-

Mortgage industry technology providers are adjusting their processes to allow for originations to keep flowing through the system as the nation combats the coronavirus.

March 18 -

Mortgage-related companies finalized four partnerships, a servicing-retention firm went up for sale, and a long-delayed insurance-related transaction moved forward this week in a wave of industry merger and acquisition activity.

March 4 -

Servicers' struggle to retain borrowers mounted in the fourth quarter when a type of loan that is tough to recapture rose to a more than 10-year high, according to Black Knight.

March 2 -

Fears stemming from the coronavirus have resulted in lower mortgage rates and more business for now, but if the situation deteriorates further, consumers could decide to put off buying a home.

March 2 -

From increased consumer engagement to new forms of payment, mortgage servicers are finding themselves faced with new trends in the market that they need to address.

February 28 -

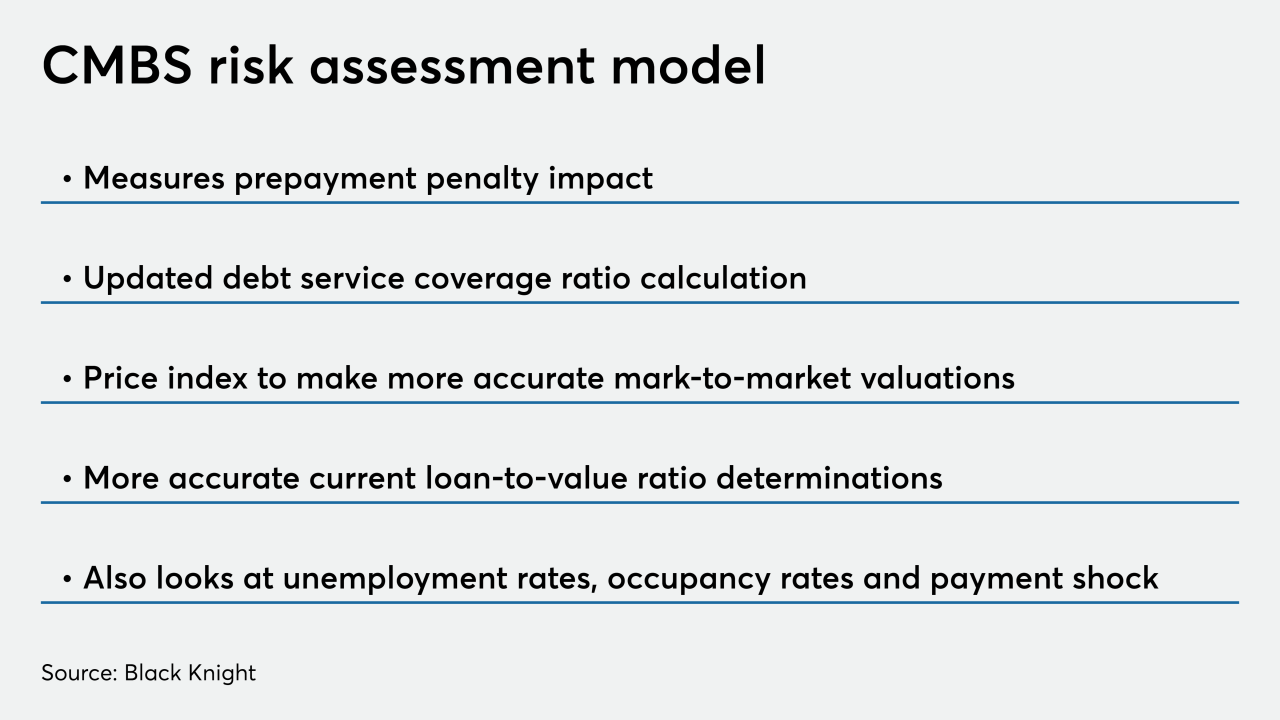

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

For the first time in 15 years, fewer than 2 million mortgaged properties lie in default or foreclosure status as of the end of January, according to Black Knight.

February 20 -

With steady home price appreciation and falling interest rates, by some measures the shares of distressed mortgages existing in the market shrunk to record lows, according to Black Knight.

