-

Called Structured Agency Credit Risk Securitized Participation Interests, the new securities are backed by mortgage loans, and are not general obligations of the government-sponsored enterprise.

October 18 -

Many of the prime jumbo loans backing the transaction, JP Morgan 2017-4, were contributed by originators with limited history in that product, according to DBRS.

October 18 -

From debating the future compliance landscape to developing a digital mortgage strategy, here's a preview of the top issues, ideas and themes on tap when the industry convenes in Denver for the Mortgage Bankers Association's Annual Convention & Expo.

October 17 -

Government-sponsored enterprises Fannie Mae and Freddie Mac's guarantee fee pricing last year kept the playing field fairly level for different-sized lenders.

October 17 -

Sens. Dean Heller and Catherine Cortez Masto of Nevada called on mortgage industry leaders to provide relief and financial assistance to victims of the Oct. 1 mass shooting at the Route 91 Harvest Festival in Las Vegas.

October 16 -

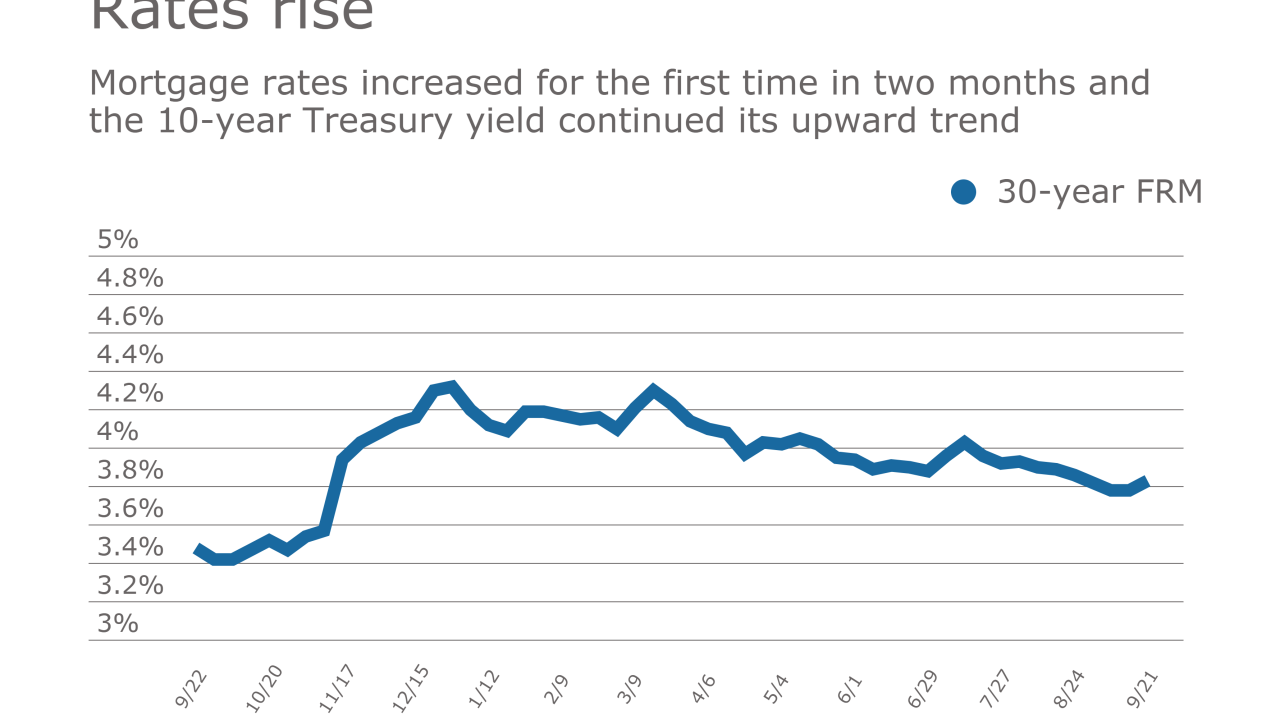

Mortgage rates posted their biggest week-over-week increase since July and the 10-year Treasury yield also rose, according to Freddie Mac.

October 12 -

Fannie Mae and Freddie Mac were not affected by a hacking incident against the accounting giant Deloitte, the companies said Tuesday, after a British newspaper alleged a server containing emails from government agencies was compromised.

October 10 -

Mortgage rates ticked up to their highest mark in six weeks, reflecting the 20-basis-point rise in the 10-year Treasury yield during September, according to Freddie Mac.

October 5 -

Incenter Mortgage Advisors is brokering on behalf of an unnamed mortgage banker an almost $10 billion mortgage servicing rights package that includes $870 million in loans with hurricane exposure.

