Federal Reserve

Federal Reserve

-

Federal Reserve Board Gov. Lael Brainard said public comments demonstrate a desire among stakeholders for reforms to be implemented consistently across the Fed, OCC and FDIC.

February 1 -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

While the London interbank offered rate won't go dark until 2021, the commercial real estate finance industry should start preparing for the transition now, says the Mortgage Bankers Association.

January 24 -

Slower growth to interest rates and home prices will boost housing affordability in 2019, according to Fannie Mae.

January 22 -

Mortgage rates remained flat after dropping for six consecutive weeks as negative economic news was balanced with a more positive outlook on housing, according to Freddie Mac.

January 17 -

American homeownership has been on the decline, and Federal Reserve researchers point to the high cost of college as one culprit.

January 16 -

Purchase mortgage application volume reached its highest level in almost nine years as homebuyers took advantage of what might be a fleeting window for lower interest rates.

January 16 -

Average mortgage rates continued the downward spiral that started before Thanksgiving and in the past week that finally boosted mortgage application activity, according to Freddie Mac.

January 10 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

Mortgage rates started 2019 by continuing their decline but as consumers worry about the broader economy that might not help to increase home sales, according to Freddie Mac.

January 3 -

It's not clear exactly what might pull investor sentiment and 10-year Treasury yields, which rates for the 30-year mortgage are benchmarked to, off the current lows.

December 31 -

An effort to increase awareness of the transition to a new benchmark rate, and nudge banks to start preparing, is expected to intensify in 2019.

December 30 -

When it comes to reversing their crisis-era bond buying, central bankers are focused on the destination. Traders in risk assets care more about what could be a painful journey.

December 26 -

There is no banking crisis, but the president’s actions are threatening to create one.

December 24 -

Mortgage rates continued to drop this week with the positive effects already aiding housing, according to Freddie Mac.

December 20 -

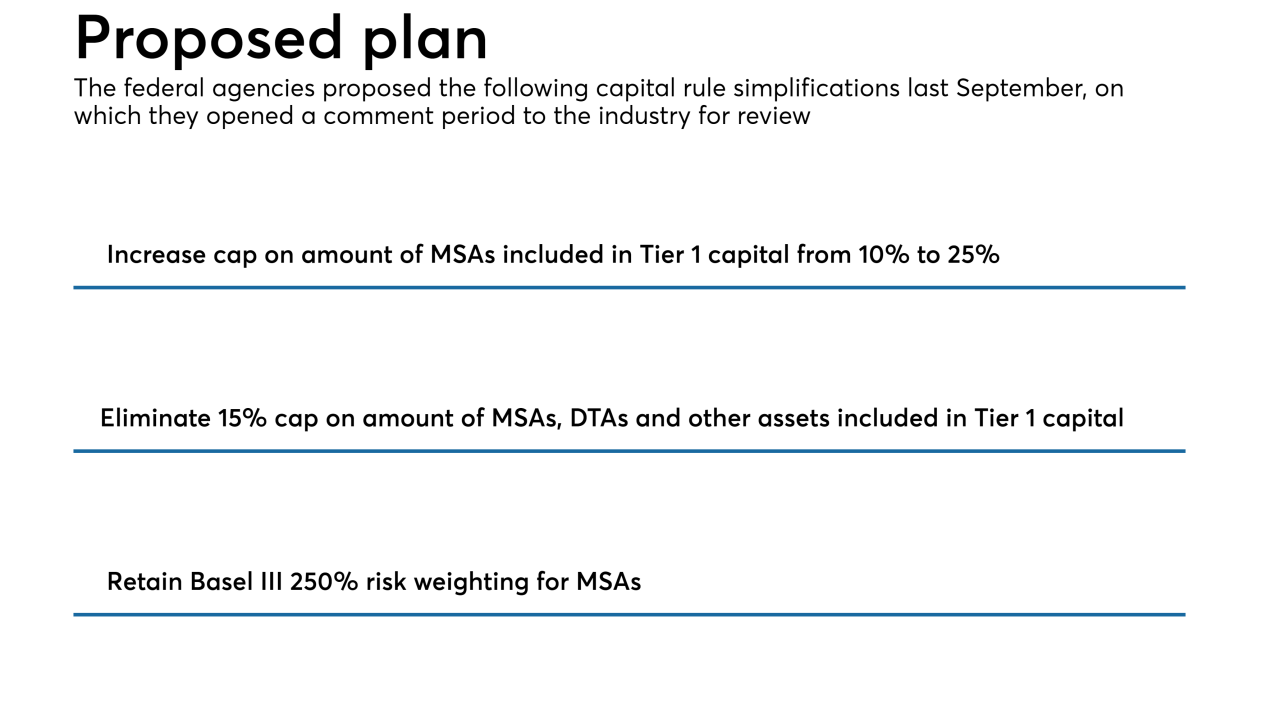

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

Sentiment among homebuilders fell in December to the lowest level since 2015, missing all forecasts and signaling that the industry's struggles are intensifying amid elevated prices and higher borrowing costs.

December 17 -

Investors in agency mortgage-backed securities will find next year to be "anything but smooth sailing" as Federal Reserve rate hikes and balance sheet reduction will lead to an increase in real rates and volatility while pushing spreads wider, Bank of America said.

December 7 -

Mortgage rates held steady this week, remaining near their lowest levels in more than a month, according to Freddie Mac.

November 29