February 3 -

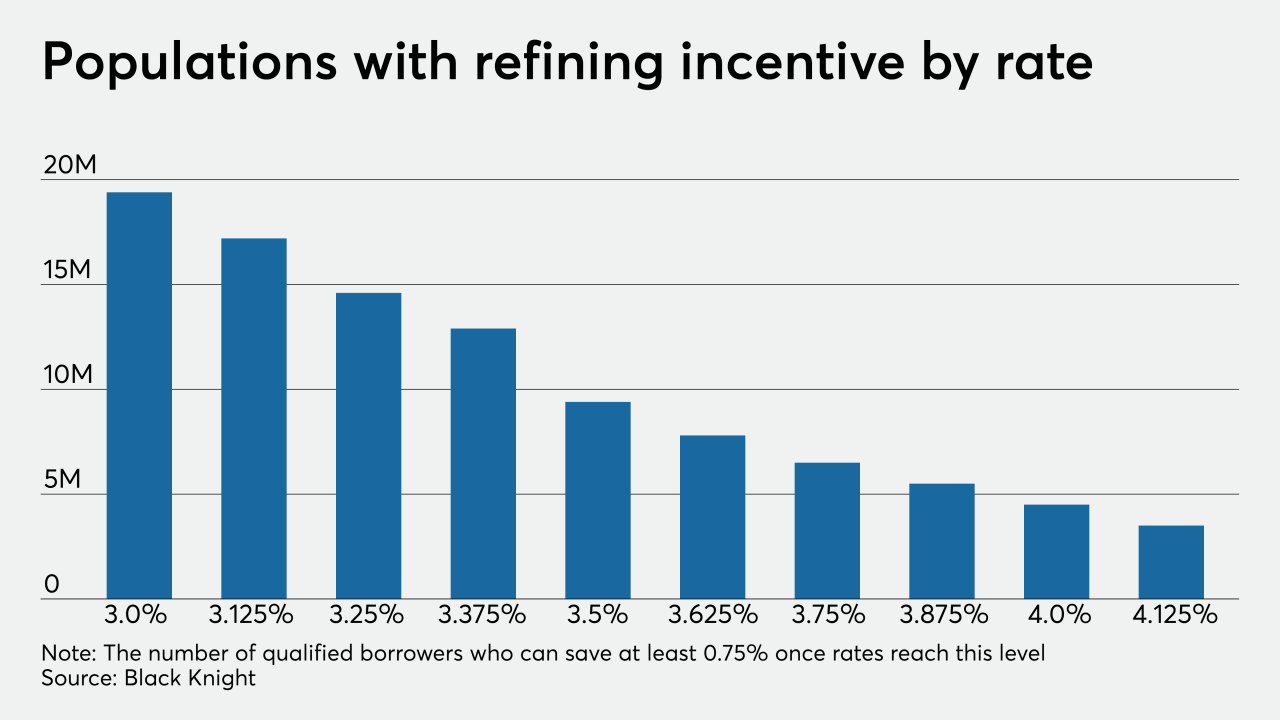

After being range-bound for several weeks, mortgage rates are fluctuating enough to spur significant changes in refi incentive, according to Black Knight.

January 29 -

November's foreclosure starts hit their lowest level since Black Knight started tracking this data in 2000, while the foreclosure rate reached a 14-year low.

January 2 -

More than half of the third quarter refinance activity was the cash-out variety, with borrowers removing the most total equity from their homes in nearly 12 years, according to Black Knight.

December 9 -

Mortgage prepayment levels were at their highest in over six years during October, as existing homeowners took advantage of the lower rates to refinance, or to a lesser extent, purchase a new residence, Black Knight said.

November 25 -

Black Knight and PennyMac Financial Services are suing each other in separate disputes linked respectively to the latter's creation of a servicing platform and the former's dominant position in the market.

November 6 -

Early payment mortgage defaults went to the highest level in nearly a decade, particularly among loans included in Ginnie Mae securities, a Black Knight report said.

November 4 -

While home affordability reached a 32-month high in September, it could continue to increase in the fall months, according to Black Knight's Mortgage Monitor.

October 7 -

Foreclosure starts dropped to their lowest level in 18 years, and properties foreclosed on but not yet sold fell to a 14-year low in August, according to Black Knight.

September 23 -

The number of mortgage holders with refinancing potential dropped by 1.5 million as the average long-term rate for home loans continued to rise, according to Black Knight.

September 20 -

A mere 7-basis-point increase in interest rates reduced what was a record-high number of borrowers with refinancing incentive by 2 million in a matter of days, according to Black Knight.

September 13 -

With more rate-and-term refinancing in the mix, home lenders did a better job of retaining borrowers in the second quarter, but there's still room for improvement.

September 9 -

There's a silver lining to the recent economic turbulence: Mortgage rates have tumbled in recent weeks, triggering a rush to refinance and a race to the closing table for many Twin Citians.

August 14