-

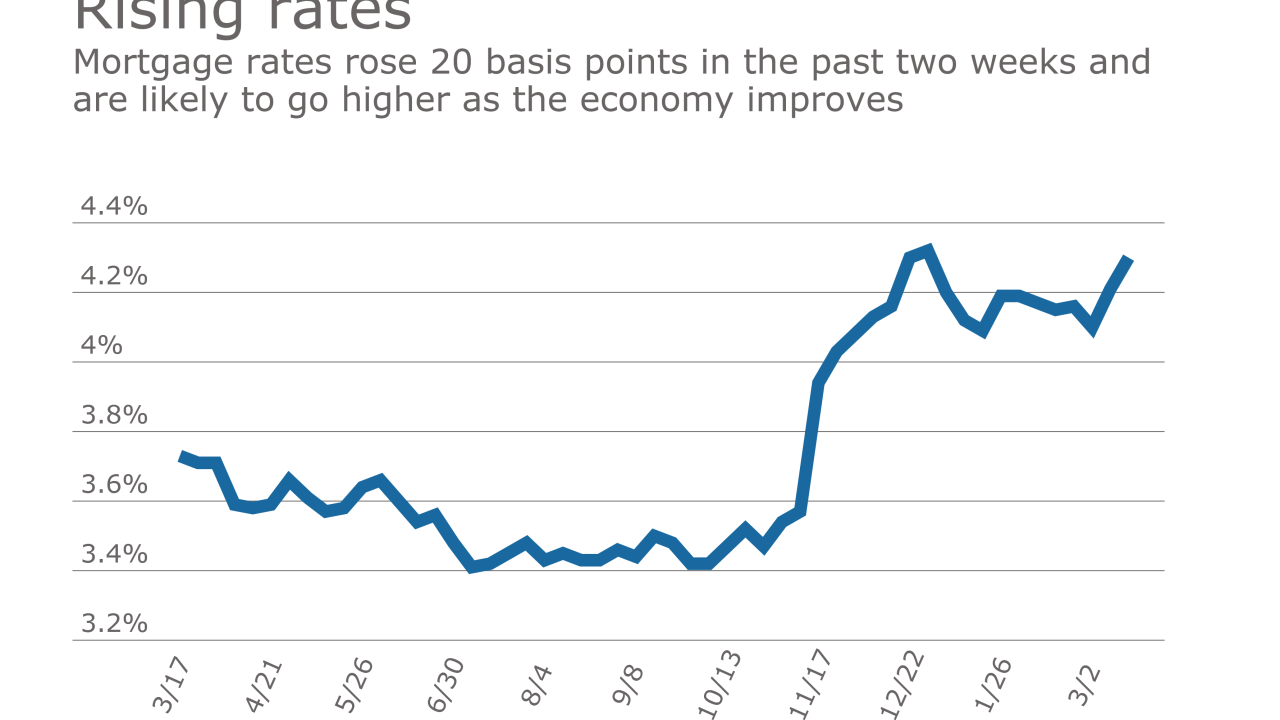

Mortgage rates have been on a steady decline since the March 15 Federal Open Market Committee meeting, hitting a new low for 2017, according to Freddie Mac.

April 13 -

The lender relationships resulted from a partnership the government-sponsored enterprise entered into with a non-profit housing group.

April 11 -

More renters are optimistic about their financial situations and expect to stay where they are even if their rents increased.

April 11 -

The average weekly rate for a 30-year fixed-rate mortgage dropped to 4.1% from 4.14% despite the release of information about further tapering of the Federal Reserve's mortgage bond holdings.

April 6 -

Freddie Mac has obtained two new insurance policies under its Agency Credit Insurance Structure program.

April 4 -

Private market mortgage insurance companies should better align their buyback and rescission policies with those of Fannie Mae and Freddie Mac, the Federal Housing Finance Agency said.

March 30 -

The 30-year fixed-rate mortgage averaged 4.14% for the week ending March 30,

down from last week when it averaged 4.23%.March 30 -

A bipartisan group of senators told Mel Watt, the regulator who oversees Fannie Mae and Freddie Mac, that he shouldn't allow the companies to recapitalize without congressional approval.

March 30 -

In a bitterly partisan Congress, two senators are making a rare push across party lines to solve a persistent riddle with huge implications for the U.S. housing market: What to do with Fannie Mae and Freddie Mac?

