-

A lower court “erred” when it sided with Fannie Mae and Freddie Mac’s investors, the Justice Department said in its petition to the high court.

October 30 -

The government has used the law to bring fraud claims against Federal Housing Administration lenders, but the new steps respond to criticism that minor offenders were also getting punished.

October 28 -

A list of upcoming cases published by the high court did not include a challenge to the bureau's constitutionality, but the justices could still decide to review it at a later date.

October 15 -

A Rochester, N.Y., developer who faces federal mortgage fraud charges connected to apartments in Buffalo and other cities has pushed back the sale of a significant part of his real estate portfolio until later this month.

October 7 -

Flagstar Bank expects to recover $1 million of its loan to defunct reverse mortgage lender Live Well Financial following the sale of the collateral that secured it.

September 19 -

The agency's director told congressional leaders and staff that she backs a Supreme Court challenge to the bureau's leadership structure.

September 17 -

Deutsche Bank is cooperating with the Justice Department's antitrust investigation into whether several of the largest global banks conspired to rig trading in unsecured bonds issued by Fannie Mae and Freddie Mac.

September 12 -

Robert Shapiro, the former chief executive officer of Woodbridge Group of Companies, pleaded guilty to running a $1.3 billion fraud that caused more than 7,000 investors to lose money, according to prosecutors.

August 9 -

Former Lend America executive Michael Ashley was sentenced to three years in prison for his actions that led to the implosion of the once-high-flying Melville, N.Y.-based mortgage lender.

July 18 -

An Indiana man was sentenced to seven years in federal prison after his conviction for participating in a foreclosure rescue fraud scheme.

July 5 -

Mortgage lenders might be feeling a little less stressed over False Claims Act actions being brought against them following recent headlines but there is still some work to be done before they can chill out.

July 2 -

The CFPB did not file any fair-lending enforcement actions in the 2018 fiscal year and did not refer any Equal Credit Opportunity Act violations to the Department of Justice.

July 2 -

Quicken Loans claimed victory in its dispute with the Department of Housing and Urban Development over the False Claims Act, only paying the agency for losses incurred and interest.

June 14 -

Charges against Stephen Calk indicate he lied to regulators about what he knew when he approved loans to Paul Manafort, as well as his interest in landing a job in the Trump administration.

May 23 -

Four real estate professionals could face up to 30 years in prison and hefty fines after being indicted on charges related to allegedly defrauding Fannie Mae, Freddie Mac and multifamily lenders.

May 23 -

The industry welcomed a proposed overhaul of how the government identifies False Claims Act violations, but some say it remains to be seen if the changes are enough to satisfy companies that had bolted.

May 9 -

With nearly $90 million added in the past two months, Goldman Sachs marched closer to its $1.8 billion consumer-relief mortgage settlement with the U.S. Department of Justice.

May 2 -

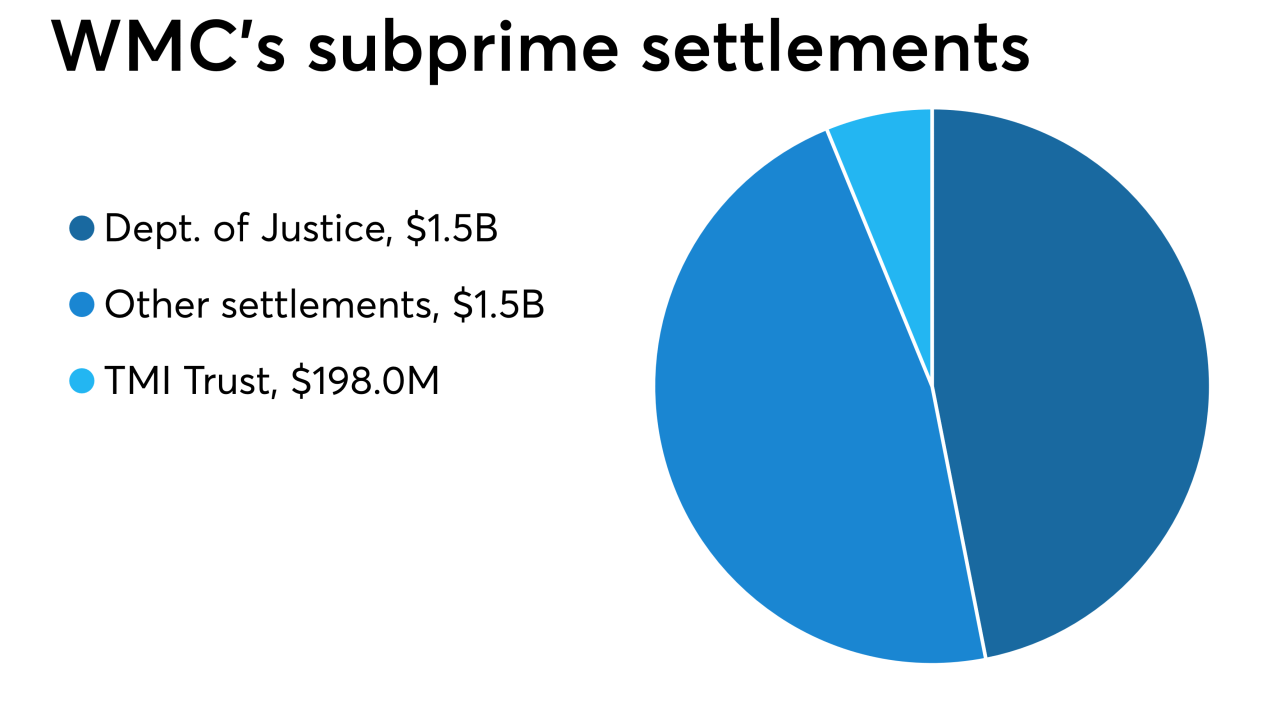

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

A judge in Michigan has ordered the Justice Department and Quicken Loans attempt a settlement in a years-old lawsuit in which the federal government accused the mortgage lending company of fraud.

April 9