Mortgage rates hit new record low

MERS owner Intercontinental Exchange to buy Ellie Mae for cash, stock

Forbearance extensions are skyrocketing

Rocket's IPO lifts off, with first close up $3.51 per share

Hiring for mortgage jobs ramps up as loans keep streaming in

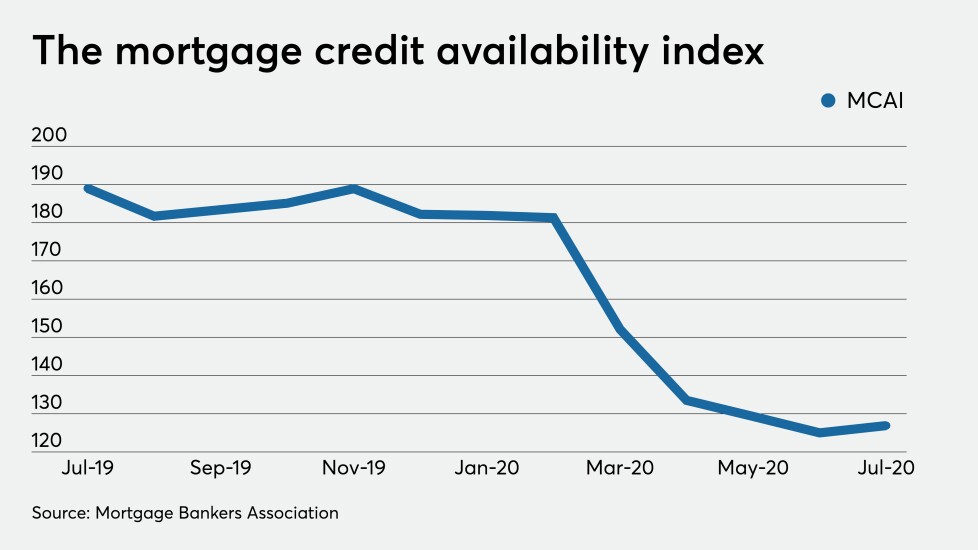

Mortgage credit rises in July, as ARMs, jumbos come back

Multifamily borrowers in forbearance cannot evict tenants, FHFA says

Black mortgage applicants nearly twice as likely to be denied

Bipartisan team introduces plan to offer savings accounts for down payments

National MI beats expectations on 2Q earnings despite higher losses

Housing groups seek change to FHA loan restriction on student debt

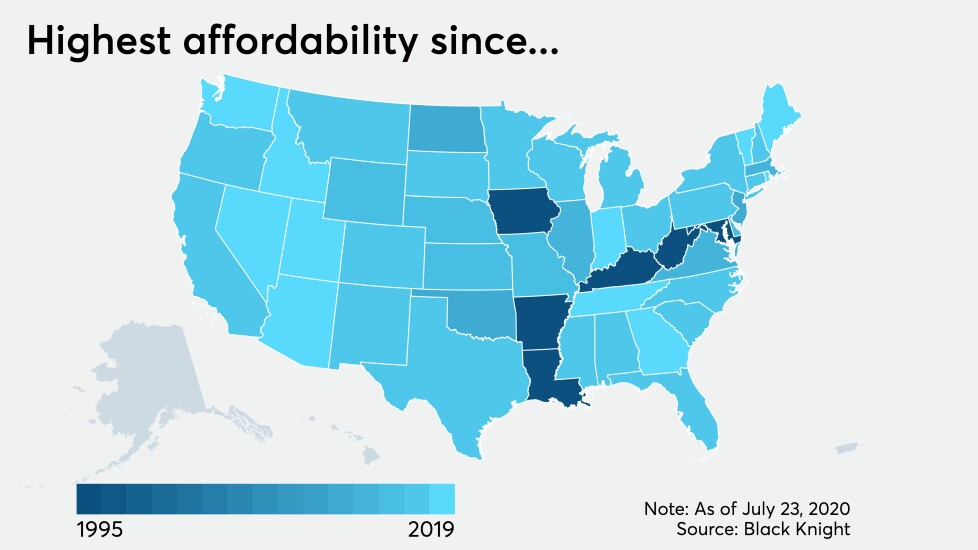

Plummeting mortgage rates afford buyers $32,000 more house

Impac to revive third party originations, non-QM in 3Q