-

Nonbank mortgage employment took its biggest drop since January following the recent hurricanes, according to the Bureau of Labor Statistics.

November 3 -

Fed Gov. Jerome Powell, who was first nominated to the central bank by former President Obama, is widely seen as a continuity choice.

November 2 -

Continued economic growth, a strong jobs market and higher wages will lead to a 7.3% increase in purchase origination volume next year, according to the Mortgage Bankers Association.

October 24 -

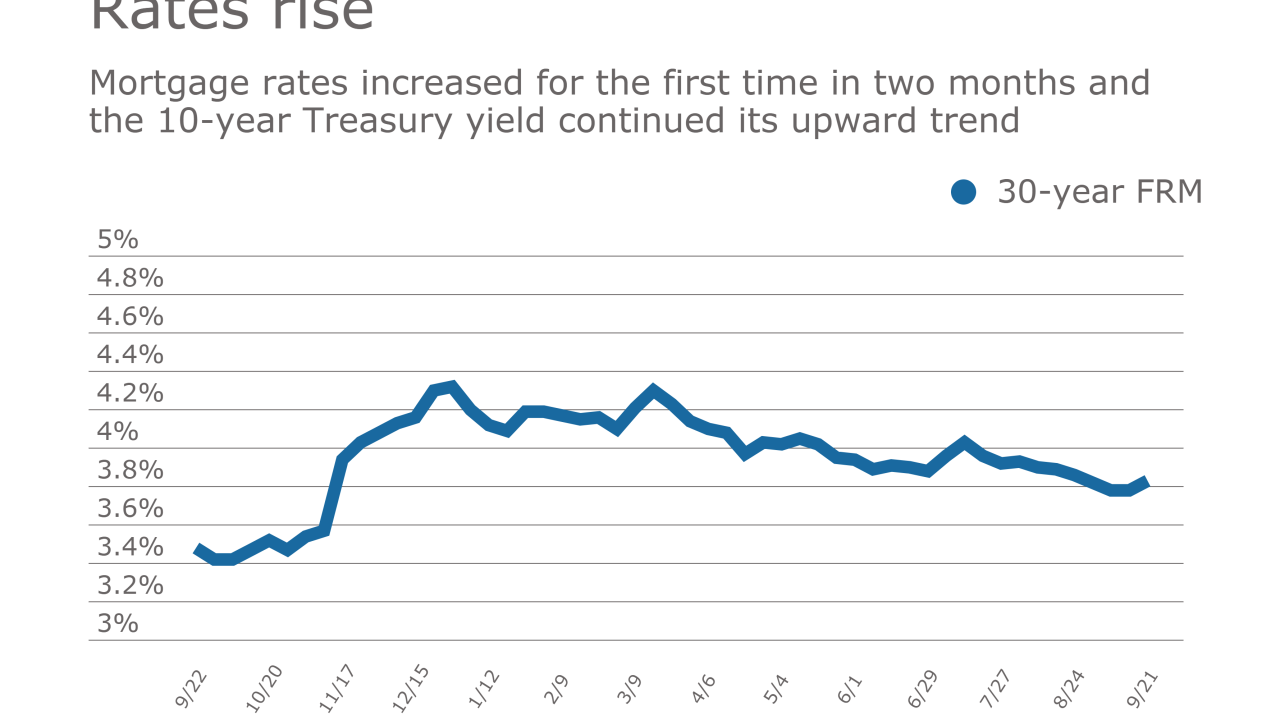

Mortgage rates posted their biggest week-over-week increase since July and the 10-year Treasury yield also rose, according to Freddie Mac.

October 12 -

Mortgage rates increased for the first time in seven weeks, while the 10-year Treasury yield continued its upward trend, according to Freddie Mac.

September 21 -

Federal Reserve Chair Janet Yellen said Wells Fargo’s treatment of customers was “egregious and unacceptable," hinting that more regulatory action was likely.

September 20 -

Mortgage rates dropped to a year-to-date low for the third consecutive week as the 10-year Treasury yield also declined, according to Freddie Mac.

