-

The number of Americans who are behind on their mortgage payments is the lowest in more than a decade.

September 12 -

Houston area home prices rose 5.4% over the last year through July, slightly below the national appreciation rate of 6.2%.

September 10 -

The dollar volume of private-label residential mortgage-backed securities issuance this year is the highest it has been since the Great Recession, despite a decline in new originations.

September 6 -

Sacramento's once hot housing market continued its cooling trend in July, with median prices dipping slightly in five of the six local counties.

September 6 -

The median Bay Area home price fell from June to July but was still up double digits over last year, according to CoreLogic.

September 5 -

Growth in home prices remained churning at a steady pace, with sellers holding out for better returns and suppressing the supply of available housing.

September 4 -

Southern California’s red-hot housing market continued to cool in July as rising home prices and higher interest rates discouraged homebuyers, new housing figures show.

August 31 -

Home buyers in the Twin Cities and beyond will have to wait until at least 2020 for key indicators in the housing market tilting toward buyers, according to a new survey.

August 31 -

For the first time in a year and a half, Washington is no longer the state with the hottest housing market in the country, though not because homes here have suddenly become cheap.

August 14 -

Mortgage delinquency rates dropped on an annual basis, a sign of a strengthening economy, but could soon see a spike due to this year's wildfires, according to CoreLogic.

August 14 -

Dallas-area home prices are up by less than the national average in another new housing report.

August 8 -

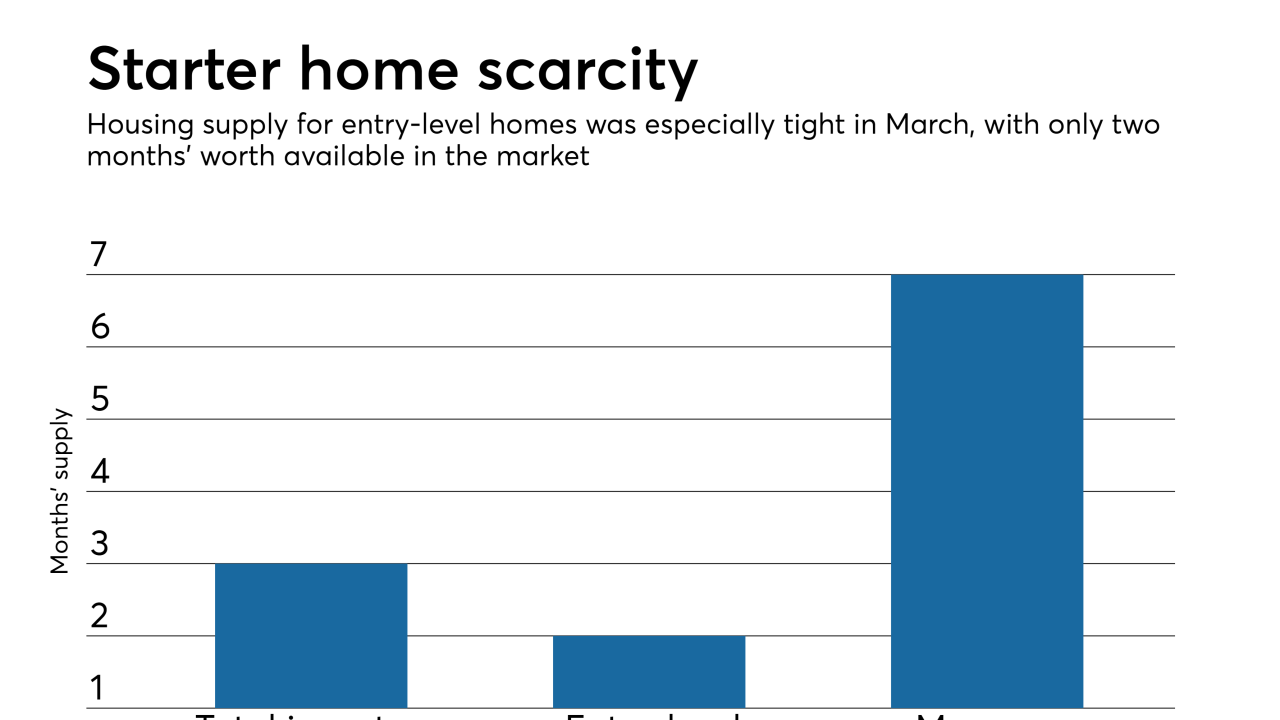

Growth in home prices continued wearing down affordability at the start of the season, preventing first-time buyers from entering the housing market.

August 7 -

CoreLogic has updated its Risk Quantification and Engineering tool amid California wildfires to include U.S. Wildfire and U.S. Severe Convective Storm models to support the mortgage and insurance industries in better assessing natural disaster risk.

July 31 -

Fewer Dallas-area homeowners are behind in their mortgage payments than at any time since the Great Recession.

July 16 -

Healthier economic conditions, more effective underwriting methods and recovering hurricane-impacted states helped drive delinquency and foreclosure rates to their lowest level in over 10 years, according to CoreLogic.

July 10 -

Housing demand is high, but few homeowners are interested in selling and the resulting inventory shortage continues to drive home prices higher.

July 3 -

Dallas-area home prices are up 7.8% from a year ago in the latest national comparison by CoreLogic.

July 3 -

The Southern California median home price surged 8.2% in May from a year earlier, hitting a new all-time high of $530,000, according to a report from CoreLogic.

June 25 -

Resale inventory is at its lowest level in 18 years and new construction supply continues being outpaced by high demand, according to CoreLogic.

June 19 -

Los Angeles and Inland Empire house prices increased by more than 8% for the second month in a row in April, the CoreLogic Home Price Index showed.

June 12