-

ACHM 2025-HE1 will repay notes using a pro-rata, sequential pay structure that must satisfy an overcollateralization test, and cumulative loss and delinquency triggers.

March 29 -

WeWork co-founder Adam Neumann's family office is in discussions to put additional capital in Peach Street Inc., a startup focused on mortgage servicing.

January 7 -

Jefferies is housing the initial round of $300 million in loans under a repurchase agreement with four lenders, as well as with the trust established for the transaction in Jefferies’ standing as the repo seller.

July 22 -

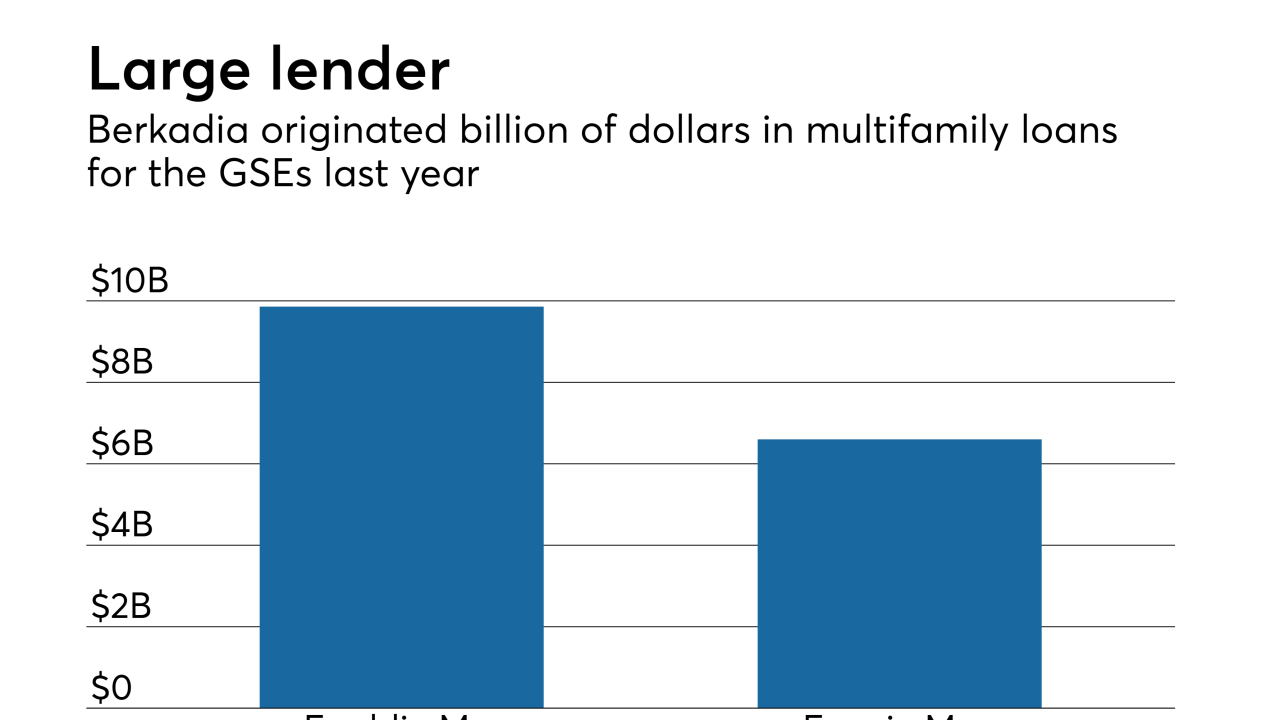

Berkadia, a joint venture run by Berkshire Hathaway and Jefferies Financial Group, is acquiring real estate capital advisory firm Central Park Capital Partners to diversify its capital sources.

March 6 -

It's not clear exactly what might pull investor sentiment and 10-year Treasury yields, which rates for the 30-year mortgage are benchmarked to, off the current lows.

December 31 -

The five-year legal odyssey of former Jefferies Group managing director Jesse Litvak, the first person charged in a federal crackdown on questionable bond-trading tactics, came to an end as prosecutors said they don't intend to try him a third time.

July 30 -

A former Cantor Fitzgerald managing director was cleared of charges that he defrauded customers by lying about prices of mortgage-backed securities.

May 3 -

Freddie Mac has priced its first credit-risk transfer securities backed in part by tax-exempt loans used to finance affordable multifamily rental properties.

June 15 -

Three former Nomura Holdings mortgage-bond traders accused of cheating their customers called no witnesses in their defense against fraud charges, betting that prosecutors’ evidence is too weak to convict them.

May 31 -

Jesse Litvak was sentenced to two years in prison and fined $2 million after he was convicted a second time for lying about mortgage-backed securities prices.

April 26 -

Former Jefferies & Co. Managing Director Jesse Litvak says he should be spared prison when he is sentenced later this month following his conviction of a single count of fraud.

April 11