-

The total coronavirus-related mortgages in forbearance grew by 55 basis points, in lockstep with rising unemployment claims, according to the Mortgage Bankers Association.

May 4 -

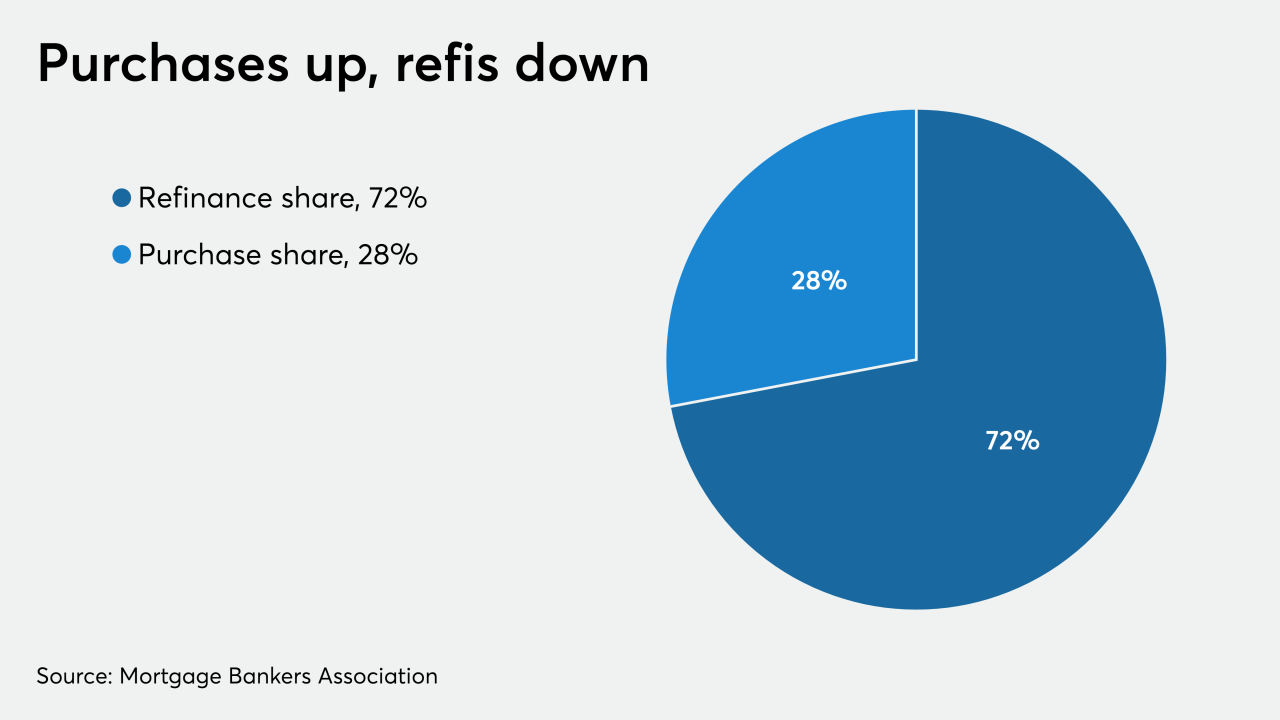

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

The number of loans in forbearance increased by a full percentage point over the past week, according to the Mortgage Bankers Association.

April 27 -

The Federal Housing Finance Agency has promised to take care of advances on principal and interest payments for coronavirus forbearances after four months, but servicers remain concerned about other responsibilities.

