-

Some speculate that the banks who do business with credit reporting agencies may be looking for alternatives after mounting concerns about their ability to keep information private. But breaking up is hard to do.

April 4 -

Some fear that the removal of such data from individual credit reports could lead lenders to believe a consumer is a better bet than they really are.

April 2 -

Default rates in second mortgages and bank cards rose notably in December, suggesting consumers are having trouble managing increased spending.

January 17 -

The average VantageScore last year was higher than it has been since 2007 due to improved hiring and despite stagnant wages that aren't keeping pace with rising debt levels.

January 11 -

A breach at Alteryx that exposed sensitive information from more than 100 million U.S. households could add to fraud risks in housing finance

December 22 -

Consumer credit bureau and data aggregator Experian will gain a foothold in the U.K. mortgage market by acquiring a minority stake in mortgage brokerage London & Country Mortgages Limited.

December 11 -

Consumer default rates are up month-to-month, which may reflect a gap between spending and income that is stressing second mortgages and bank cards, Standard & Poor's and Experian find.

November 22 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

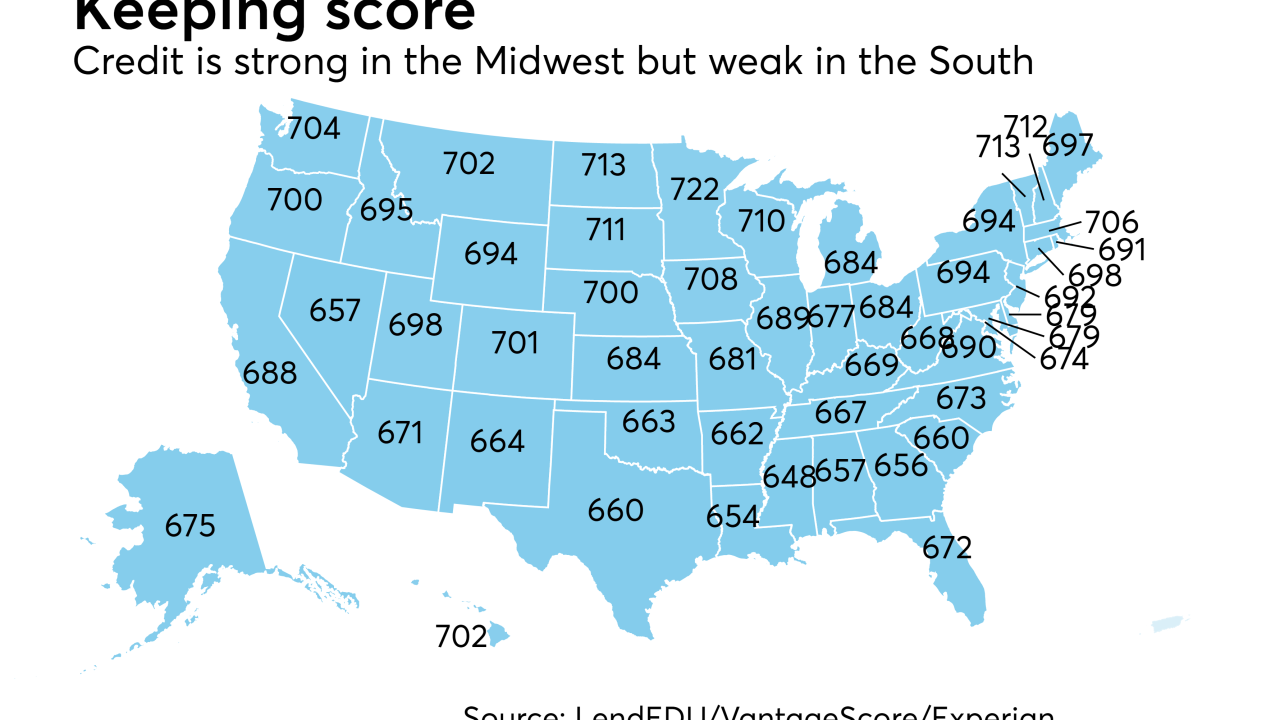

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

Mortgage defaults keep rising and are getting much nearer to where they were in 2016 as damage from natural disasters continues to add to slight upward pressure on credit.

October 17 -

Default rates for first-lien mortgages rose slightly higher in August and remain lower year-over-year, but recent hurricanes could intensify loan performance concerns.

September 20 -

The Equifax breach has millions of Americans now thinking about freezing their credit to guard against identity theft. But those who act could be cutting themselves off from the nation's vast credit economy.

September 19 -

Efforts to persuade regulators to allow Fannie Mae and Freddie Mac to use alternative credit scores would stifle competition between the credit bureaus and FICO and do little to expand access to credit, according to industry analyst Chris Whalen.

September 18 -

Defaults on second-lien mortgages have crept up on a year-to-year and a consecutive-month basis; and first-lien defaults are above where they were the previous month, but still below year-ago levels.

August 15 -

First-lien mortgage defaults in June were down 4 basis points from the previous month and 5 basis points from where they were the previous year at 0.6%.

July 19 -

Defaults on first-lien mortgages fell 5 basis points in May from the previous month, dropping to their lowest level in a year, according to the S&P/Experian Consumer Credit Default Index.

June 20 -

The Consumer Financial Protection Bureau said Experian sold consumers an "educational" credit score and falsely claimed in advertisements that the score was used by lenders to make credit decisions.

March 23 -

First- and second-lien mortgage default rates increased slightly in February, according to the S&P/Experian Consumer Credit Default Indices.

March 21 -

Experian and Finicity have released a product that aims to speed up decisions on mortgage applications, using financial data aggregation technology.

March 20