-

The coronavirus put a dent in May's home sales and inventory, but some indicators offer hope for a turnaround on the horizon.

June 18 -

Purchase mortgage application volume was at its most in over a decade as consumer confidence continued to improve in the aftermath of the coronavirus shutdown, according to the Mortgage Bankers Association.

June 17 -

Credit unions have seen historic mortgage growth so far this year despite the pandemic, but there are concerns some institutions may be overly relying on refinancing and not focusing enough on generating new purchase business.

June 17 -

The availability of some loans used to build homes dried up due to the coronavirus. Opening up the economy may help if it doesn't lead to a spike in infections, and if consumer demand persists.

June 16 -

Unemployment is high. Credit is tight. And scientists are warning that a dangerous second wave of the coronavirus is coming. But somehow, U.S. mortgage companies are having one of their best years in history.

June 16 -

The number of loans going into coronavirus-related forbearance ground down to a growth rate of 2 basis points between June 1 and June 7, according to the Mortgage Bankers Association.

June 15 -

Mortgage applications increased 9.3% from one week earlier, fueled by low mortgage rates and the release of pent-up demand, according to the Mortgage Bankers Association.

June 10 -

Looming economic uncertainties forced mortgage lenders to tighten underwriting standards in May.

June 9 -

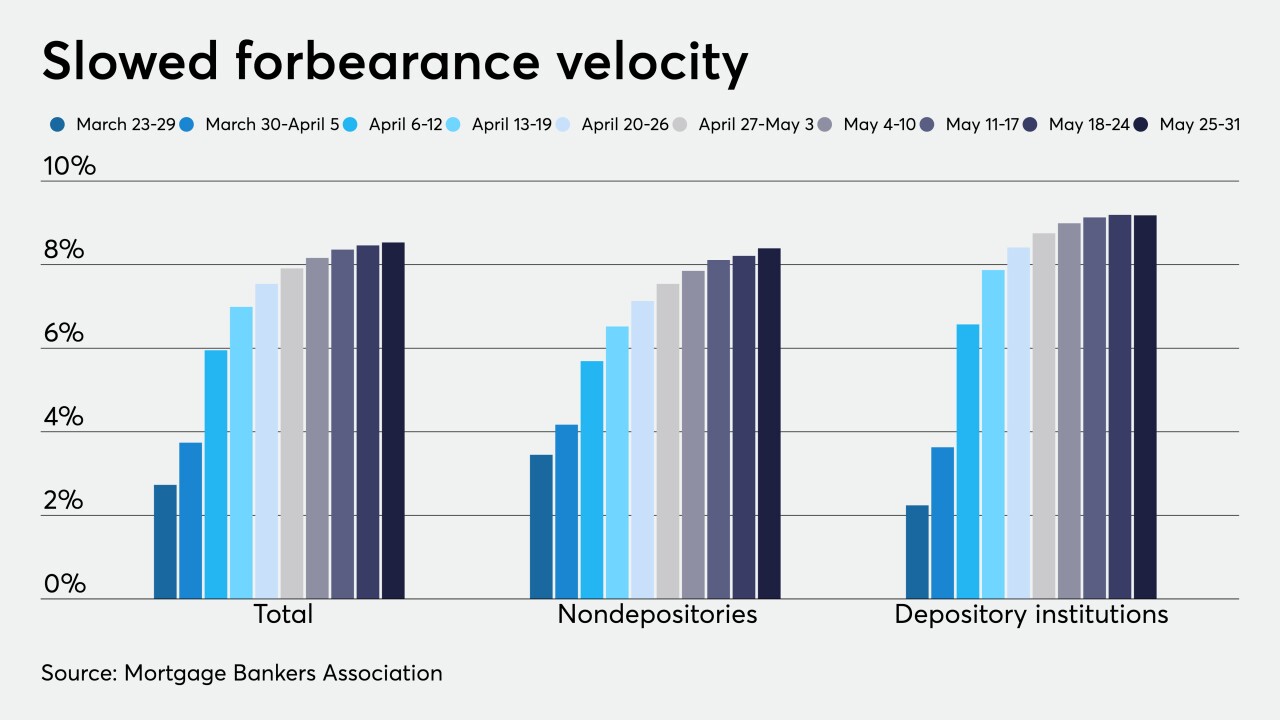

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

Independent mortgage banks started 2020 strong after three quarters of high profits, according to the Mortgage Bankers Association.

June 4 -

Purchase mortgage application volume continued its upswing as consumers acted on record low rates, but high unemployment and low inventory could hold home buying activity back in the future, the Mortgage Bankers Association said.

June 3 -

Culture scores at the lender are equal or higher than before lockdown.

June 2 -

Coronavirus-related remote work has elevated the need to find a dedicated source of funding for managing and developing real estate finance industry data standards, according to the Mortgage Bankers Association.

June 1 -

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

June 1 -

Steps have been taken to manage coronavirus-related liquidity risks to the housing finance system, but some remain, according to Mortgage Bankers Association President and CEO Robert Broeksmit.

June 1 -

Mortgage applications increased 2.7% from one week earlier, as purchase volume is now outpacing the prior year's activity, according to the Mortgage Bankers Association.

May 27 -

Coronavirus-related mortgages in forbearance grew 20 basis points between May 11 and May 17, according to the Mortgage Bankers Association.

May 26 -

The MBA also said it has been lobbying for a measure that would enable cash-out refinances in forbearance to be sold to the GSEs.

May 20 -

Mortgage applications decreased 2.6% from one week earlier, as tighter underwriting drove the refinance index to its lowest level since March, according to the Mortgage Bankers Association.

May 20 -

The Mortgage Bankers Association's forecast anticipates tremendous coronavirus stimulus-related debt coming on to the market.

May 19