-

Freddie Mac and Arch Capital are testing a new form of risk-sharing deal to boost investor appetite for low down payment mortgages. But the pilot is raising concerns about "charter creep" because it dictates private mortgage insurance decisions typically made by lenders.

March 14 -

A late addition to regulatory relief legislation would direct the Federal Housing Finance Agency to review credit-scoring alternatives, but some say the provision is redundant.

March 13 -

Think you know your IRRRL from your LPMI? See if you can ace this quiz of 10 quirky abbreviations from the origination sector of the mortgage industry.

March 13 -

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12 -

Essent Guaranty is marketing $360.75 million of notes linked to the performance of a pool of residential mortgages that it insures; its following in the footsteps of Arch Capital.

March 12 -

A Senate proposal calling for a federal guarantee on mortgage-backed securities would only benefit the largest banks and increase the risk of bailouts.

March 8

-

The success of the government-sponsored enterprises' credit risk transfer programs shows that they can be the basis for housing finance reform.

March 7 -

Consumer confidence in the housing market fell in February, with fewer Americans sharing positive thoughts on mortgage rates, home buying and home prices, according to Fannie Mae.

March 7 -

Commercial and multifamily fourth-quarter mortgage delinquency rates improved for most investor types compared to one year prior as the U.S. economy continued its recovery.

March 6 -

From investor angst to regulatory scrutiny, here's a look at three obstacles that must be addressed before Ocwen Financial can acquire PHH Mortgage.

March 1 -

The Hispanic homeownership rate grew for the third straight year in 2017 and the number of homeowners in the demographic group is at an all-time high, despite ongoing concerns about immigration policy and the shortage of homes for sale.

February 27 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

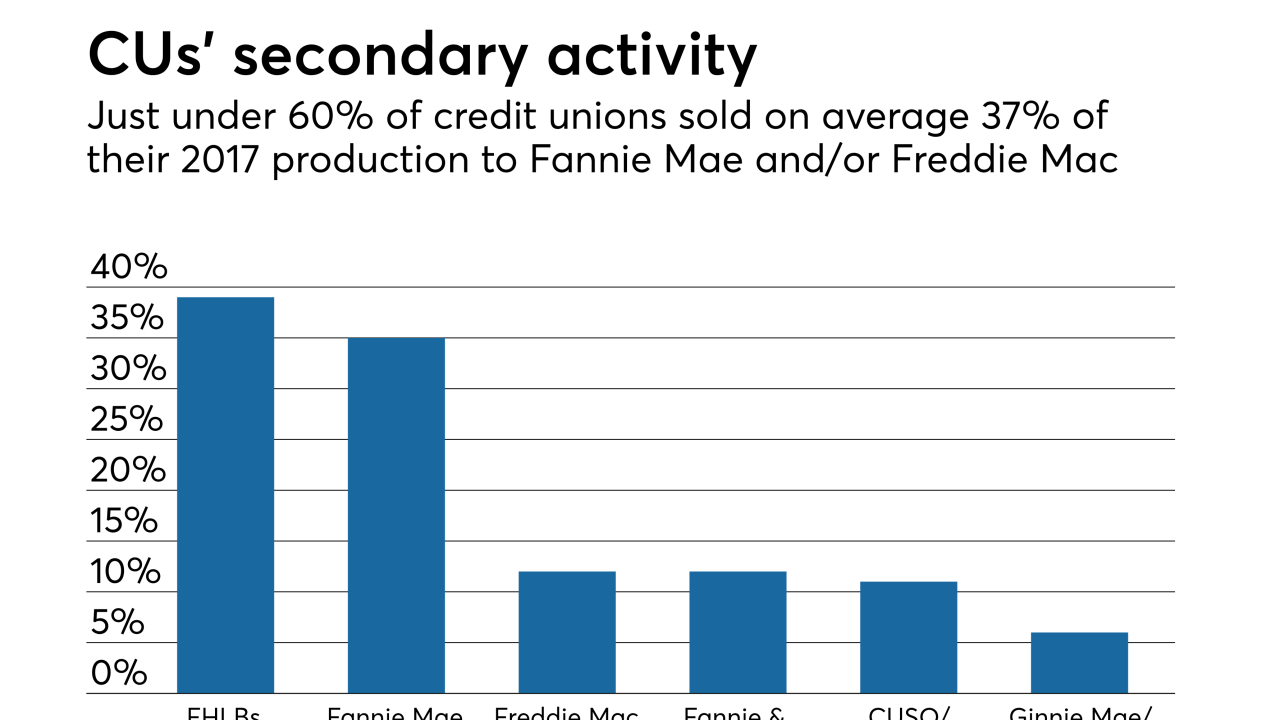

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

As inflation fears put upward pressure on 10-year Treasury bonds and mortgage rates nationally, borrowers could start to take more notice of what lenders are charging them locally.