September 7 -

Loan application defects were unchanged for July compared with June, the first time in eight months there has not been an increase, according to First American Financial Corp.

August 31 -

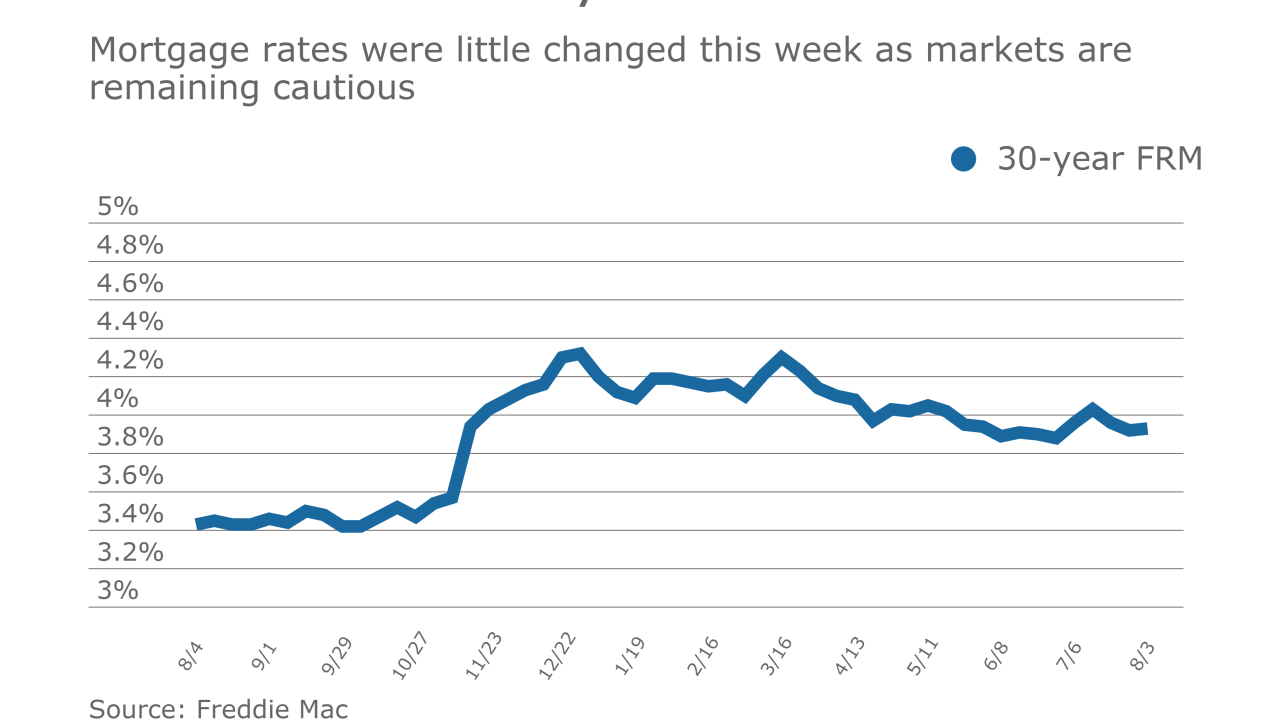

Mortgage rates were little changed this week after declining the previous two weeks, according to Freddie Mac.

August 3 -

Mortgage rates dropped for the second consecutive week, although the yield on the benchmark 10-year Treasury actually increased during the period, according to Freddie Mac.

July 27 -

Federal Reserve officials said they would begin running off their $4.5 trillion balance sheet “relatively soon” and left their benchmark policy rate unchanged as they assess progress toward their inflation goal.

July 26 -

A divided Federal Reserve policy committee couldn’t reach agreement in June on the timing of when to begin shrinking its massive balance sheet, according to minutes of the meeting.

July 5 -

The Federal Reserve can be patient in setting monetary policy and the current rate may be the right level for the forecast horizon, Federal Reserve Bank of St. Louis President James Bullard said Friday.

