-

CoreLogic's fourth-quarter earnings declined from the previous year because of the slower mortgage origination market and an $8 million impairment charge due to its restructuring plans.

February 27 -

Home prices in 20 U.S. cities rose in December at the slowest pace in four years, continuing to decelerate as buyers balked at purchases amid still-elevated housing costs and a falling stock market.

February 26 -

When it comes to cars, tunnels and rockets, Elon Musk thinks big. The same is true for his household finances.

February 22 -

Mortgage loan performance remained strong in November as serious delinquencies fell to their lowest reported level since before the housing bubble burst, according to CoreLogic.

February 12 -

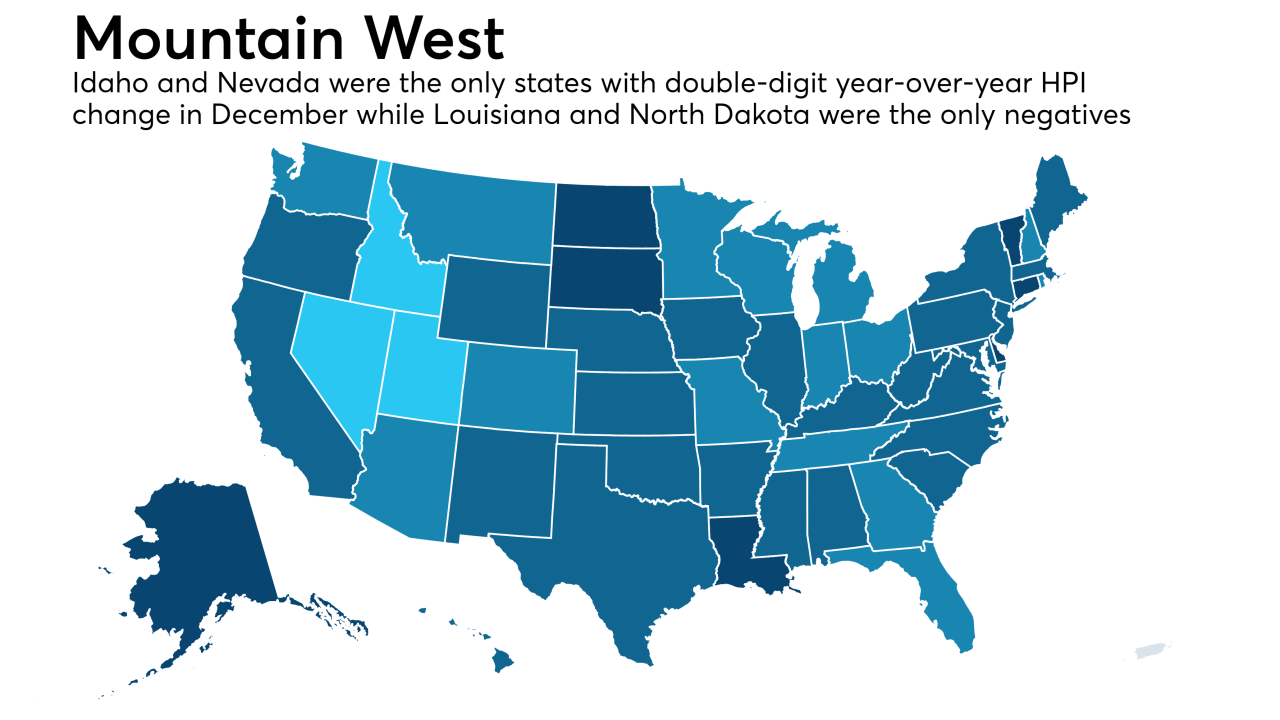

Inventory deficiency and affordability issues kept sales down and hampered home price growth, according to CoreLogic.

February 5 -

The seven-year fever driving up Bay Area home prices may finally be breaking.

February 4 -

The housing market's chill grew colder in December, as sales plunged across Southern California and home prices barely rose.

February 1 -

Home prices in 20 U.S. cities rose in November at the slowest pace since early 2015, decelerating for an eighth straight month as buyers balk at the ever-receding affordability of properties.

January 29 -

Consecutive-month default rates for home loans are increasing, and they could remain higher the next few months, according to a recent report.

January 15 -

The strong economic headwinds from last fall facilitated a declining loan delinquency rate across the country, though areas hit by natural disasters had increased defaults, according to CoreLogic.

January 8 -

House prices in Los Angeles and Orange counties rose in November at the slowest rate since the last housing slump ended in 2012, according to a new housing report.

January 7 -

U.S. home prices are at "high tide," but they will top out well before they inflate to the dangerous highs seen during the 2006 housing boom, according to a recent study.

January 3 -

Dallas-area home price gains slightly outperformed the national average in November.

January 3 -

Rising mortgage rates are helping decelerate home price growth, which is expected to slow further during the coming year, according to CoreLogic. Consumer uncertainty in the economy due to stock market declines may also weaken house values.

January 2 -

Southern California home sales fell sharply in November, deepening a retreat from a sustained housing boom that placed home ownership out of reach for many.

December 28 -

Home prices in 20 U.S. cities slowed in October for a seventh consecutive month, extending the longest streak since 2014, a sign of waning demand amid higher mortgage rates and elevated property values.

December 26 -

CoreLogic is exiting its loan origination software and default management operations over the next 24 months and instead accelerated plans to transform its appraisal management company unit.

December 21 -

Rising rents combined with growing housing inventory could lead to increased purchase mortgage originations in the near future.

December 18 -

Other than in areas hit by natural disasters, delinquency rates are falling with help from a healthier labor market, but a rise in riskier lending habits could signal trouble for borrowers should housing conditions change, according to CoreLogic.

December 11 -

As home value appreciation slowed, gains in home equity for the third quarter fell to the lowest level in two years, according to CoreLogic's homeowner equity report.

December 6