-

While the nationwide run-up in mortgage loan application defects appears to have slowed, instances of fraud remain on the rise in Texas and Florida.

December 1 -

Consumer house-buying power, measuring how much one can purchase based on changes in income and interest rates, fell 2.1% year-over-year, but increased by 1.3% from the month prior, according to First American Financial Corp.

November 28 -

The housing market has been underperforming its potential since May, and October's performance gap was the largest it's been since November of last year, according to First American Financial Corp.

November 21 -

As employment and home prices reach and surpass previous levels of normal economic and housing activity, building permits continued holding markets back from hitting historic norms during the third quarter, according to the National Association of Home Builders.

November 6 -

Nonbank mortgage employment took its biggest drop since January following the recent hurricanes, according to the Bureau of Labor Statistics.

November 3 -

Connecticut was the lone state in the nation in September to see a decline in borrowers misrepresenting facts on mortgage loan applications.

November 2 -

Hurricanes Harvey and Irma were responsible for an increase in loan application defects during September in Texas and Florida, according to First American Financial Corp.

November 1 -

The market for potential existing-home sales declined in August, while Hurricanes Harvey and Irma are also expected to impact the market for home sales in the short term.

September 20 -

Not every housing market is dealing with an inventory shortage, as over one-third of respondents said there was excess supply in their local area, according to a First American Financial survey.

September 13 -

Loan application defects were unchanged for July compared with June, the first time in eight months there has not been an increase, according to First American Financial Corp.

August 31 -

My Home is Realtor.com's attempt to compete with Zillow's Zestimate home valuation product, as it seeks to help homeowners manage their property as an investment.

August 24 -

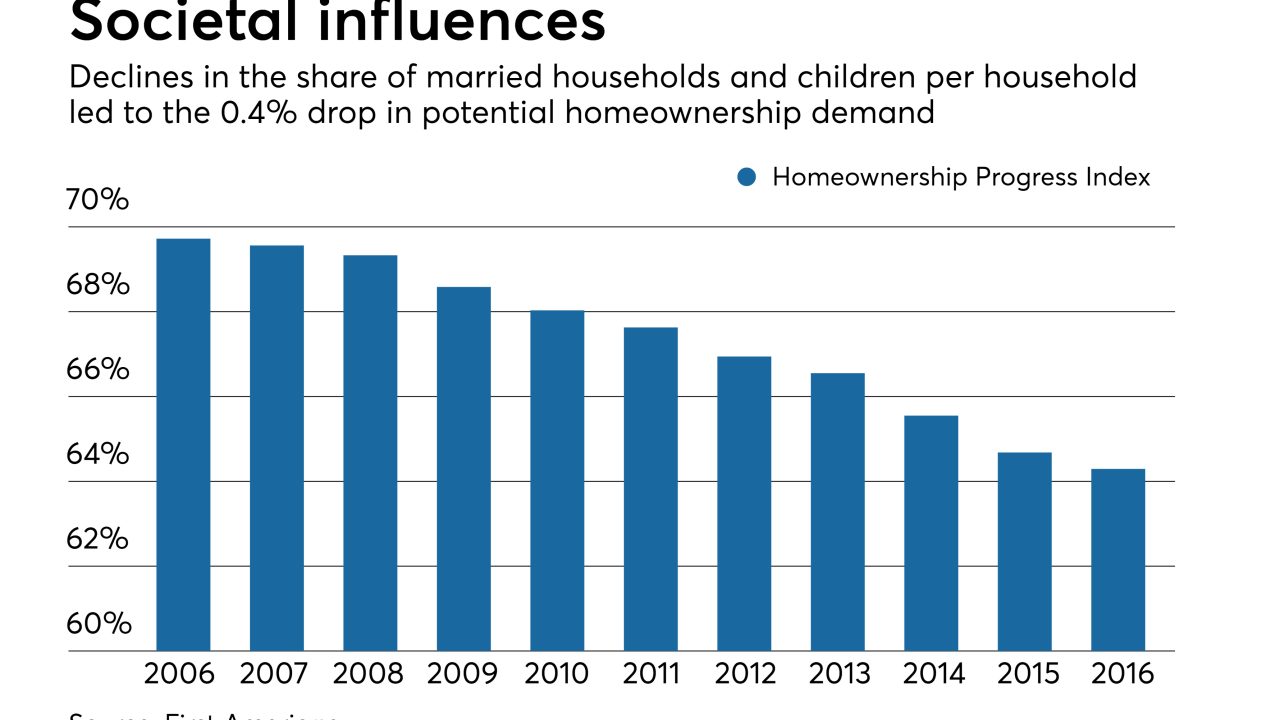

Though potential homeownership demand declined moderately between 2015 and 2016, the underlying fundamentals for demand remained positive.

August 18 -

The cheapest housing markets aren't always the most affordable cities for first-time home buyers and existing homeowners. Here's a look at 12 cities with low home prices, but where other factors put a damper on purchasing power.

July 31 -

Loan application defects increased for the seventh consecutive month in June, due to the highly competitive purchase market, according to First American Financial Corp.

July 31 -

Strong housing demand continued to outpace supply in June, in large part because millennial buyers are on the rise, according to First American Financial Corp.

July 24 -

Here's a look at the 12 cities where the combination of prices and local wages offer homebuyers the best bang for the buck this house hunting season.

June 28 -

Defects and misrepresentations on mortgage applications rose 2.5% in May, reaching levels last seen in 2015, according to the First American Loan Defect Index

June 28 -

The market for existing-home sales underperformed its potential by 3.8% because of the inventory shortage, according to First American Financial Corp.

June 20 -

Defects and misrepresentations on mortgage applications rose for the fifth consecutive month in April, with increases for both purchase and refinance loans.

June 2 -

Rising prices are holding back some potential sellers from listing their properties because they fear they won't find an affordable replacement, according to First American Financial Corp.

May 26