-

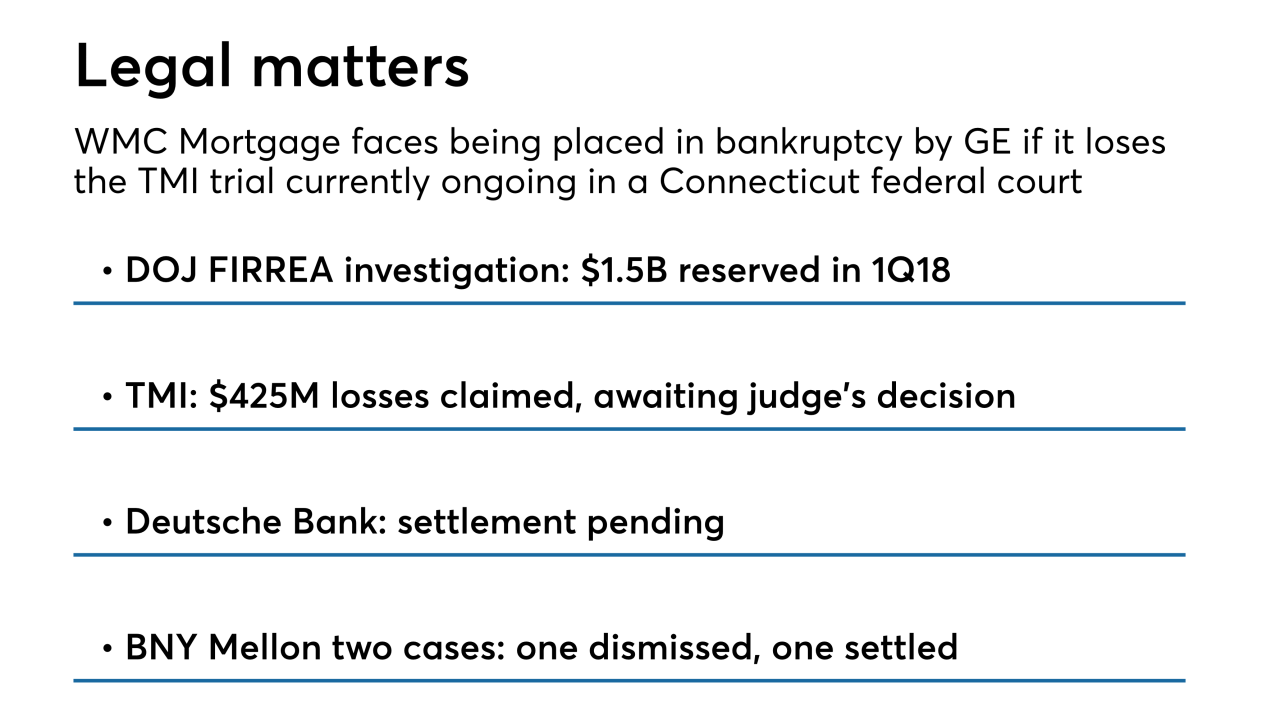

WMC Mortgage, a leading subprime originator during the boom era, could file for bankruptcy by parent company General Electric if it loses a legal proceeding regarding indemnifications on mortgage-backed securities.

May 3 -

A federal jury is poised to determine whether a former Cantor Fitzgerald managing director's tactics in trading mortgage-backed securities constitute securities fraud.

May 1 -

A Texas lawyer pleaded guilty to his role in an elaborate $5 million mortgage fraud scheme involving pricey beach homes, according to the U.S. Attorney's Office in Houston.

May 1 -

After less than a week of trial, prosecutors rested their case against a former Cantor Fitzgerald trader accused of lying to his customers about bond prices.

April 30 -

A portfolio manager for an investment firm allegedly defrauded by a former Cantor Fitzgerald managing director said he might still work with a trader who lied to him — depending on the circumstances.

April 27 -

The trial of a former Cantor Fitzgerald mortgage-backed securities trader charged with lying to his clients turned contentious as his lawyer aggressively questioned one of his alleged victims about methods his firm uses to invest.

April 26 -

Former Cantor Fitzgerald managing director David Demos is on trial, accused of deceiving clients about the prices his firm could sell or pay for mortgage-backed securities.

April 23 -

The investigation targeted 36 residential mortgage-backed securities deals involving $31 billion worth of loans, more than half of which defaulted, according to the Justice Department.

March 29 -

Almost two years after settling mortgage securitization allegations with the Department of Justice and a group of states, Goldman Sachs has fulfilled more than half of its consumer relief commitment.

February 16 -

Servicers that handle loans in the government's Making Home Affordable program could face more enforcement at the urging of the Special Investigator General for the Troubled Asset Relief Program.

February 1 -

Sen. Sherrod Brown called on the Trump administration to support the Consumer Financial Protection Bureau's enforcement action against PHH Corp., which agreed to a

$45 million settlement this week related to foreclosure abuses.January 4 -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

Shifting policy stances and a renewed focus on housing finance reform from the White House could make 2018 a breakout year for Congress to finally resolve the conservatorship of Fannie Mae and Freddie Mac.

December 26 -

HUD Secretary Ben Carson has spent much of his first year trying to convince lenders they wouldn't be harshly penalized if FHA-guaranteed loans went bad. But he still has a ways to go.

December 26 -

A Stratford, Conn., man faces up to five years in prison after he pleaded guilty to bankruptcy fraud, according to the Department of Justice.

December 20 -

RCO Legal, once one of the largest foreclosure law firms in the Northwest, is shutting down permanently in December, a victim of the strong economy and housing market.

December 5 -

Trump officials have made clear their intent to reexamine how Federal Housing Administration lenders are cited under the False Claims Act, but whether that means lenders can rest easier is an open question.

November 10 -

The U.S. Justice Department has sued the largest foreclosure trustee in the Pacific Northwest, claiming it illegally foreclosed on at least 28 military members or veterans in the past six years.

November 10 -

Credit Suisse's plan for consumer relief in a multibillion-dollar Department of Justice settlement related to residential mortgage-backed securities could reduce the costs involved, according to the settlement monitor's first report.

October 30 -

Barclays and the Justice Department, engaged in a legal battle over the suspected fraudulent sale of mortgage securities a decade ago, have revived discussions about reaching an out-of-court settlement, according to people with knowledge of the situation.

October 27