October 5 -

Though FHFA Director Mel Watt stopped short of saying he would break with a Treasury agreement that forces all profits of the GSEs to go to the government, he emphasized that it couldn’t continue indefinitely.

October 3 -

Fannie Mae and Freddie Mac's regulator may have a travel kerfuffle of his own.

October 3 -

The majority of borrowers impacted by Hurricane Harvey have a significant amount of equity, while many in Hurricane Irma disaster areas have limited or negative equity, according to Black Knight Financial Services.

October 2 -

The Federal Housing Finance Agency's Duty to Serve program must increase manufactured housing lending in rural communities.

September 29 NeighborWorks America

NeighborWorks America -

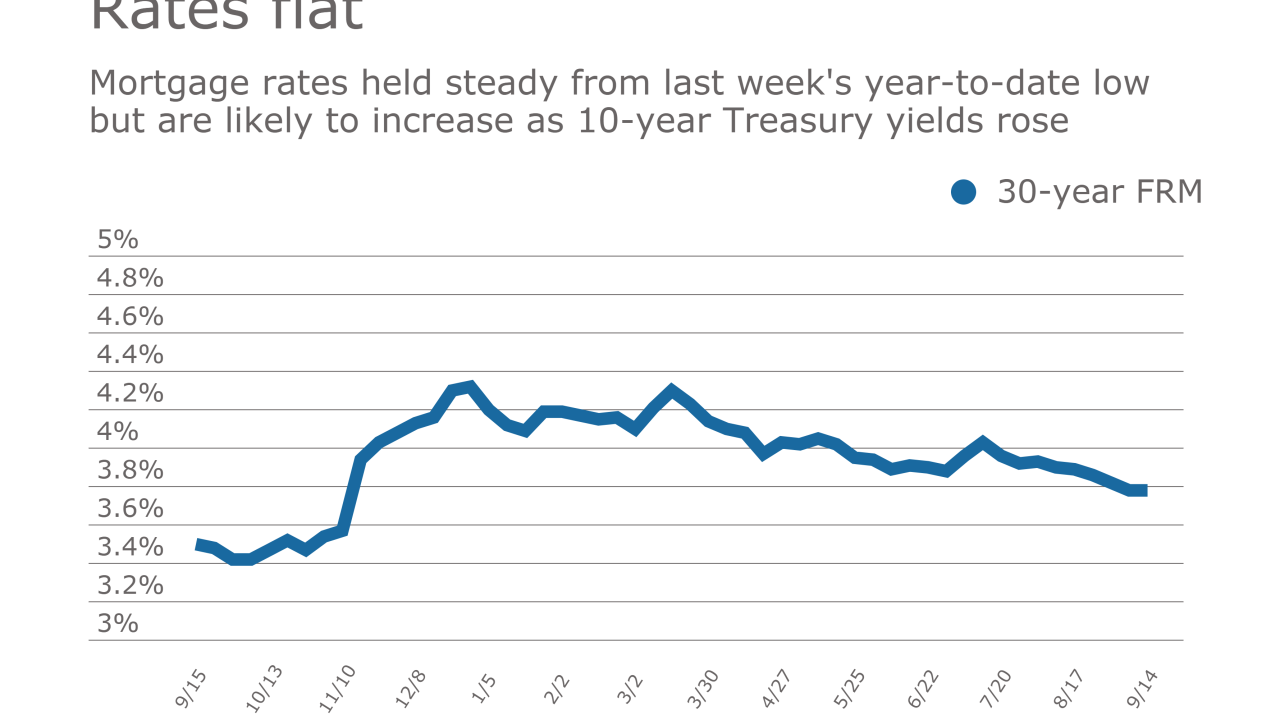

Mortgage rates remained unchanged from last week even through the 10-year Treasury yield first moved lower then spiked up during the period, according to Freddie Mac.

September 28 -

Sen. Bob Corker has been a key voice in the housing finance reform debate. His departure at the end of next year puts a deadline of sorts on his efforts to unwind and replace Fannie Mae and Freddie Mac.

September 26 -

The percentage of newly originated loans that are used to refinance an existing mortgage could shrink dramatically in 2018 as rates rise and burnout continues.

September 22 -

Mortgage rates increased for the first time in seven weeks, while the 10-year Treasury yield continued its upward trend, according to Freddie Mac.

September 21 -

Automated data validations are integral to a seamless digital mortgage experience. But the extent of data exposed in the Equifax breach raises questions about the risk of fraudsters exploiting those technologies to further compromise consumer data.

September 20 -

Mortgage investors want Freddie Mac to align its policy with Fannie Mae's when it comes to how delinquencies related to Hurricane Harvey affect credit risk transfer deals.

September 19 -

Mortgage rates remained unchanged from last week's year-to-date low but going forward they are likely to increase as 10-year Treasury yields rose.

September 14