-

The Treasury secretary said he hopes lawmakers will back reforms of Fannie Mae and Freddie Mac within three to six months.

September 9 -

Fannie Mae and Freddie Mac investors won a victory in their long battle to reap benefits from their stakes in the mortgage giants with a court ruling letting them pursue claims that the U.S. sweep of the companies’ earnings is illegal.

September 9 -

The Trump administration raised the goal posts for ending the conservatorships of Fannie Mae and Freddie Mac, but how officials get there is still highly uncertain.

September 6 -

The Treasury Department made clear in a much-anticipated report that it prefers Congress take up reform of the government-sponsored enterprises, but it also recommended steps that federal agencies could take without legislation.

September 5 -

The Mortgage Industry Standards Maintenance Organization has released a dataset designed to prepare lenders for a new mortgage application and automated underwriting system upgrades at Fannie Mae and Freddie Mac.

September 5 -

Mortgage rates fell to lows not seen October 2016, affected by concerns over manufacturing and the ongoing trade war with China, according to Freddie Mac.

September 5 -

New Home Mortgage Disclosure Act data shows debt-to-income ratios have risen but also have been frequently cited among reasons for denials, suggesting lenders are becoming more cautious about this underwriting metric.

September 3 -

Damage from Hurricane Dorian's storm surge has the potential to affect 668,052 homes, according to CoreLogic's latest analysis. Reports estimate a worst-case total of $144.6 billion in reconstruction cost value.

August 30 -

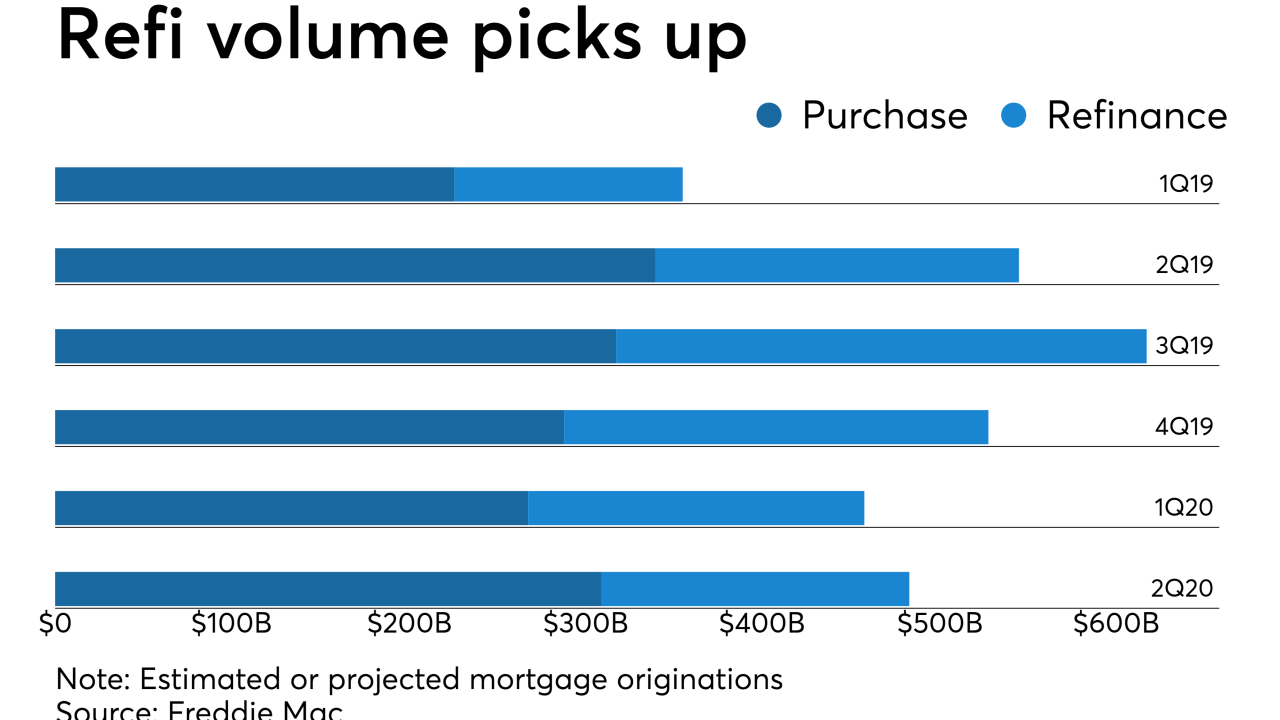

Freddie Mac now forecasts that refinance volume will make up nearly half of third and fourth quarter production, and has increased its origination estimate for the year to over $2 trillion.

August 30 -

Mortgage rates remained near three-year lows last week, but their movement did not mirror the period's big shifts in the 10-year Treasury yield.

August 29 -

The Treasury’s takeover of Fannie Mae and Freddie Mac left legacy shareholders holding the bag.

August 28 The Delaware Bay Company

The Delaware Bay Company -

Though advocates and industry are rarely aligned, they are starting to coalesce around a plan that would call for the elimination of the CFPB’s 43% debt-to-income limit as part of its qualified mortgage rule.

August 27 -

Mortgage rates continued to drop this week and hit their lowest levels since November 2016, while stimulating the real estate market and the economy, according to Freddie Mac.

August 22 -

Complaints made by legacy shareholders of Freddie Mac have no value after the Treasury Department pumped up Freddie and Fannie Mae through conservatorship.

August 22 American Enterprise Institute Housing Center

American Enterprise Institute Housing Center -

Freddie Mac is automating a manual form submission process used to correct post-settlement and real estate owned data, and adding policy changes aimed at accommodating electronic signatures on loss mitigation documents.

August 20 -

The global rally in bonds on Thursday drove the yield on the benchmark 10-year Treasury below 1.5% for the first time since August 2016.

August 15 -

Mortgage rates remained unchanged this past week even with all of the upheaval in the bond markets that pushed long-term Treasury yields down, according to Freddie Mac.

August 15 -

The regulator of the government-sponsored enterprises retreated from an earlier proposal that had barred VantageScore because of its ties to the credit bureaus.

August 13 -

Fannie Mae and Freddie Mac's corporate debt ratings shouldn't be downgraded in the near term as a result of the Treasury Department's to-be-released government-sponsored enterprise reform plan, Fitch Ratings said.

August 13 -

With the agency mulling changes to the “Qualified Mortgage” regulation, mortgage lenders say little-known standards for how they document a borrower’s income would be a good place to start.

August 12