-

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Loan application defect risk fell in December after stabilizing the prior month, but it's not dropping as it quickly as it once was, according to First American Financial.

January 30 -

December's potential for existing-home sales grew by 1.7% compared with November because of low mortgage rates, but in the future that factor could constrain the housing market, First American Financial said.

January 23 -

The drop in home buying power heightened the risk of misrepresentations on purchase mortgage loan applications during November, as consumers are more willing to fudge information in an uncertain market, First American Financial said.

December 30 -

Homebuyer purchase power took another big jump in October as wages grew and mortgage rates stayed low despite continuously tight housing inventory, according to First American Financial.

December 23 -

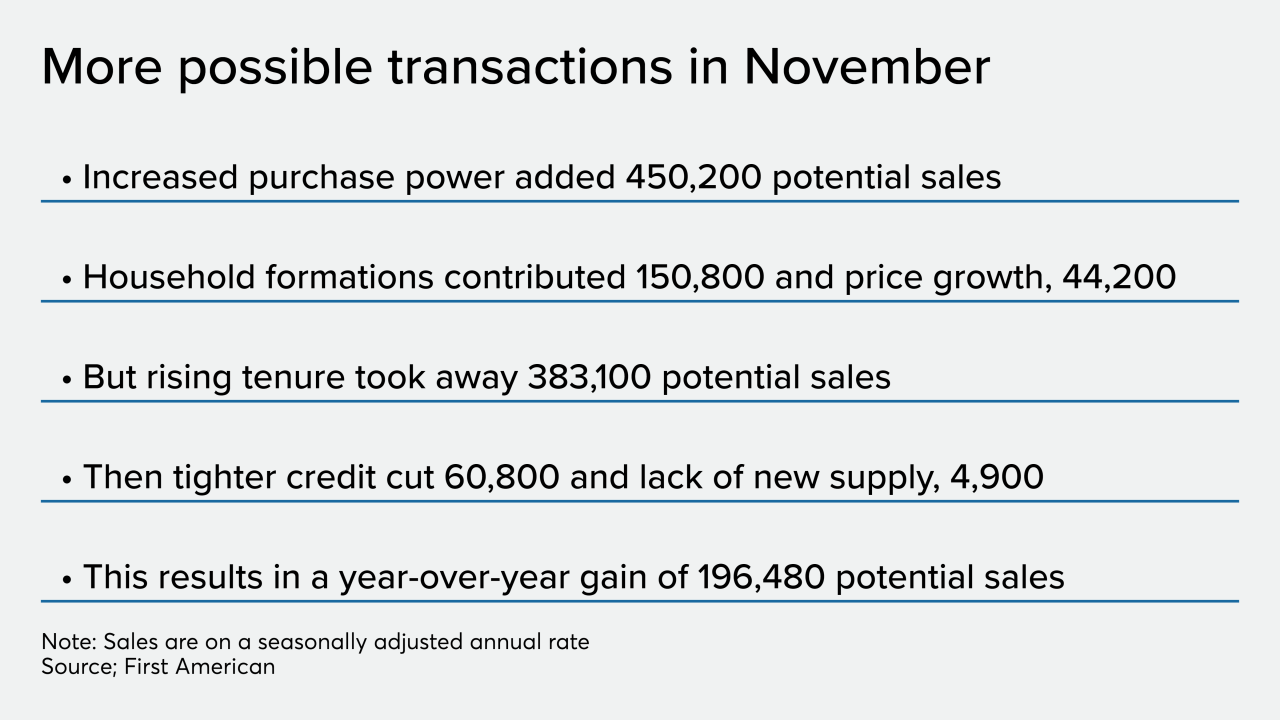

November was another month in the latter part of 2019 where actual existing-home sales outperformed their potential, but that momentum seems unlikely to continue in 2020, First American said.

December 18 -

From the Southeast to the Midwestern plains, here's a look at the 12 cities where first-time homebuyers can afford the largest share of houses for sale, according to First American.

