-

Cardinal Financial's utilization of the FICO alternative credit metric could help pave the way for broader use as Fannie Mae and Freddie Mac move to adopt it.

February 27 -

Consumer advocates and fintechs say the traditional credit score and lending systems that use it are murky and perpetuate bias. FICO’s leader points out that new FICO scores use expanded data sets, just as fintechs do.

April 4 -

As more borrowers between 21 and 40 leveraged the historically low mortgage rates in January, the average age rose to a report high, according to ICE Mortgage Technology.

March 10 -

More borrowers between 21 and 40 are leveraging the historically low mortgage rates to either buy their first homes or slash their monthly payments, according to Ellie Mae.

November 4 -

Millennials continue to lock in the lowest average mortgage rates on record, keeping lenders busy and the housing market churning, according to Ellie Mae.

October 7 -

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

As the country wrestles economic volatility, millennial homeownership demand rises, fueled by historically low mortgage rates.

July 1 -

Millennial refinance activity hit a new high-water mark behind historically low mortgage rates, up 40 percentage points from the year before, according to Ellie Mae.

June 3 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

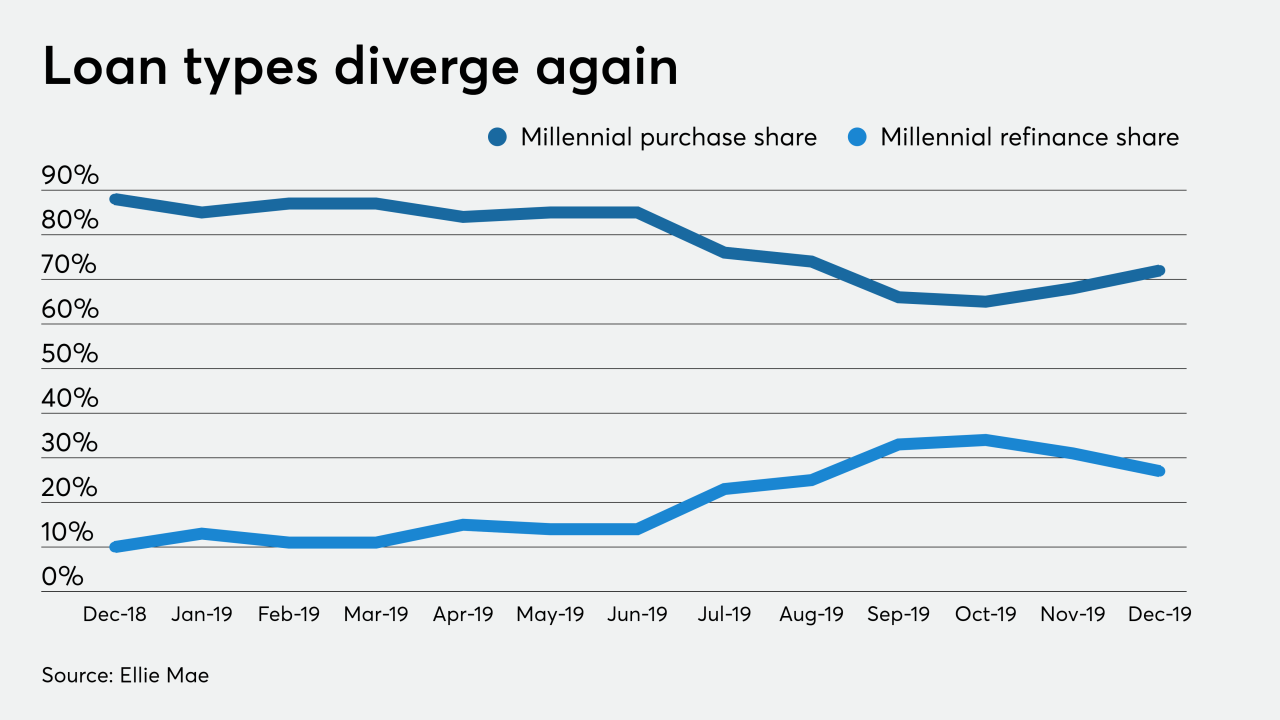

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

FICO plans to release a new suite of scores that could reduce defaults on newly originated mortgages by 17%, but home lenders may not use it unless the government-sponsored enterprises do.

January 23 -

With most U.S. households spending more and paying their bills on time, their creditors are feeling more confident than ever.

January 17 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

VantageScore totaled 12.3 billion scores across consumer credit loan categories over a 12-month period between 2018 and 2019 with minimal mortgage volume, leaving potential for a major ramp up.

October 29 -

Millennials took advantage of mortgage rates falling to near three-year lows in August, increasing their refinance share to the highest percentage since December 2015, according to Ellie Mae.

October 2 -

Millennial mortgage debt is on pace to reach levels higher than any other generation, according to Experian.

August 23 -

The regulator of the government-sponsored enterprises retreated from an earlier proposal that had barred VantageScore because of its ties to the credit bureaus.

August 13 -

Millennials jumped to take advantage of low mortgage rates by refinancing at an increased share of 6 percentage points in June, according to Ellie Mae.

August 7