April 22 -

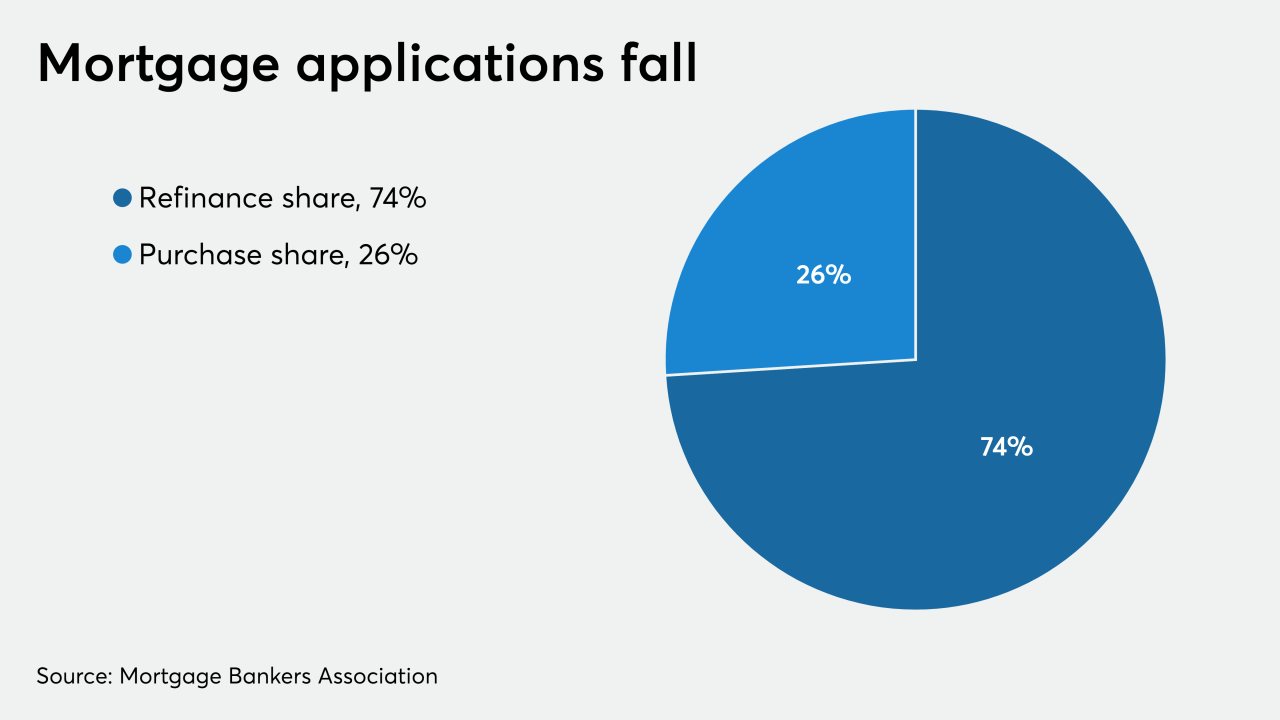

Mortgage applications decreased 0.3% from one week earlier, although purchase activity was higher for the first time in six weeks, according to the Mortgage Bankers Association.

April 22 -

Surging unemployment from COVID-19 shutdowns brought a rapidly rising tide of forbearance requests, according to the Mortgage Bankers Association.

