-

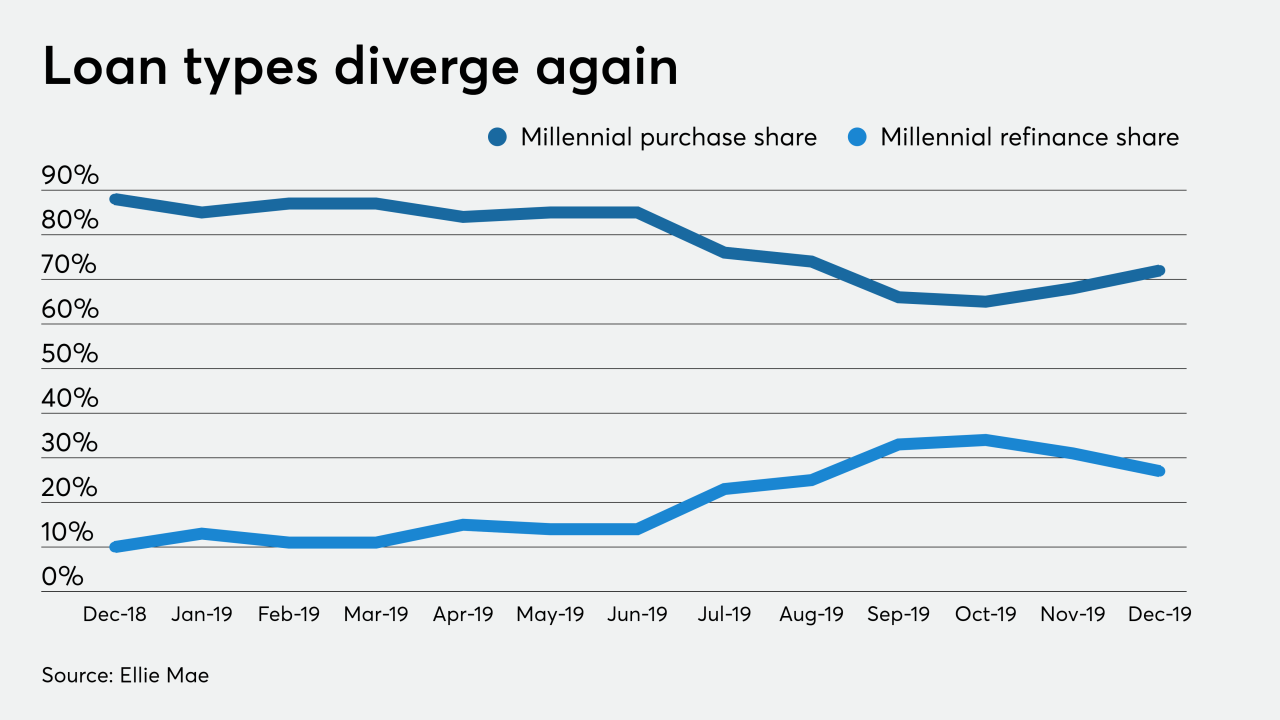

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

FICO plans to release a new suite of scores that could reduce defaults on newly originated mortgages by 17%, but home lenders may not use it unless the government-sponsored enterprises do.

January 23 -

With most U.S. households spending more and paying their bills on time, their creditors are feeling more confident than ever.

January 17 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

VantageScore totaled 12.3 billion scores across consumer credit loan categories over a 12-month period between 2018 and 2019 with minimal mortgage volume, leaving potential for a major ramp up.

October 29 -

Millennials took advantage of mortgage rates falling to near three-year lows in August, increasing their refinance share to the highest percentage since December 2015, according to Ellie Mae.

October 2 -

Millennial mortgage debt is on pace to reach levels higher than any other generation, according to Experian.

August 23 -

The regulator of the government-sponsored enterprises retreated from an earlier proposal that had barred VantageScore because of its ties to the credit bureaus.

August 13 -

Millennials jumped to take advantage of low mortgage rates by refinancing at an increased share of 6 percentage points in June, according to Ellie Mae.

August 7 -

Waterstone Mortgage is now qualifying borrowers without a traditional credit history for both its conventional and government mortgage programs.

July 24 -

As mortgage rates dip lower and lower through home buying season, the rate of closing loan applications keeps climbing, according to Ellie Mae.

June 19 -

Millennial homeowners took advantage of April's drop in mortgage rates by quickly securing refinance loans, which closed faster than purchases for the first time since March 2016, according to Ellie Mae.

June 5 -

Consumers' knowledge of the mortgage process and what it takes to purchase a home has not improved from four years ago and lenders have an opportunity to fill that need, Fannie Mae said.

June 5 -

Plaza Home Mortgage has improved its pricing for certain jumbo loans that Fannie Mae's automated underwriting system approves, but categorizes as ineligible due to loan size.

May 28 -

Mortgage rates descended through the onset of spring's home buying season, pushing up the share of refinance loans and volume of new-home purchase applications, according to Ellie Mae and the MBA.

May 16 -

Mortgage rates continued to decline through the spring home buying season, driving up the share of refinance loans and overall closing rates, according to Ellie Mae.

April 17 -

The Federal Housing Administration is returning to manual reviews of higher-risk loans it insures because it's finding that a growing share have lower credit scores, higher debt-to-income ratios, or both.

March 18 -

The specialty finance company is contributing all of the collateral for the $259.7 million deal; by comparison, the previous deal included collateral contributed by Goldman Sachs.

January 22 -

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13