-

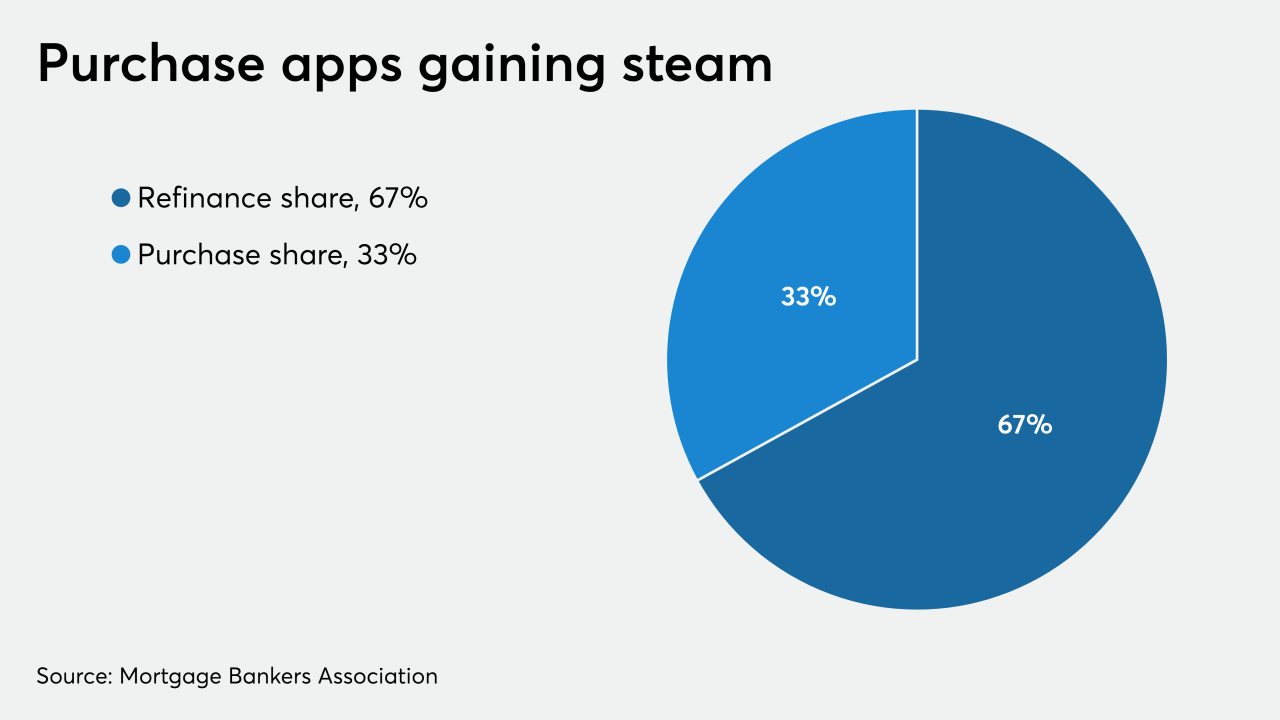

Purchase mortgage application volume continued its upswing as consumers acted on record low rates, but high unemployment and low inventory could hold home buying activity back in the future, the Mortgage Bankers Association said.

June 3 -

Culture scores at the lender are equal or higher than before lockdown.

June 2 -

Coronavirus-related remote work has elevated the need to find a dedicated source of funding for managing and developing real estate finance industry data standards, according to the Mortgage Bankers Association.

June 1 -

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

June 1 -

Steps have been taken to manage coronavirus-related liquidity risks to the housing finance system, but some remain, according to Mortgage Bankers Association President and CEO Robert Broeksmit.

June 1 -

Mortgage applications increased 2.7% from one week earlier, as purchase volume is now outpacing the prior year's activity, according to the Mortgage Bankers Association.

May 27 -

Coronavirus-related mortgages in forbearance grew 20 basis points between May 11 and May 17, according to the Mortgage Bankers Association.

May 26 -

The MBA also said it has been lobbying for a measure that would enable cash-out refinances in forbearance to be sold to the GSEs.

May 20 -

Mortgage applications decreased 2.6% from one week earlier, as tighter underwriting drove the refinance index to its lowest level since March, according to the Mortgage Bankers Association.

May 20 -

The Mortgage Bankers Association's forecast anticipates tremendous coronavirus stimulus-related debt coming on to the market.

May 19 -

To deal with the crunch, servicers should combine cloud and digital workflow automation technologies.

May 19 Clarifire

Clarifire -

Director Mark Calabria, who abandoned the Fannie and Freddie capital proposal written by his predecessor, said he expects a revised framework to be ready “very soon.”

May 19 -

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

May 18 -

Pent-up demand is already pushing buyers to a gradual return to the market, the report asserts.

May 18 -

Ginnie Mae is offering temporary relief related to its acceptable delinquency-rate threshold in response to issuers' need to fulfill the forbearance requirements in the coronavirus rescue package.

May 18 -

While overall mortgage application volume remained flat, purchase activity continued to rebound — and that should be the case through the remainder of the spring, according to the Mortgage Bankers Association.

May 13 -

By the end of the first quarter, the number of borrowers 30 days late on their mortgage increased by 59 basis points.

May 12 -

The number of mortgages in coronavirus-related forbearance rose by 37 basis points as the unemployment rate soared, according to the Mortgage Bankers Association.

May 11 -

Many originators stopped making riskier products, including jumbo loans and low credit score offerings, during April.

May 7 -

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6