-

This year will top the total volume generated in the housing boom year of 2003. Meanwhile, next year's 30-year FRM is predicted to stay at 2.8%.

October 16 -

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

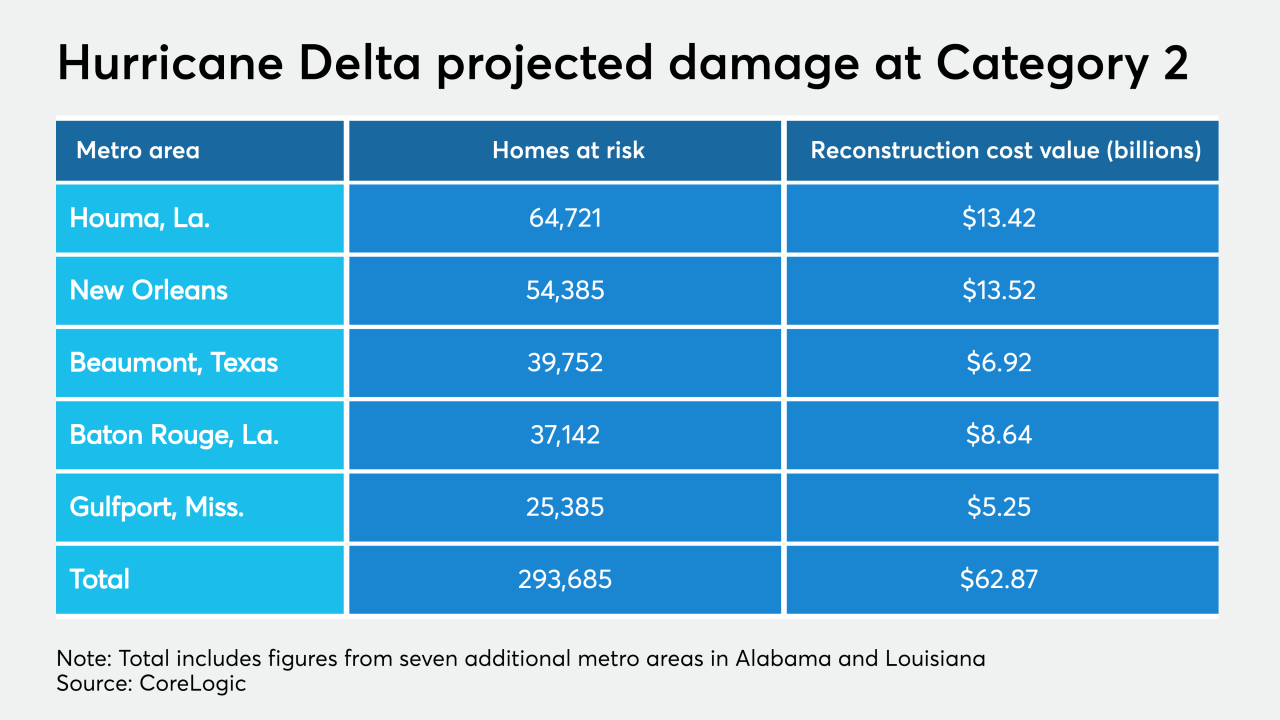

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

But overall sentiment as measured by Fannie Mae continued to recover from the depths of this spring.

October 7 -

HSBC, Bank of the West and Fannie Mae are among those offering green mortgage bonds, financing commercial clients’ efforts to rein in carbon emissions and developing other novel products that help customers tackle environmental challenges.

October 6 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

Approximately 75% of the quarter-to-quarter growth came from multifamily mortgage originations.

September 29 -

The Financial Stability Oversight Council said the mortgage giants may need a bigger capital cushion than their regulator has proposed, but stopped short of designating them as “systemically important financial institutions.”

September 25 -

The agency’s report on mortgage data submitted by lenders identified persistent disparities between white borrowers and minorities in denial rates and pricing. Some observers say the bureau should have been more explicit as the nation wrestles with systemic racism.

September 24 -

But the group is more conservative than Fannie Mae when it comes to interest rate movements over the next six quarters.

September 22 -

Remote, homeowner-assisted appraisals used amid the coronavirus could be a useful tool post-pandemic, in limited circumstances.

September 18 -

Fannie Mae and Freddie Mac have been slammed for planning an additional refinancing charge to cover COVID-related losses, but the head of the Federal Housing Finance Agency defended the policy in House testimony.

September 16 -

Low rates, along with increased new and existing home sales activity drives the latest forecast.

September 16 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

That, along with continued high refinance volume over the next three months, keeps originators' profit forecasts elevated, Fannie Mae said.

September 11 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

As bidding wars raged on and mortgage rates remained near historic lows, housing market confidence grew in August, according to Fannie Mae.

September 8 -

The Federal Housing Finance Agency's proposal could undermine the companies’ mission to support the housing market and penalize consumers in underserved communities, industry and consumer groups say.

September 8 -

The agency’s plan to extend the "qualified mortgage" stamp of approval to more loans could help lenders that rely on alternative data and cushion the blow of other QM changes for Fannie Mae and Freddie Mac.

September 2 -

The pandemic drives home the point that without those funds being siphoned off, the recent fee hikes would not be necessary.

September 2 Community Home Lenders Association

Community Home Lenders Association