Citizens Financial

Citizens Financial

Citizens Financial Group is a retail bank holding company operating primarily in the New England, Mid-Atlantic, and Midwest regions of the United States. The bank operates through two segments: consumer and commercial banking.

-

Reskilling and giving AI the boring work are two approaches banks take to making agentic AI palatable to workers who may fear that bots will take their jobs.

November 20 -

The Rhode Island-based bank plans to use artificial intelligence to boost efficiency and improve customer service. "Everything is fair game," said CEO Bruce Van Saun.

July 17 -

Time is running out for the 90-day pause on most of President Trump's tariffs. But at least two bank CEOs are confident there won't be a summer sequel to "Liberation Day."

June 27 -

Citizens Financial Group's promotion of Brendan Coughlin to company president comes at the same time as CFO John Woods prepares to leave for State Street. Both executives have been viewed as potential successors to CEO Bruce Van Saun.

April 30 -

After the bank's 2014 spinoff from Royal Bank of Scotland, its executives worked to shore up weaknesses. Now they're concentrating on how to close the gap with regional banking peers.

September 24 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

After the Rhode Island-based company eliminated 650 positions, severance-related costs contributed to a 71% decline in quarterly net income.

January 17 -

-

Once the pace of private equity-backed sales of middle-market companies picks up, the Rhode Island-based bank expects to benefit. CEO Bruce Van Saun says that Citizens' recent expansions in private banking and wealth management will provide opportunities to cross-sell to corporate clients.

December 7 -

The Rhode Island bank endured a sharp decline in fee income from home loans, which had spiked earlier in the pandemic. But CEO Bruce Van Saun says the company is well positioned as the refinancing boom fades and the home purchase market becomes more important.

July 20 -

Fears of widespread credit losses have largely subsided, but demand for new commercial real estate loans remains lackluster because many companies are sitting on so much cash they don’t need to borrow. Meanwhile, competition from private equity groups and other nonbank lenders is escalating.

June 14 -

Managing a major lender in the midst of COVID fears and social unrest has required a rethink of banking norms. Exploring the executive decisions all leaders must consider is the recipient of American Banker's Banker of the Year award.

-

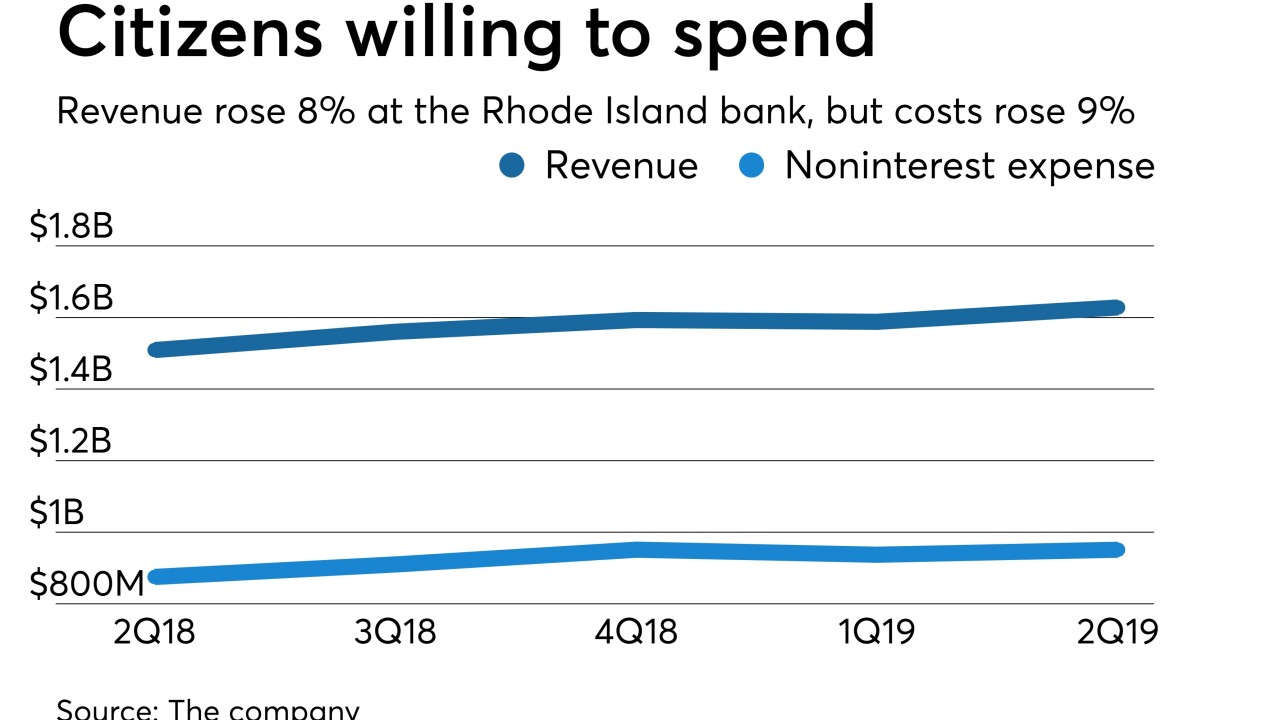

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

It’s the one consumer loan category where balances continue to fall, and disruption from nimbler fintechs is a big reason why. To win back market share, banks will need to beat the upstarts at their own game.

June 7 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

The Providence, R.I., company reported a double-digit increase in quarterly profits despite a year-over-year decline in fee-based revenue.

April 20 -

Shares of the Providence, R.I., company plunged Monday after a news report that it faces possible legal risks from the latest charges filed against Paul Manafort, the former campaign manager for President Trump.

February 26 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

October 30 -

Auto risks mounting. Mortgage market tightening. Are there any good risks these days in consumer lending? Regional bank executives insist partnerships with online lenders, unsecured personal loans and other niche efforts can work if done properly.

July 21 -

Executives at BB&T, KeyCorp and Citizens are milking commercial lending niches and balancing cost control with new investments while waiting for more rate hikes to fatten margins.

April 20