-

New Residential Investment Corp., fresh off a substantial first-quarter reduction of its asset holdings, is now planning to securitize the receivables on its $200 billion servicing portfolio of Fannie Mae-owned mortgages.

June 17 -

The FHFA and FHA both announced for the second time that they were delaying the freeze to protect borrowers and renters during the coronavirus pandemic.

June 17 -

The report by Unison also advised investors to focus on "diversified residential real estate" over traditional retail and office spaces.

June 17 -

The Federal Housing Finance Agency was supposed to finalize its original proposal this month, but will redraft it because it was drawn up before the coronavirus emerged as a concern.

June 15 -

As they prepare to exit government conservatorship, Fannie Mae and Freddie Mac have enlisted the investment banks to help them boost capital and evaluate market opportunities.

June 15 -

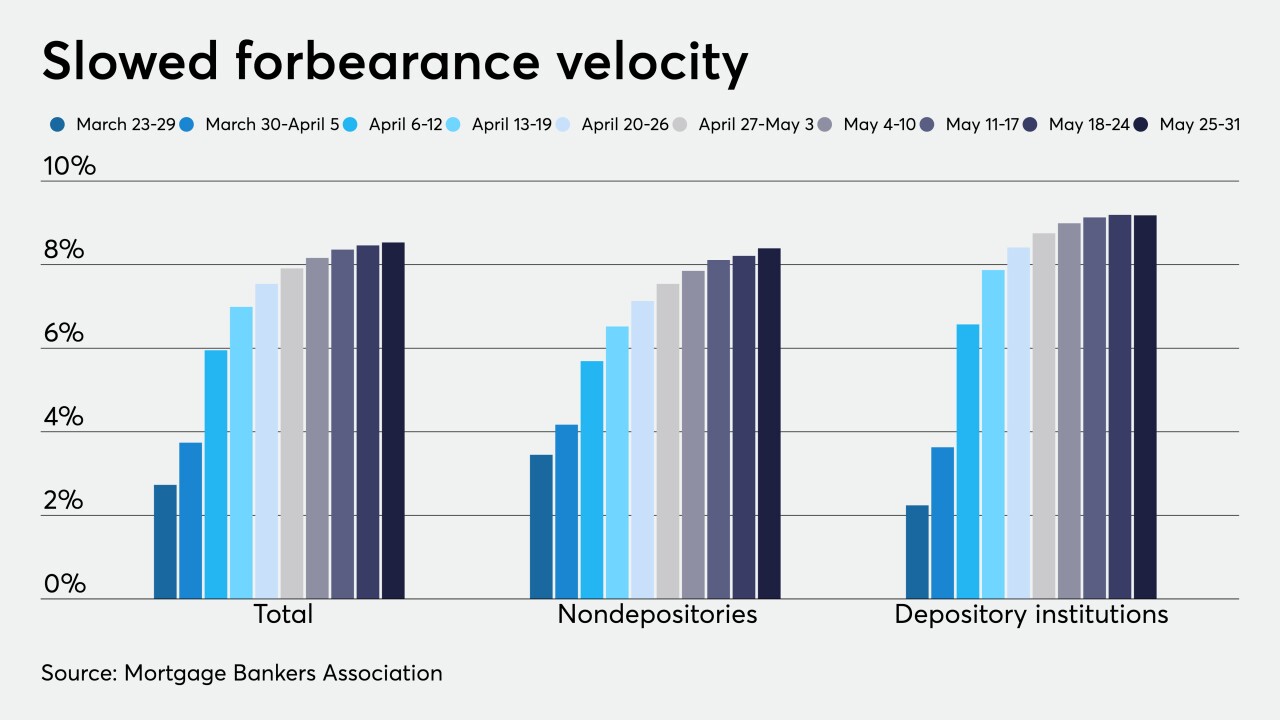

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

The expected rise in refinance volume overrides pessimism about purchase activity for their businesses.

June 11 -

A federal grand jury indicted Ronald J. McCord, 69, of Oklahoma City, on charges of defrauding two banks, Fannie Mae, and others of millions of dollars, money laundering, and making a false statement to a financial institution, said Timothy J. Downing, U.S. attorney for the Western District of Oklahoma.

June 9 -

The FHFA’s proposal is intended to strengthen Fannie Mae and Freddie Mac, but many experts warn that it could boost guarantee fees for lenders that they say may be passed on to borrowers.

June 8 -

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

After bottoming out at a 10-year low in April, consumer sentiment for home buying rebounded in May, according to Fannie Mae.

June 8 -

Self-service portals fielded at least half of coronavirus-related forbearance-plan requests and made it possible to handle an influx at a challenging time, but the GSEs recommend circling back to borrowers.

June 3 -

The FHFA looks to shed light on the amount of funds Fannie and Freddie will need to hold for their risk-sharing deals.

June 3 -

The firm also predicts that the coronavirus pandemic will delay the GSEs' release from government control.

June 3 -

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

June 1 -

Aggregate numbers for coronavirus-related payment suspensions are showing more consistency as organizations clarify how they handle them, and some consumers' incentives to use them may be declining.

May 29 -

Fannie Mae and Freddie Mac have different timelines for the switch.

May 28 -

The company will still offer the product it is most known for, Point.

May 27 -

Forecasts about the pandemic's impact on the mortgage market have grown less dire after forbearance requests by homeowners nearly leveled off in the first half of May.

May 26 -

Coronavirus-related mortgages in forbearance grew 20 basis points between May 11 and May 17, according to the Mortgage Bankers Association.

May 26