December 12 -

Loan defect risk in purchase applications stopped falling and plateaued in October, according to First American Financial Corp.

December 2 -

While affordability remains a challenge with the continued strain on housing supply, purchasing power took a big leap in September thanks to a rise in income and descending interest rates, according to First American Financial Corp.

November 27 -

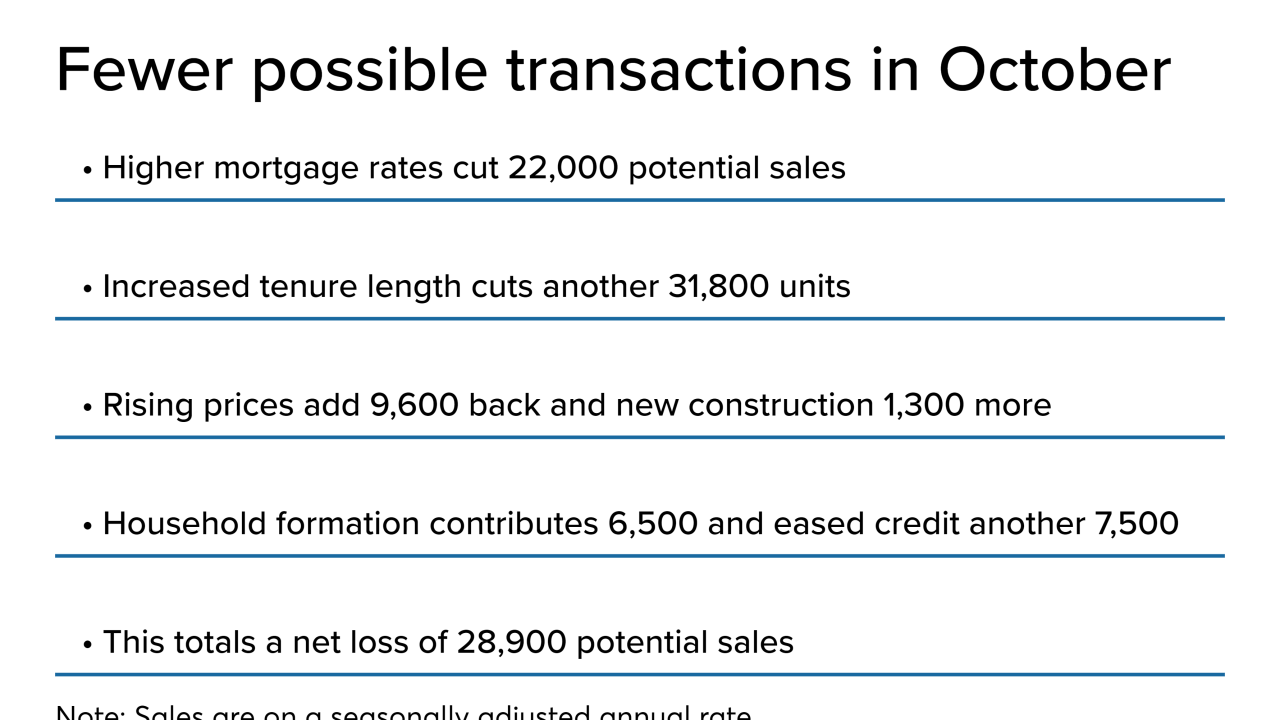

Existing-home sales outperformed their estimated potential for October on improved consumer buying power since the start of 2019 and lower mortgage rates, First American said.