February 20 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

As the debate over housing reform heats up, policymakers should give careful consideration to a plan that recapitalizes the government-sponsored enterprises.

February 16 -

The House Financial Services Committee chairman is calling out Fannie Mae and Freddie Mac's regulator for authorizing payments to two housing trust funds while the mortgage giants have their own financial struggles.

February 16 -

Freddie Mac is now accepting bids on $420 million in nonperforming loans, its first NPL sale of 2018.

February 16 -

Despite a legislative push by some senators and other stakeholders to jump-start housing finance reform, efforts to form consensus over a bill once again are stuck in neutral.

February 15 -

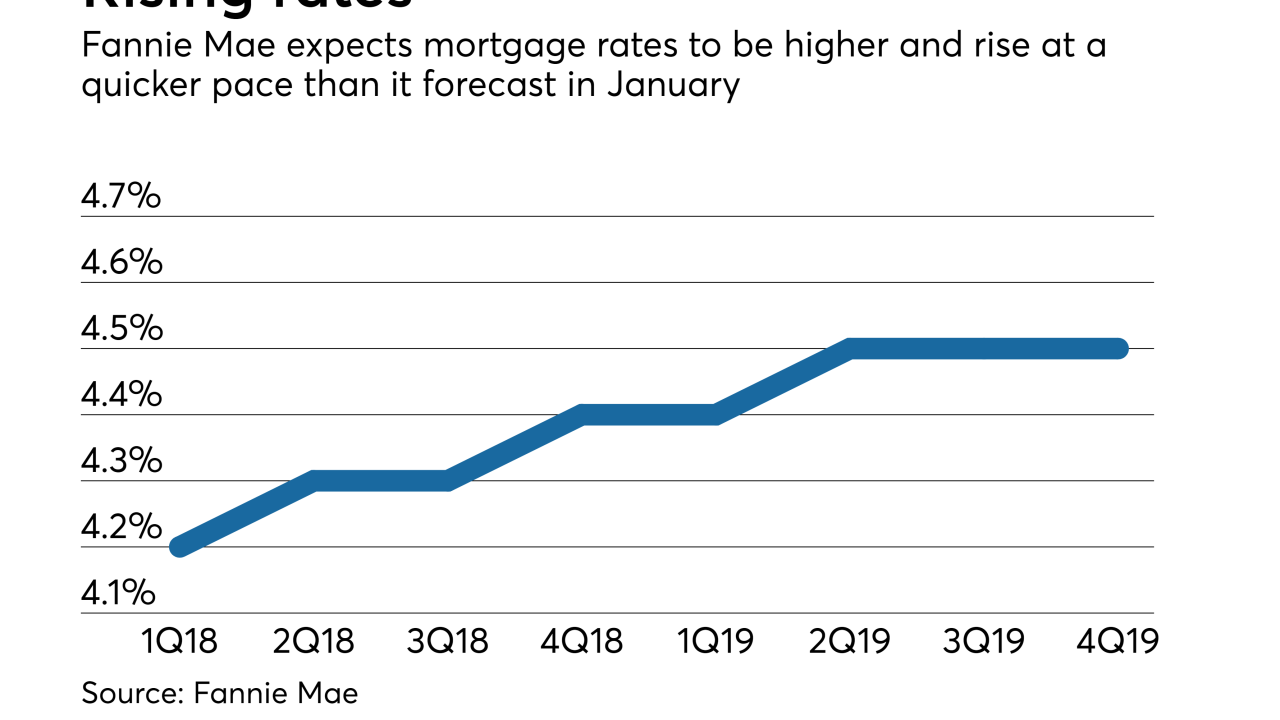

The recent bond market volatility will cause mortgage rates to rise to a higher level than previously projected, according to Fannie Mae.

February 15