June 23 -

Fed Chair Janet Yellen called the Treasury's report a "complicated document" that shared many of the central bank's objectives, including reducing regulatory burden without sacrificing safety and soundness.

June 14 -

Federal Reserve officials forged ahead with an interest-rate increase and additional plans to tighten monetary policy despite growing concerns over weak inflation.

June 14 -

Federal Reserve officials surprised some onlookers by unveiling a rough plan for balance sheet runoff in the minutes for their May meeting.

June 12 -

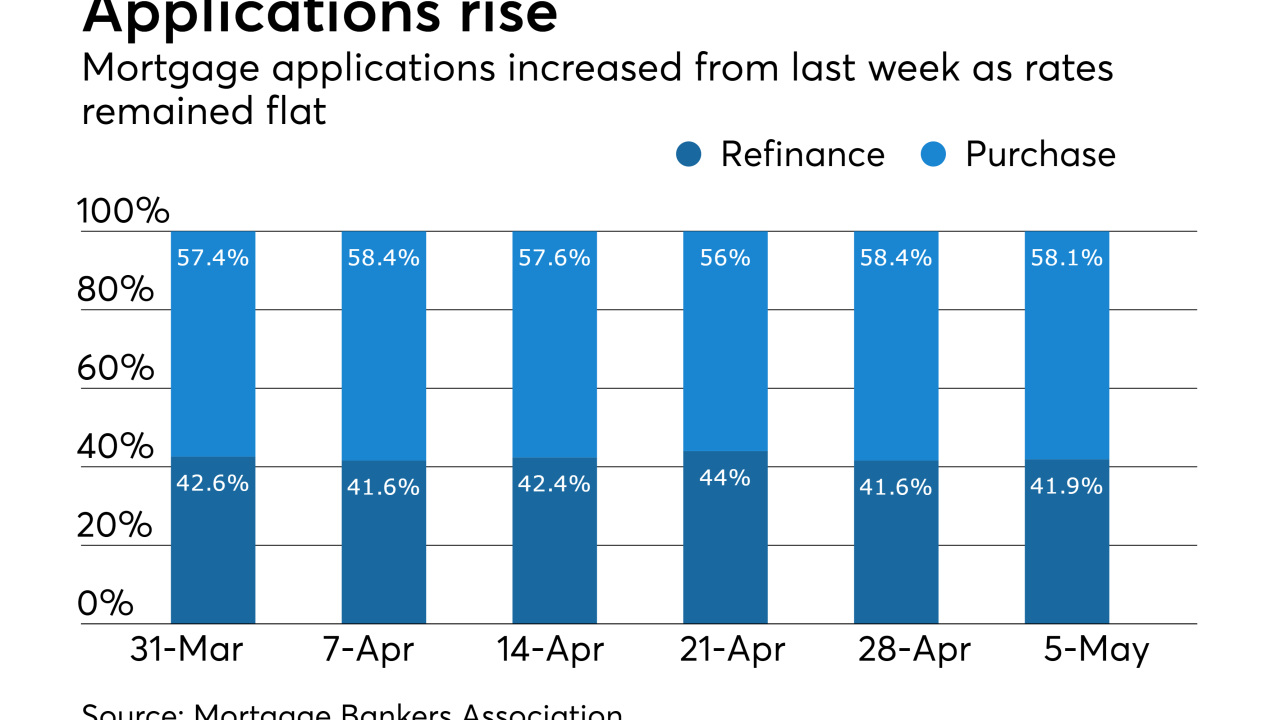

Mortgage applications increased 2.4% from one week earlier as there was little movement in interest rates, according to the Mortgage Bankers Association.

May 10 -

Mortgage rates held steady in anticipation of the Federal Open Market Committee not increasing short-term rates at its meeting Wednesday, according to Freddie Mac.

May 4 -

For the first time since the Federal Open Market Committee

acted five weeks ago , there was an increase in mortgage rates.April 27 -

Mortgage rates have been on a steady decline since the March 15 Federal Open Market Committee meeting, hitting a new low for 2017, according to Freddie Mac.

April 13