Citi

Citi

Citigroup is a global financial services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into two primary segments: the global consumer banking segment and the institutional clients group.

-

-

Ultimately, firmwide headcount will decline by 60,000 jobs to 180,000 by the end of 2026, Chief Financial Officer Mark Mason said.

January 12 -

The cuts amount to less than 1% of Citigroup's 240,000-person workforce, according to people familiar with the matter.

March 2 -

With the Colonial Pipeline attack still in the news, bank CEOs testifying at a recent hearing cited cyber risk as the biggest threat facing the industry. But members of Congress did not share those concerns, and instead were more focused on criticizing banks about overdraft fees and their level of investment in minority communities.

June 11 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25 -

Jane Fraser, President of Citigroup and CEO of Global Consumer Bank, shares her thoughts on becoming the firm’s next CEO, expresses her gratitude for the outpouring of support she’s received, and pays homage to all the women who have paved the path before her.

October 16 -

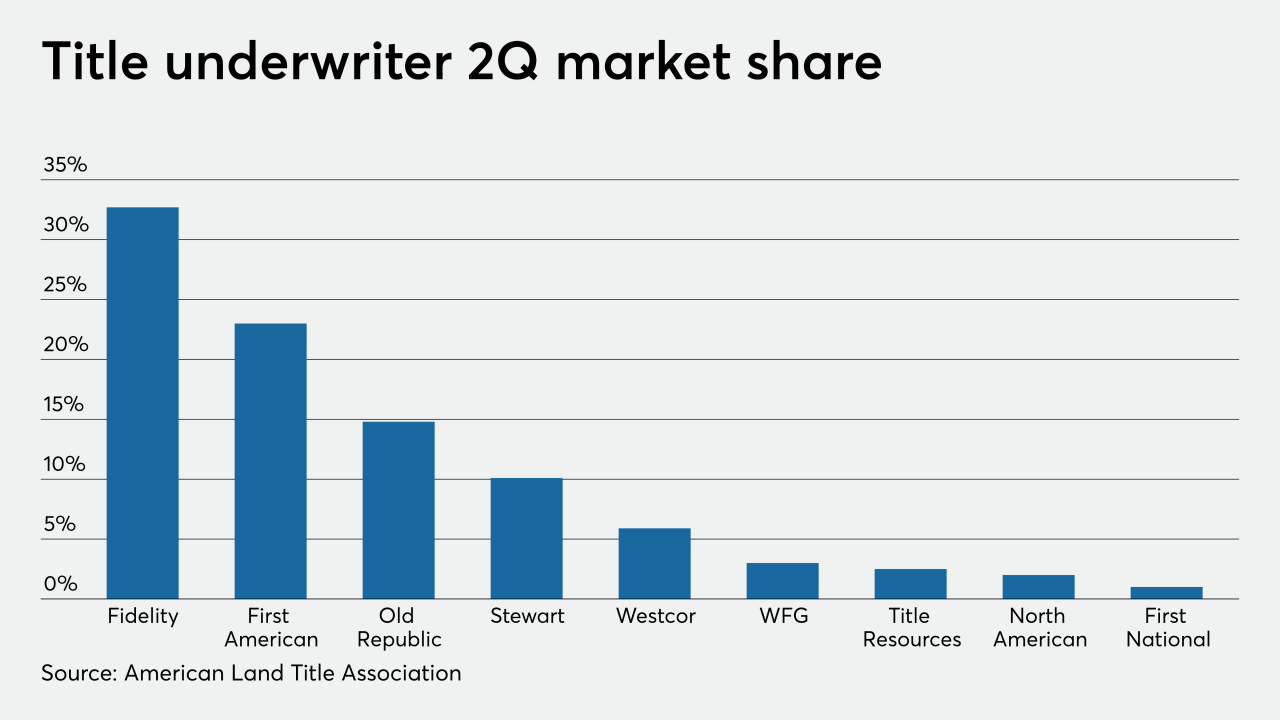

Westcor has been gaining market share, growing to 5.9% of premiums written in 2Q 2020, versus 3.4% in the first quarter of 2019.

September 21 -

Plus: mortgage credit availability hits 6-year-low and Ellie Mae and ICE Mortgage change leadership

September 11 -

When Jane Fraser takes the reins of Citigroup in February, she will have to tackle the company’s cards slump, lagging performance metrics and challenges presented by employees’ return to the office.

-

Jane Fraser, a longtime Citigroup executive, will be the first female CEO of a major Wall Street bank. She succeeds Michael Corbat, who had held the post for eight years.

September 10 -

Deferrals on residential mortgages and home-equity loans have been a common theme at JPMorgan Chase, Bank of America, Wells Fargo and Citigroup since the start of the coronavirus pandemic.

