-

If recent corporate expansions at GE, Google and Toyota are any indication, the city that lands Amazon's second headquarters should expect widespread real estate speculation and unrealistic home price expectations that will strain affordability and make it difficult for mortgage lenders to qualify borrowers.

February 7 -

Major corporate relocations can be a mixed blessing for housing markets. Here's a snapshot of local real estate conditions in the 20 cities vying for the Amazon HQ2 second headquarters.

February 7 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

Home prices will continue to increase this year, albeit at a slower pace, as inventory is expected to remain tight and demand will continue to rise.

February 6 -

The percentage of flood damage to residential properties from Hurricane Harvey that is uninsured is turning out to be a little higher than earlier estimates.

January 25 -

U.S. home prices are surging to new records. Homebuilder stocks last year outperformed all other groups. And bears? They're now an endangered species.

January 22 -

Despite the overall mortgage delinquency rate being down in October, early-stage mortgage delinquencies increased following an active hurricane season, according to CoreLogic.

January 9 -

Consumer credit scores are improving, but many qualified borrowers are still hesitant about buying a house. New tools are helping lenders better assess risk and show consumers with lower credit scores they can qualify for mortgages.

January 8 -

Dallas-area home prices are at record levels but are rising at a slower rate than in recent years.

January 4 -

The gap between the average credit score for homebuyers and other consumers has widened to its highest point in 12 years, and lenders don't know what, if anything, to do about it.

January 3 -

Southern California home prices rose at their fastest pace in almost two years in November as falling numbers of homes for sale pushed home prices ever higher, figures from CoreLogic show.

January 3 -

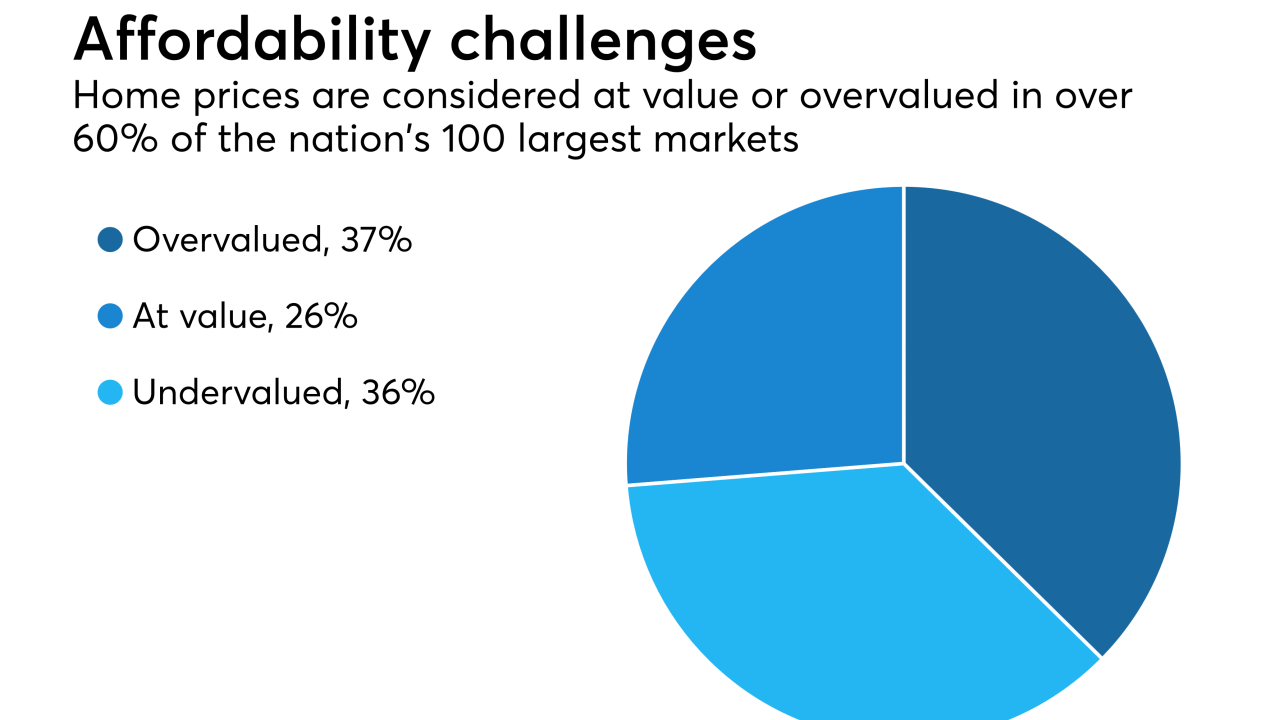

Home price growth is likely to slow in the near future but affordability remains a concern, especially at the lower end of the market, according to CoreLogic.

January 2 -

The median price of a Marin County, Calif., home spiked 15.5% to $952,250 in November, compared with the $824,500 median price a year earlier.

January 2 -

The foreclosure rate in Minnesota is now at the lowest level in more than a decade, and far below the national average.

December 29 -

Dashing wannabe home buyers' dreams yet again, the Bay Area's jaw-dropping home prices soared still higher in November — setting a new record.

December 29 -

Underwriting purchase loans is inherently more precarious for mortgage lenders and that contributed to the year-over-year increase in risk in new originations during the third quarter, CoreLogic said.

December 19 -

From Ellie Mae to Remax, here's a look at seven publicly traded companies in the mortgage and real estate industries expecting accelerated growth in 2018.

December 12 -

Early-stage mortgage delinquencies had their largest year-over-year gain during September in over eight years, a direct result of Hurricanes Harvey and Irma.

December 12 -

There are fewer Albuquerque-area homeowners underwater on their mortgages compared with last year.

December 11 -

Homeowners with mortgages have collectively seen their equity increase 11.8% year-over-year in the third quarter, according to CoreLogic.

December 7