-

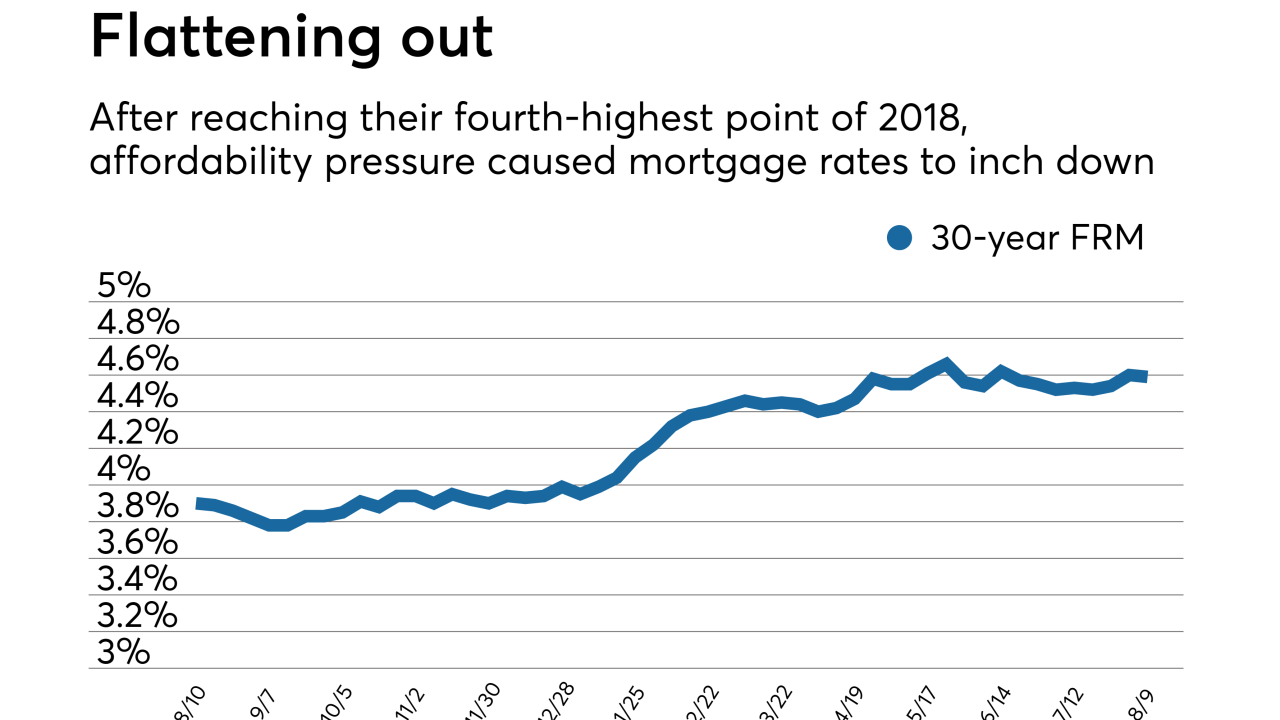

Mortgage rates took a small step back due to affordability pressure after climbing for the past two weeks, according to Freddie Mac.

August 9 -

The House Financial Services Committee has scheduled an FHFA oversight hearing for September in the wake of waste, fraud and abuse allegations.

August 8 -

The mortgage giants Fannie Mae and Freddie Mac would have to draw as much as $78 billion in the event of a serious economic crisis, according to stress test results released Tuesday by the housing regulator.

August 7 -

The biggest impact may be to focus the administration’s efforts on selecting a nominee to succeed Director Mel Watt, whose term ends in January.

August 7 -

Mortgage rates rose to their highest level in seven weeks and fourth-highest of 2018, thanks to strong economic trends, according to Freddie Mac.

August 2 -

Fannie Mae and Freddie Mac remain in conservatorship nearly a decade after the financial crisis, and there’s still no end in sight.

August 1 Calvert Advisors LLC

Calvert Advisors LLC -

Freddie Mac produced modest second-quarter results, reflecting a stabilizing business that CEO Donald Layton compared to a utility company.

July 31 -

The agency said multiple stakeholders had requested more time to evaluate the proposal.

July 31 -

The D.C. movers and shakers at the center of the financial crisis — and the government’s response — have all moved on to new positions. Here's a look at what they did afterward.

July 30 -

Mel Watt's term as director of Federal Housing Finance Agency ends in January, but his exit may be accelerated if the accusations in a new report prove true.

July 27IntraFi Network -

Mortgage rates rose to their highest level since late June, going up for the third time in the past nine weeks, according to Freddie Mac.

July 26 -

Whoever succeeds current Director Mel Watt will have a front-and-center role in efforts to reform Fannie Mae and Freddie Mac.

July 26 -

Nonbank mortgage-backed securities servicers increase their exposure to agency loans as the housing market distances itself from last decade's crash, according to Fitch Ratings.

July 24 -

Michael Bright co-wrote a paper in 2016 that envisioned making the agency a backstop for the housing finance system, but appeared to distance himself from the proposal at his confirmation hearing.

July 24 -

The Federal Housing Finance Agency is suspending its ongoing review of new credit scoring models and will instead move forward with creating a regulatory framework for providers of alternative credit scores to apply and be evaluated for use by Fannie Mae and Freddie Mac.

July 23 -

The fees that Fannie Mae and Freddie Mac charge for low down payment mortgages disproportionately reflect their risk exposure and make homeownership more difficult for underserved borrowers.

July 23 Milken Institute Center for Financial Markets

Milken Institute Center for Financial Markets -

There is an opportunity for home sales to break out of the doldrums if price appreciation slows, mortgage rates remain flat and supply increases, Freddie Mac said.

July 23 -

Mortgage rates took a small step down, decreasing for the sixth time in the eight weeks since Memorial Day, according to Freddie Mac.

July 19 - Finance and investment-related court cases

With ruling in GSE case, the two agencies are emerging as the test subjects for a legal showdown over their authority.

July 17 -

A federal appeals court in Texas agreed with Fannie Mae and Freddie Mac shareholders that the FHFA, led by a single director, violates the separation of powers.

July 17