-

“They are willing to play this to the end, one way or the other.”

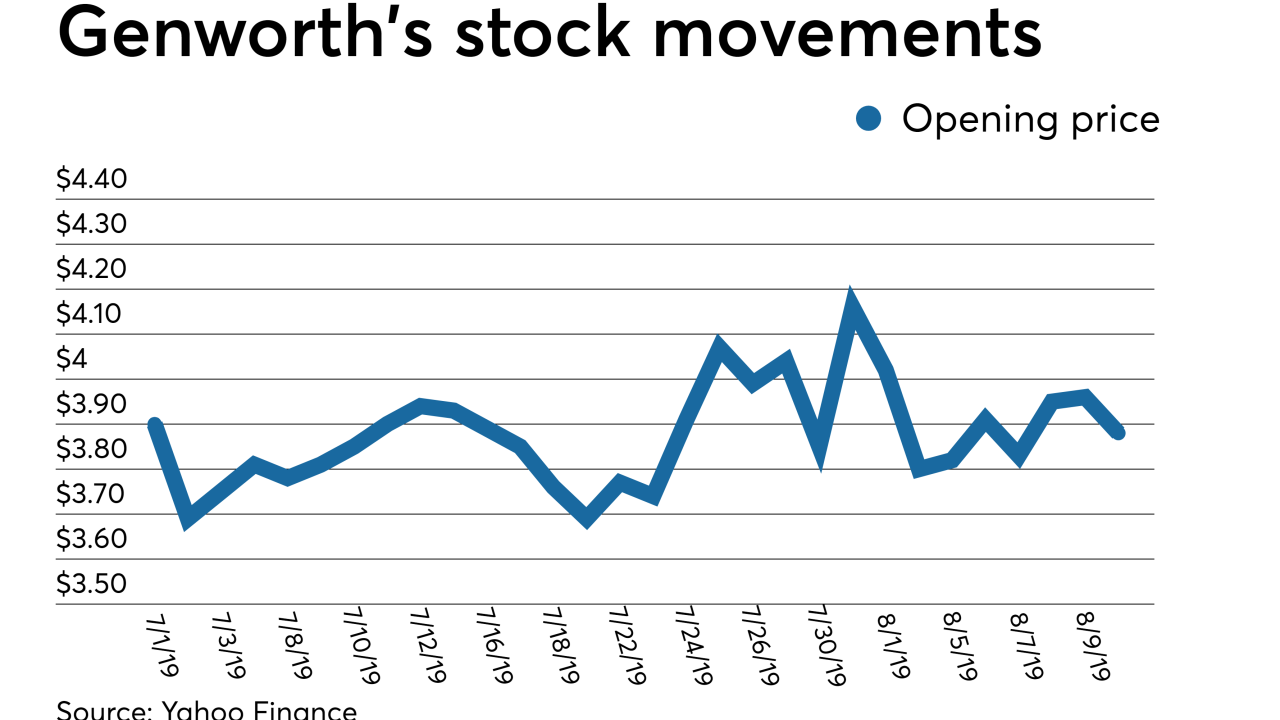

August 13 -

While low interest rates drove up new insurance written, the increased defaults stymied overall performance.

July 30 -

The domestic mortgage insurer could have a portion of its equity sold as an initial public offering if the China Oceanwide transaction were to be terminated.

July 21 -

If the transaction does not go through, Genworth is looking at reviving a spin-out of its U.S. mortgage insurance business.

