-

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

In a letter to the Consumer Financial Protection Bureau, the Mortgage Bankers Association recommended adding six more months to the latest GSE patch proposal.

August 12 -

The number of loans going into coronavirus-related forbearance was down for the eighth consecutive week, as the growth rate fell 23 basis points between July 27 and August 2, according to the Mortgage Bankers Association.

August 10 -

The collateral pool consists of 59 loans for mostly older garden-style and mid-rise apartment buildings that have undergone recent upgrades and renovation.

August 10 -

Earnings reports out this week beat pessimistic expectations, but strained coronavirus relief negotiations in Congress cloud the outlook for what's ahead.

August 7 -

Whether mortgage rates continue to decline may depend on Friday’s job numbers.

August 6 -

The agency said property owners can enter into new or modified forbearance plans if they have a hardship due to the coronavirus, but the landlords must agree not to kick out renters solely for nonpayment of rent.

August 6 -

The mortgage servicing rights package going up for bid adds to signs that the market for large offerings is becoming more active.

August 3 -

The number of loans going into coronavirus-related forbearance fell for the seventh straight week, but the Mortgage Bankers Association predicts the rate will increase if the number of coronavirus cases continues to rise.

August 3 -

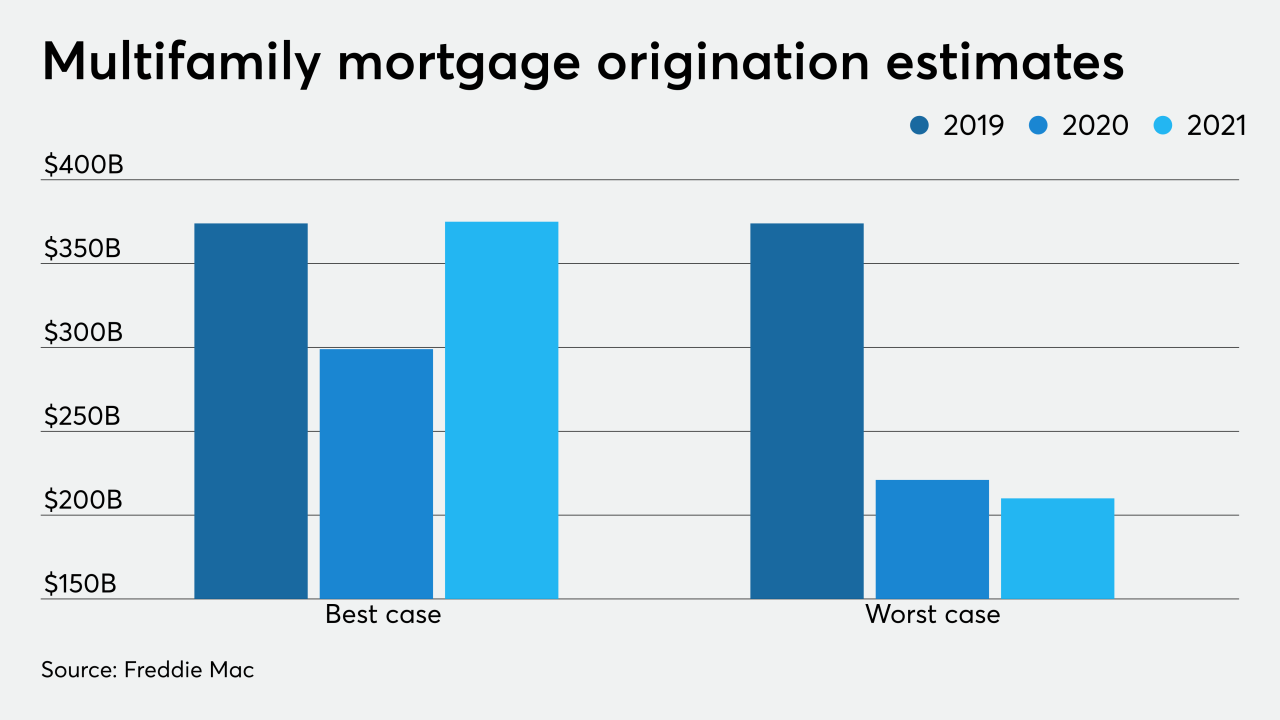

The size of the decline depends on how bad the economy sinks and if the coronavirus spread is halted.

August 3 -

The mortgage giants will have to meet benchmarks for covering cash flow needs during stressed periods. The FHFA views the requirements as a prerequisite to the companies exiting conservatorship.

July 31 -

The government-sponsored enterprise's earnings were up tenfold as it stabilized mortgage market liquidity amid the coronavirus.

July 30 -

Mortgage rates fell 2 basis points this week, remaining near their historic lows as they have for the past month with the markets roiled by uncertainty, according to Freddie Mac.

July 30 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 28 ACES Risk Management Corp.

ACES Risk Management Corp. -

The number of loans going into coronavirus-related forbearance dropped for the sixth consecutive week, as the growth rate fell 6 basis points between July 13 and July 19, according to the Mortgage Bankers Association.

July 27 -

Mortgage rates rose for the first time in six weeks, going back the above the 3% mark, as spreads to the 10-year Treasury yield widened again, according to Freddie Mac.

July 23 -

Fannie Mae and Freddie Mac have imposed heavy price adjustments for loans that were granted relief under the pandemic relief law enacted in March.

July 22 -

The Financial Stability Oversight Council’s plan to study the market explains very little about which activities or firms, like Fannie Mae and Freddie Mac, will be designated as systemically important. Here's some clearer guidance.

July 21

-

The number of loans going into coronavirus-related forbearance dropped for the fifth straight week, as the growth rate plummeted 38 basis points between July 6 and July 12, according to the Mortgage Bankers Association.

July 20 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20