-

The Pennsylvania Housing Finance Agency is switching to Black Knight's LoanSphere MSP to service the agency's $4.9 billion mortgage loan portfolio.

July 30 -

Mortgage foreclosure starts and active foreclosures were at their lowest level in over a decade although there was an increase in new delinquencies in June, according to Black Knight.

July 24 -

Despite available home equity shooting up in the first quarter, the share of total equity withdrawn by borrowers hit a four-year low, likely due to an increase in interest rates, according to Black Knight.

July 9 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25 -

With its acquisition of artificial intelligence and machine learning developer HeavyWater, Black Knight is turning to its Artificial Intelligence Virtual Assistant to streamline the mortgage process, with an immediate focus on the originations sector.

June 6 -

Black Knight has acquired HeavyWater, a developer of artificial intelligence and machine learning technology for the mortgage industry, and plans to incorporate the startup's borrower data verification and other automation capabilities into its existing product suite.

June 4 -

Historically, mortgage delinquencies in the month of April have risen 85% of the time, but April 2018 bucked that trend as they fell, according to Black Knight.

June 4 -

The number of mortgage borrowers for whom it made sense to refinance declined by nearly half since the end of last year and is at its lowest since November 2008.

May 7 -

March's increase in foreclosure starts was a direct result of the end of the moratorium for borrowers affected by Hurricanes Harvey and Irma, Black Knight said.

April 19 -

Publicly traded mortgage technology firms seeking growth could eventually end up squaring off against or buying privately owned point of sale system startups.

April 17 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but they've been slow to borrow against this newfound wealth, according to Black Knight.

April 2 -

The number of mortgage borrowers with an interest rate incentive to refinance fell 40% during the first six weeks of the year and now sits at the lowest level in more than nine years.

March 5 -

Incenter Mortgage Advisors is putting up for bid a $712.8 million package of government-sponsored enterprise and Ginnie Mae mortgage servicing rights concentrated in the Southeast.

March 2 -

Home prices achieved a new peak in December while also marking 68 consecutive months in annual home price appreciation, according to Black Knight.

February 26 -

Delinquencies from Hurricanes Harvey and Irma are starting to subside, even as pre-storm foreclosures that were put on hold resume.

February 23 -

It was a record-setting year in terms of the low number of foreclosure starts, partially helped by the various post-storm moratoria, according to Black Knight.

February 5 -

After 67 months of consecutive home price appreciation, home prices hit a new peak at $283,000 in November 2017, according to Black Knight's Home Price Index.

January 29 -

Homeowners can tap into more home equity than ever before, but deciding between a home equity line of credit and cash out refinance mortgage has gotten more complicated following recently passed tax reforms.

January 8 -

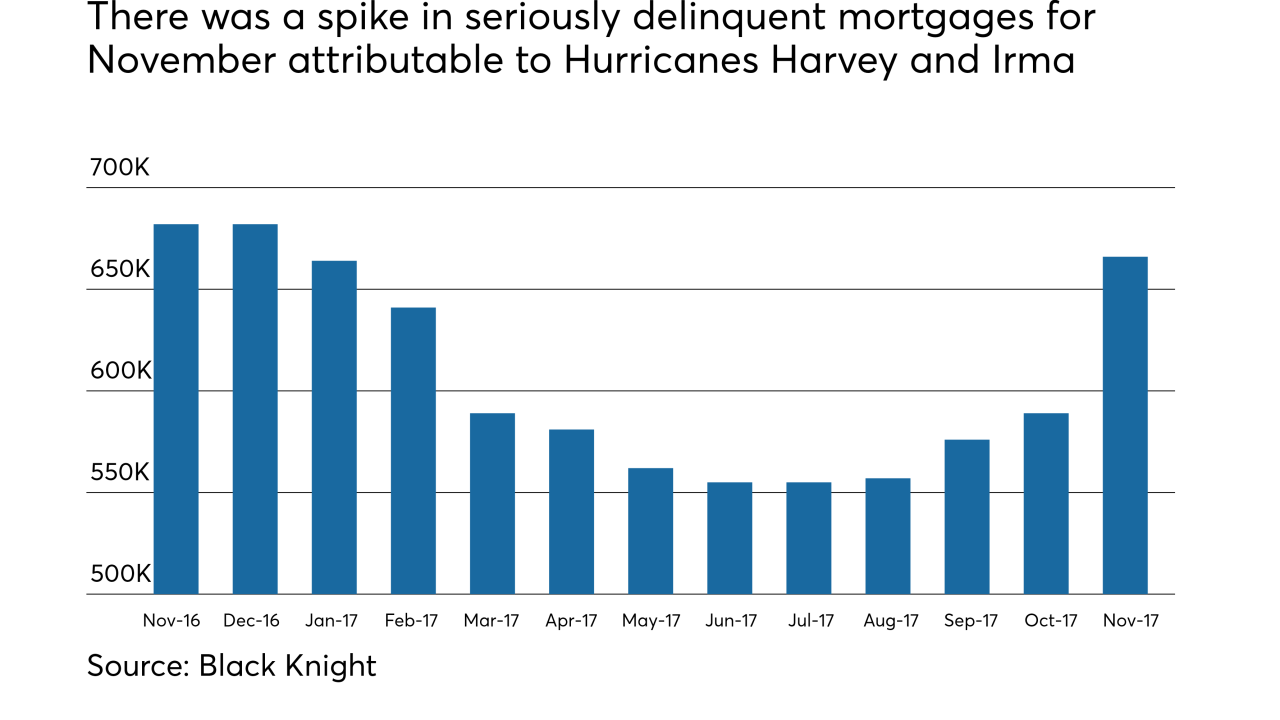

Hurricanes Harvey and Irma contributed to a surge in seriously delinquent mortgages in November.

December 22 -

Here's a look at the 11 housing markets where the share of entry-level homes for sale is greater than the share of first time home buyer shoppers.

December 19