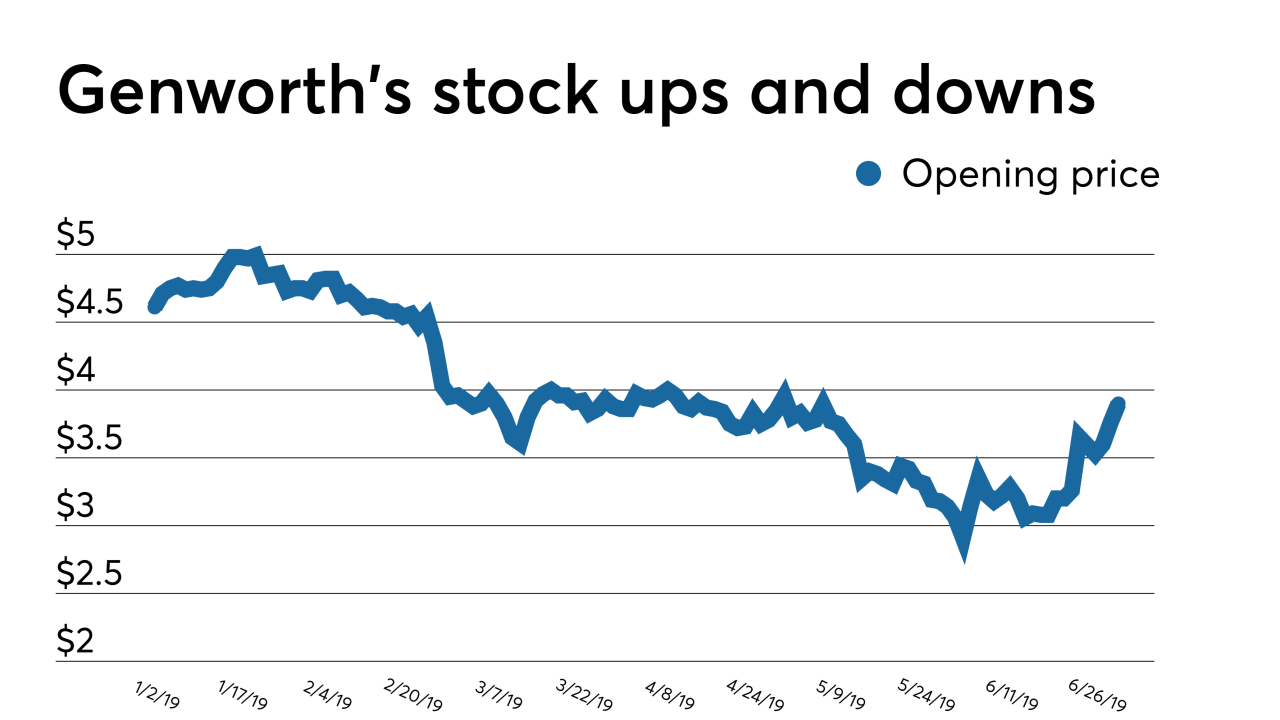

June 30 -

But the coronavirus put a hold on the market in April and remains an overhanging cloud for the future.

June 25 -

But it is still looking to conserve capital to cover future delinquencies and will likely halt dividends to the parent company.

May 6 -

The latest deadline for Genworth Financial's acquisition by China Oceanwide is June 30, but the parties are looking to get the transaction completed by the end of next month.

April 1 -

With the economy and job market both healthy before the COVID-19 crisis, first-time homebuyers took advantage of low mortgage rates and hit their highest volume in two decades.

March 17 -

Mortgage-related companies finalized four partnerships, a servicing-retention firm went up for sale, and a long-delayed insurance-related transaction moved forward this week in a wave of industry merger and acquisition activity.

March 4 -

The deadline for China Oceanwide to complete its acquisition of Genworth Financial was extended for a 13th time, following completion of the sale of Genworth MI Canada to Brookfield Business Partners.

December 23 -

The housing market is likely changing to predominantly repeat purchasers, even as growth in the first-timer buyer segment continued in the third quarter, a study from Genworth found.

December 10 -

More private mortgage insurers reported significant year-over-year gains in new business during the third quarter, mainly driven by the increase in refinance volume.

October 31 -

Genworth Financial agreed to sell its Canadian unit to Brookfield Business Partners for C$2.4 billion ($1.8 billion) as it works to win regulatory approval for its acquisition by China Oceanwide Holdings Group.

August 13 -

Genworth Financial's efforts to advance its sale to China Oceanwide hit a roadblock as bondholders did not respond to a consent solicitation for easing a possible Canadian mortgage insurance unit sale.

August 12 -

The oft-delayed sale of Genworth Financial might need new approvals from U.S. insurance regulators if and when it disposes of its Canadian mortgage insurance stake.

July 31 -

Genworth Financial is marketing its stake in Genworth MI Canada in a possible last-ditch effort to save the long-delayed proposed acquisition by China Oceanwide.

July 1 -

In a weak first quarter, housing activity held up better for first-time homebuyers than others, according to a new Genworth Mortgage Insurance report.

May 23 -

Private mortgage insurers can help to ease banks' compliance burden when it comes to the Current Expected Credit Loss accounting standard, an industry executive said.

May 22 -

Despite a lower rate of increase, 2019 equity gains could pull 350,000 households from being underwater on mortgages, according to CoreLogic.

March 7 -

Rises in the amount of low down payment loans and private mortgage insurance due to tight affordability led to the most first-time homebuyers since 2006, according to Genworth Mortgage Insurance.

March 1