April 20 -

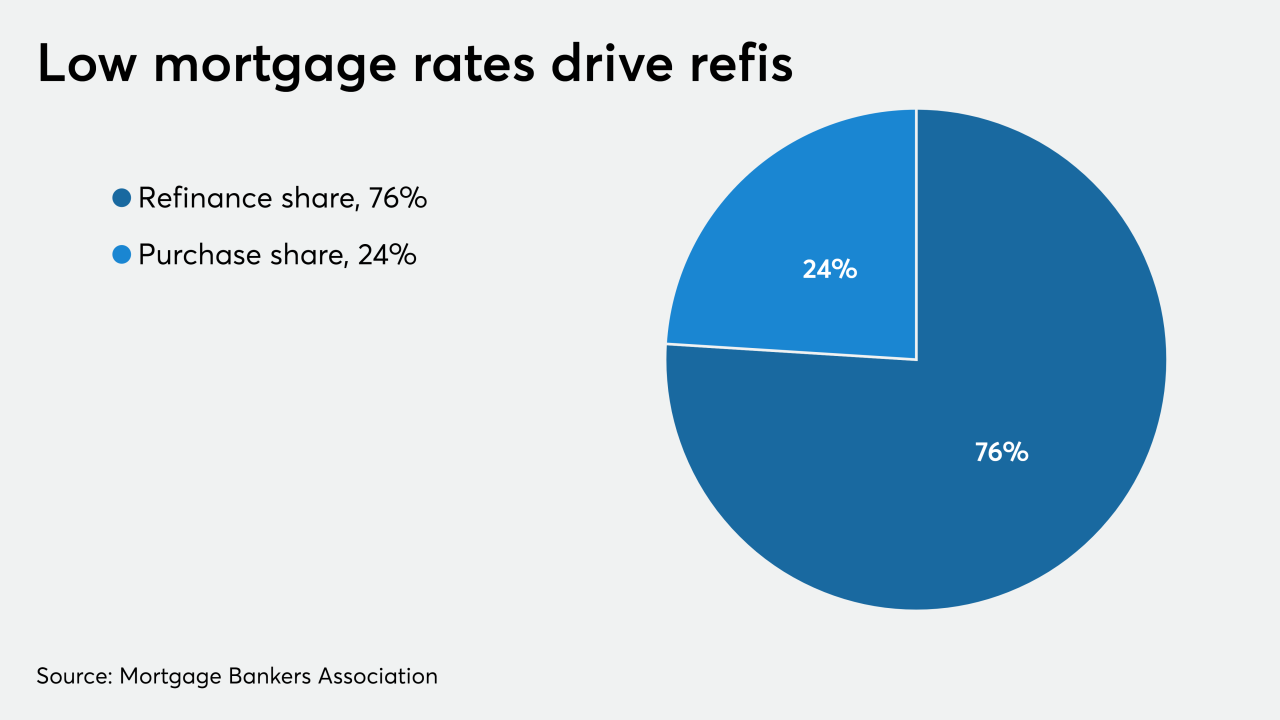

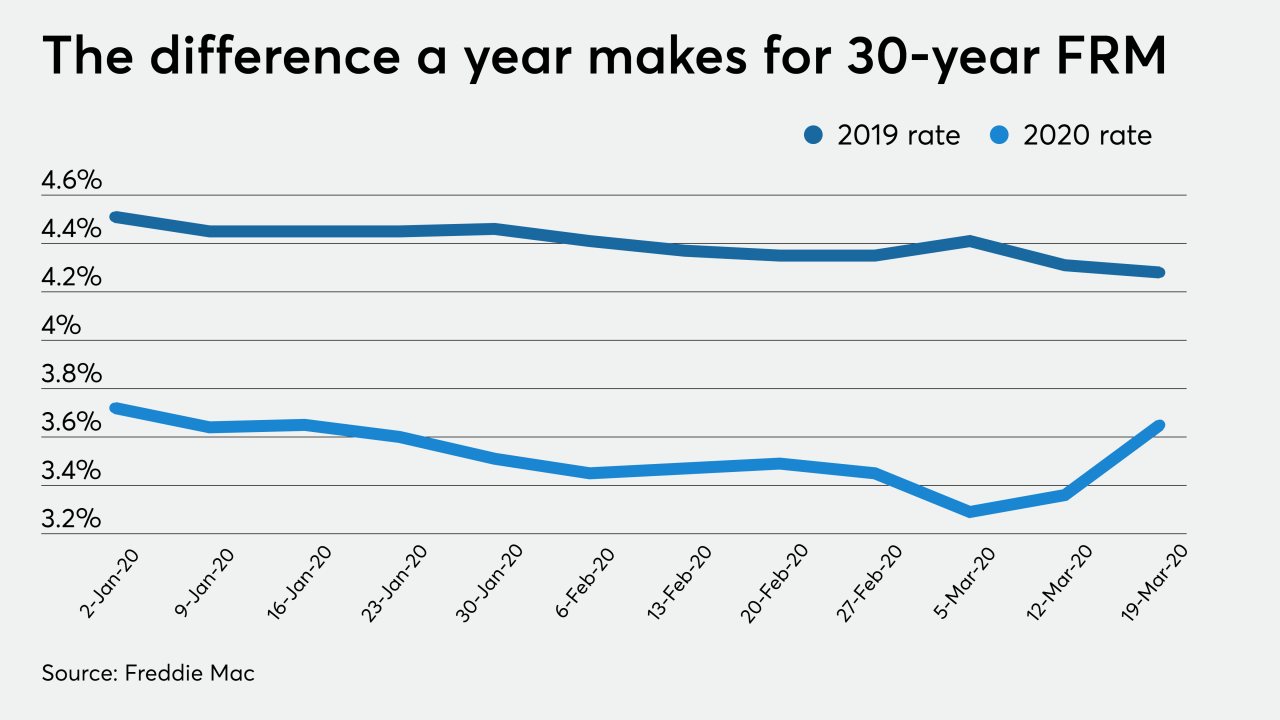

Mortgage application volume increased 7.3% over the prior week, as rates for the 30-year fixed loan reached the lowest level since the Mortgage Bankers Association started tracking this information.

April 15 -

The volume of COVID-19 forbearance requests has risen rapidly as operational processing has improved and hold times have contracted, according to the Mortgage Bankers Association.

April 14 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

The share of borrowers seeking payment relief rose more than tenfold as COVID-19 concerns grew and authorities encouraged the practice, according to the Mortgage Bankers Association.

April 7 -

Mortgage application activity increased from the prior week, driven by strong refinance volume after a 35-basis-point drop in conforming loan interest rates, according to the Mortgage Bankers Association.

April 1 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

March 25 -

With ambiguity surrounding the length of the COVID-19 outbreak and damage it will cause, consumers are becoming diffident in taking out a mortgage for a major purchase, according to Zillow.

March 25 -

Detroit-based mortgage giant Quicken Loans could be facing a cash crunch in coming weeks and possibly need temporary emergency federal assistance if lots of borrowers stop making payments on their home mortgages during the coronavirus pandemic, according to a news report.

March 25 -

There was a nearly 30% week-to-week decline in loan applications as Americans reacted to the uncertainty, both economic and medical, from the spread of COVID-19, according to the Mortgage Bankers Association.

March 25 -

Independent mortgage bankers had their most profitable fourth quarter in seven years for originations, but the fallout from the coronavirus could upset the economics of the industry in the short term.

March 24 -

The Federal Reserve Board should create a dedicated facility for mortgage servicers to access in order to make required advances, industry participants and observers, including its largest trade group, said.

March 24