November 20 -

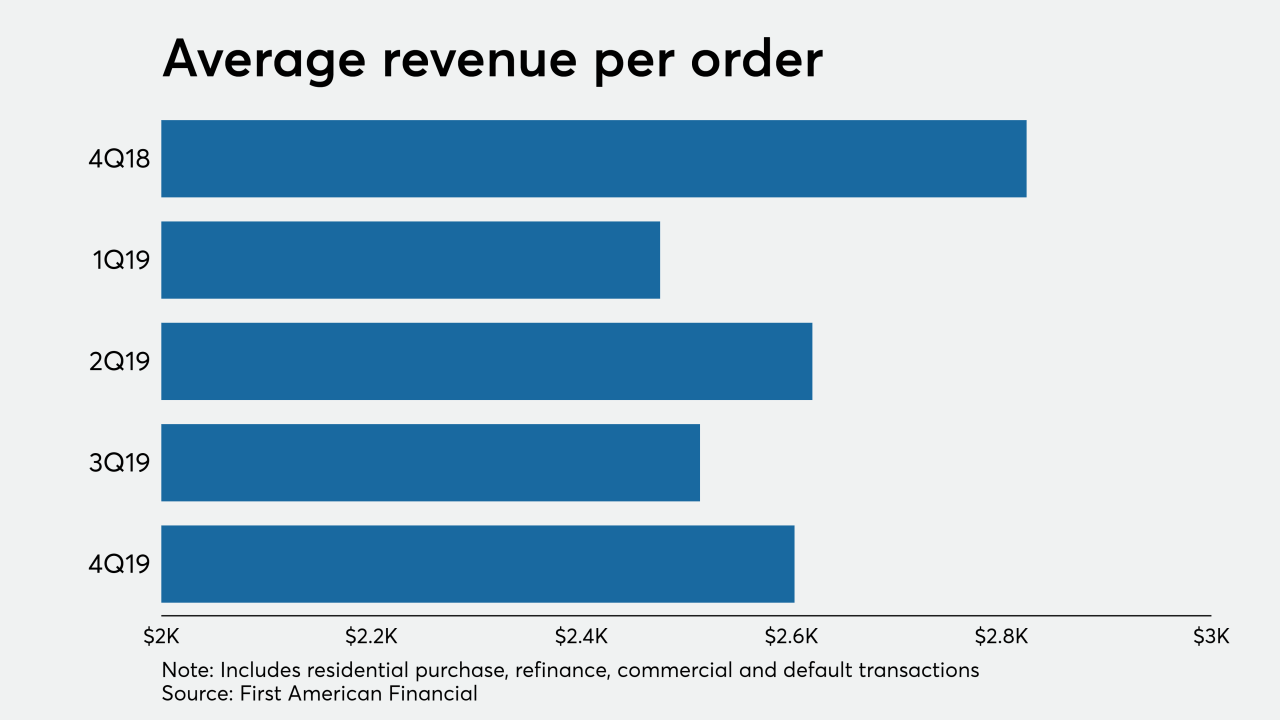

The latest round of earnings reports from home lending businesses and vendors continue the positive vibe for the sector as most reported year-over-year improvement in profitability.

October 24 -

Home sales continued to perform in line with their potential in September and indicators suggest housing will keep flourishing through the fourth quarter, according to First American.

October 18 -

The switch to a buyer's home purchase market, as well as fewer natural disasters helped drive the five-month-long decline in mortgage application fraud risk, First American said.

September 27 -

Existing-home sales exceeded their market potential again in August, and the improvement may continue for some time before there's a correction, according to First American.

September 18 -

Stewart Information Services has decided to make some big changes at the top following the dissolution of a planned merger with Fidelity National Financial.

September 10 -

Nonbank mortgage companies added 4,600 employees to their payrolls in July and may add more to address continuing rate-driven increases in loan volume.

September 6 -

A growing share of refinances born by lower rates is pushing down risk levels for fraud on a mortgage application, according to First American.

August 30 -

While affordability continues to affect homebuyers, rising income combined with descending interest rates and decelerating housing values boosted the purchase market, according to First American.

August 27 -

July's existing-home sales lived up to their potential after falling short the previous month, but that potential remains limited because tenure continues to increase, according to First American.

August 20 -

From Jacksonville, Fla., to Seattle, here's a look at the 12 most favorable housing markets for homebuyer purchasing power, based on a combination of local wages, lower property values and mortgage rates.

July 29