March 28 -

Suspending Fannie Mae and Freddie Mac's regular dividend payments to the Treasury, thus enabling the companies to replenish their reserve capital, would put their future on better footing.

March 28 -

Most tax lien and civil judgment data will be taken out of credit bureau files on July 1, possibly inflating scores and raising concerns about liability for mortgages that sour.

March 27 -

With refinance volume shrinking, some lenders are making up the difference by turning to alternative loan products for borrowers with lower credit scores.

March 23 -

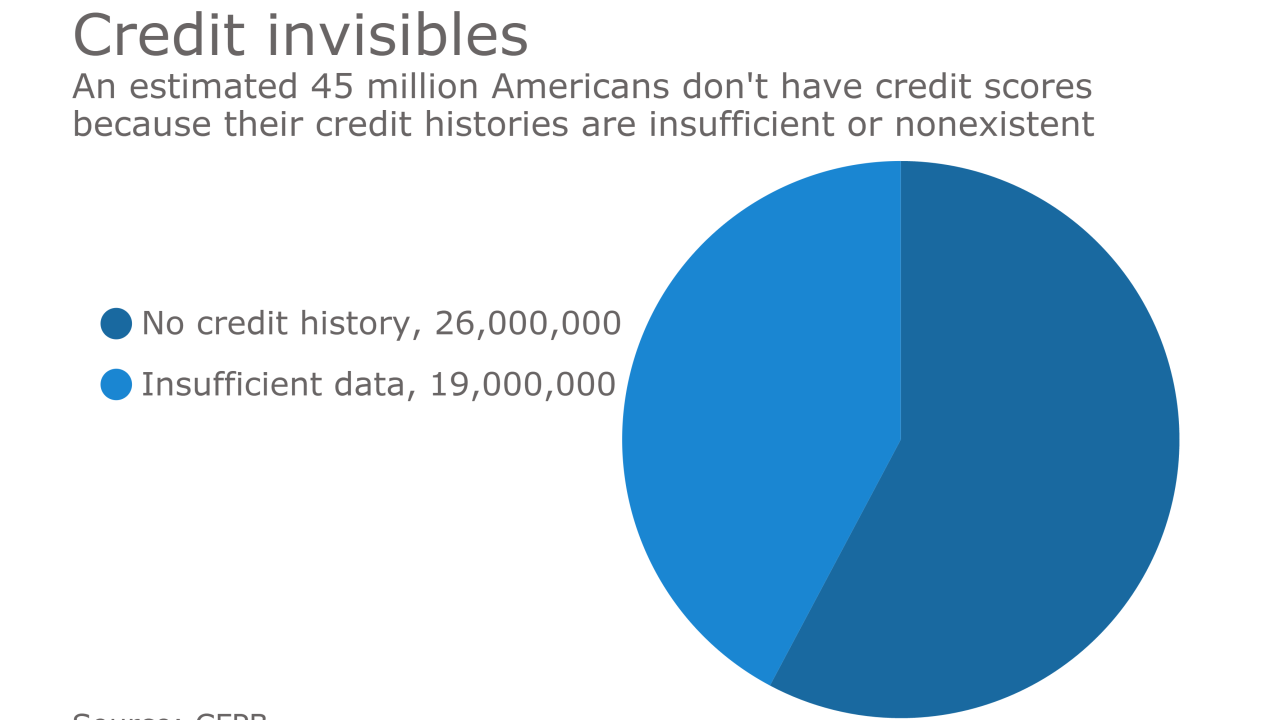

Freddie Mac will soon allow automated underwriting of borrowers who lack scores but have other financial records.

March 23 -

The 30-year fixed-rate mortgage averaged 4.23% for the week ending March 23, down from last week when it averaged 4.3%.

March 23 -

Freddie Mac is bolstering its relationships with housing finance agencies after it fell short of reaching two affordable housing goals last year.

March 21 -

Modification activity increased slightly in January over December as servicers worked their way through the remaining Home Affordable Mortgage Program applications.

March 20 -

Mortgage rates are being pushed higher by the same economic factors that led the Federal Open Market Committee to increase short-term rates.

March 16 -

Freddie Mac is considering backing loans that finance single-family rental homes for the first time, mirroring a controversial transaction that Fannie Mae disclosed in January.

March 10 -

Freddie Mac is preparing a transaction that transfers credit risk on $640 million of super-conforming residential mortgages.

March 9 -

Mortgage interest rates increased 11 basis points over the previous week, reaching their highest level so far in 2017, according to Freddie Mac.

March 9