-

Despite the release of Senate Banking Committee Chairman Mike Crapo's outline of a government-sponsored enterprise reform plan, most policy changes will likely come from the White House, and may even materialize this year, said Keefe, Bruyette & Woods.

February 4 -

As policymakers consider administrative reforms to Fannie and Freddie, they must address the problem of capital arbitrage to avoid overleveraging the mortgage system.

February 4

-

Just as the Trump administration appears focused on releasing a framework without Congress, the Senate Banking Committee has re-entered the policy fray with a new proposal.

February 1 -

The Senate Banking Committee chairman released an outline for overhauling the U.S. housing finance system more than 10 years after the government put Fannie Mae and Freddie Mac into conservatorship.

February 1 -

Affordability remains a challenge for homebuyers, but barely any mortgage lenders attribute last year's sluggish home sales to insufficient consumer income or lack of loan products for new buyers, according to Fannie Mae.

January 31 -

Mortgage rates moved up slightly after weeks of moderating, but are still low enough not to affect the upcoming prime home buying period, according to Freddie Mac.

January 31 -

The agency's acting director said he welcomes lawmakers' “insight and perspective” on how to end the conservatorships of Fannie Mae and Freddie Mac.

January 30 -

Mortgage originations for the next two years will be higher than previously expected as lower interest rates at the end of 2018 will lead to more refinance volume, Freddie Mac said.

January 30 -

A White House spokeswoman said the administration wants to work with Congress on a housing finance reform plan, providing evidence that changes might not be imminent.

January 29 -

Fixing the housing finance system is "the last piece of unaddressed business from the financial crisis," according to a summary of to-do items released by the Banking Committee's chairman.

January 29 -

The acting head of the Federal Housing Finance Agency has promised substantial changes for Fannie Mae and Freddie Mac, but the exact mechanics and timeline of an administration plan are still a mystery.

January 28 -

Recent comments attributed to the acting head of the Federal Housing Finance Agency (who is also comptroller of the currency) have stoked speculation about the Trump administration’s housing finance policy.

January 25 -

While Fannie Mae's multifamily origination volume took a step back from 2017's record high of $67 billion, its delegated underwriting and servicing program provided $65 billion in financing in 2018, led by Wells Fargo.

January 25 -

The 30-year fixed-rate mortgage remained unchanged for the third consecutive week, according to Freddie Mac, even with political uncertainty affecting the overall economic outlook.

January 24 -

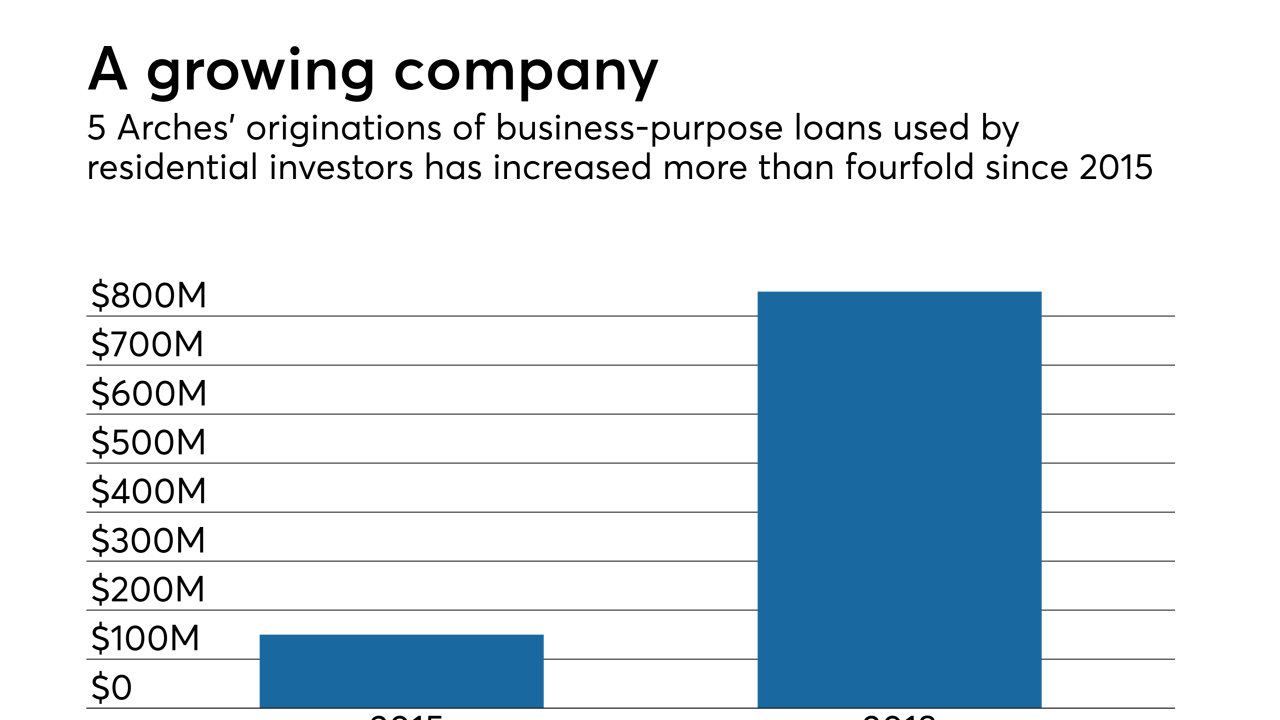

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

Fannie Mae and Freddie Mac shares soared Friday amid fresh reports that the Trump administration is working on proposal that would recommend freeing the mortgage-finance giants from government control.

January 18 -

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17 -

Fannie Mae and Freddie Mac are adding another round of new underwriting requirements and a workaround for employment verification in response to the prolonged government shutdown.

January 17 -

Mortgage rates remained flat after dropping for six consecutive weeks as negative economic news was balanced with a more positive outlook on housing, according to Freddie Mac.

January 17 -

A federal appeals court ruling that found the leadership structure of the FHFA unconstitutional will face an "en banc" review later this month.

January 16