August 5 -

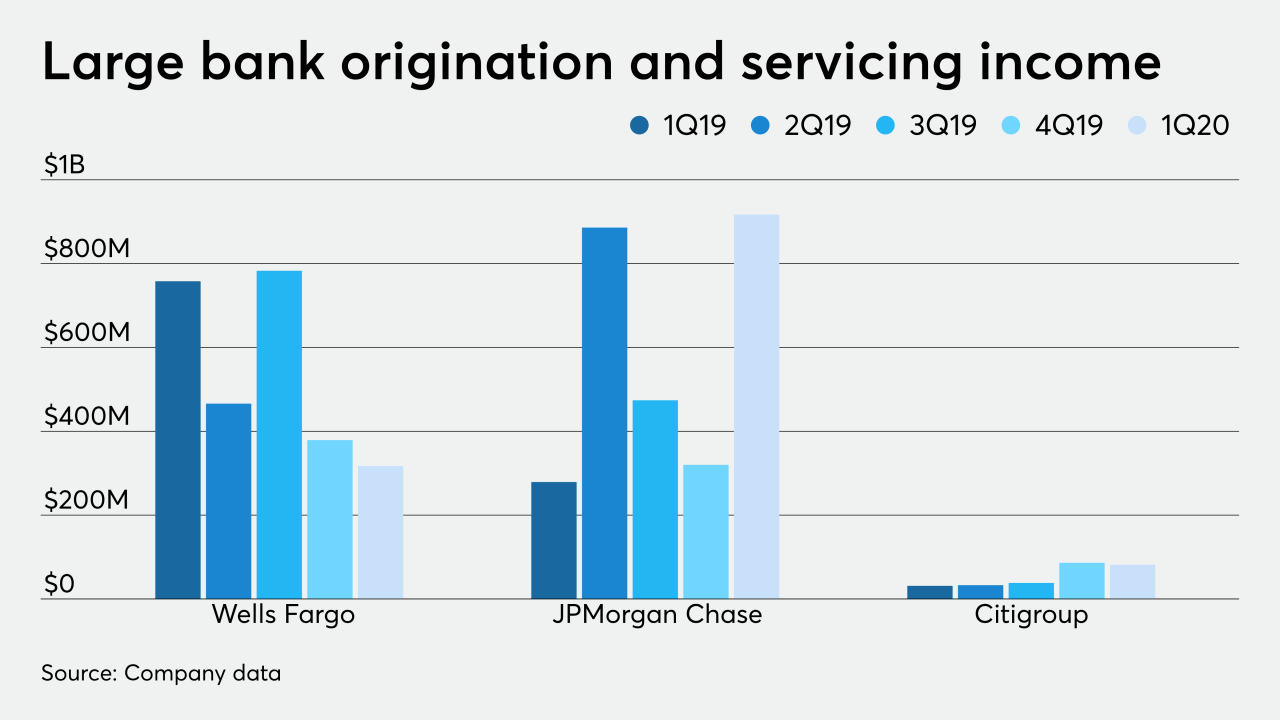

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

Policymakers have eased some rules and the Supreme Court recently dealt a blow to the Consumer Financial Protection Bureau. But as the landmark legislation approaches its 10th anniversary, the post-crisis regulatory regime has stayed largely intact.

July 13 -

The single-borrower deal, sponsored by Brookfield, was pulled in the spring due to market conditions that halted most securitizations at the onset of the COVID-19 outbreak.

July 8 -

JPMorgan Chase, Wells Fargo, Citigroup and U.S. Bancorp, along with 200 state-chartered banks and credit unions, have agreed to let borrowers skip payments for 90 days if their finances have been upended by the pandemic.

March 25 -

The notes in Citigroup Commercial Mortgage Trust 2020-555 are backed by a beneficial interest in the trust’s $350 million portion of the 119-month fixed-rate commercial loan. The loan is secured by a 52-story New York luxury apartment building in Manhattan’s Midtown West submarket.

February 18 -

The city's decision to drop a lawsuit alleging predatory ending by Wells Fargo, JPMorgan Chase, Bank of America and Citigroup highlights the challenges municipalities face in taking on deep-pocketed financial institutions.

February 4 -

A bank, a drug store, another bank: Odds are, a stroll down a random Manhattan avenue devolves quickly into a retail snoozefest.

January 24 -

Fourth quarter gain on sale margin moved in opposite directions at two of the nation's largest banks, falling 9% quarter-over-quarter at JPMorgan Chase, but increasing 25% at Wells Fargo.

January 14 -

The Office of the Comptroller of the Currency found deficiencies related to the bank's holding period for "other real estate owned."

October 11