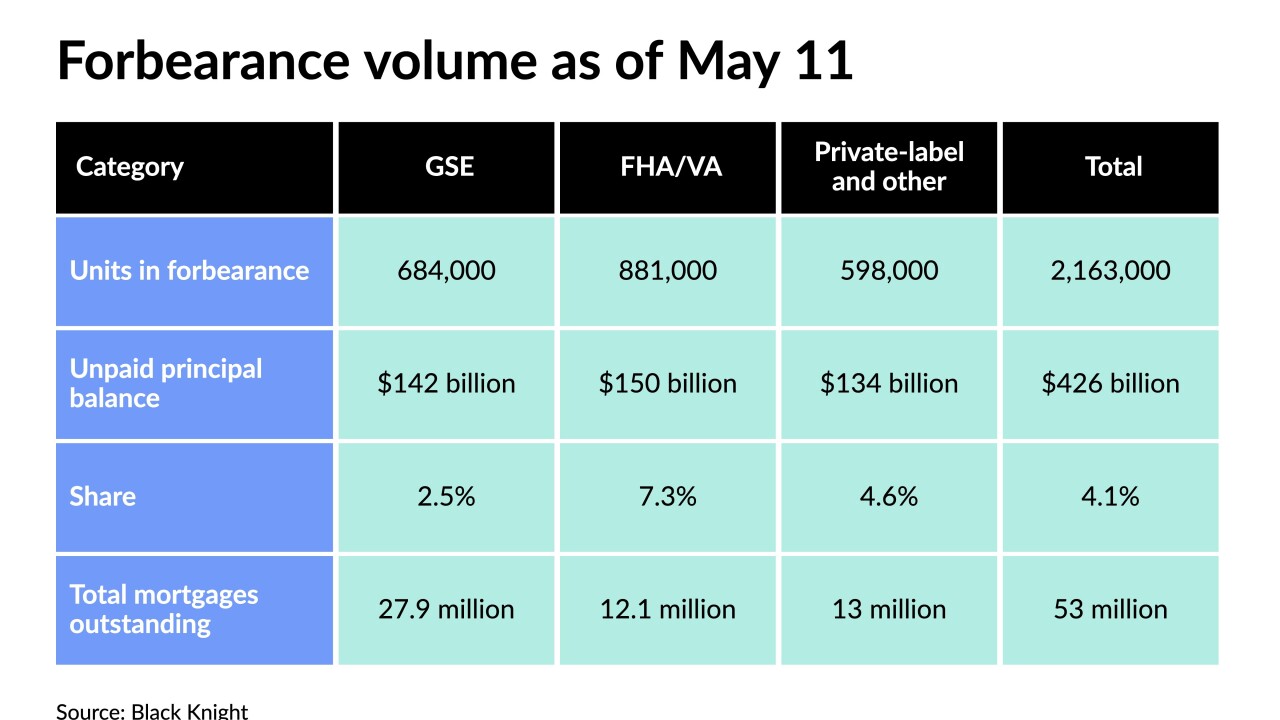

Numbers fell across the board, with private-label and portfolio loans declining most.

May 14 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The persistently slow reduction in the number of borrowers at risk of default indicates that while loan performance overall is improving, a substantial pool of mortgages will need workouts when forbearance ends.

April 22 -

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14